Kingspan is Ireland's third-largest market capitalization, after the airline Ryanair and the Kerry food group. The company offers a wide range of products and services, but the bulk of its business (82%) is focused on insulation products. In simple terms, sales can be broken down as follows:

- Insulation panels, metal facades and frameworks (62%)

- Technical and rigid insulation (20%)

- Daylighting, smoke management and ventilation systems (8%)

- Energy and water solutions and related services (4%)

- Access flooring and data center solutions (4%)

- Roofing and waterproofing (2%)

Geographically, Western and Southern Europe account for almost half of sales (46%). Central and Northern Europe is also an important region for the Group (26%). Finally, the Americas are not insignificant (22%). The rest of the world accounts for 6%.

An extraordinary addressable market

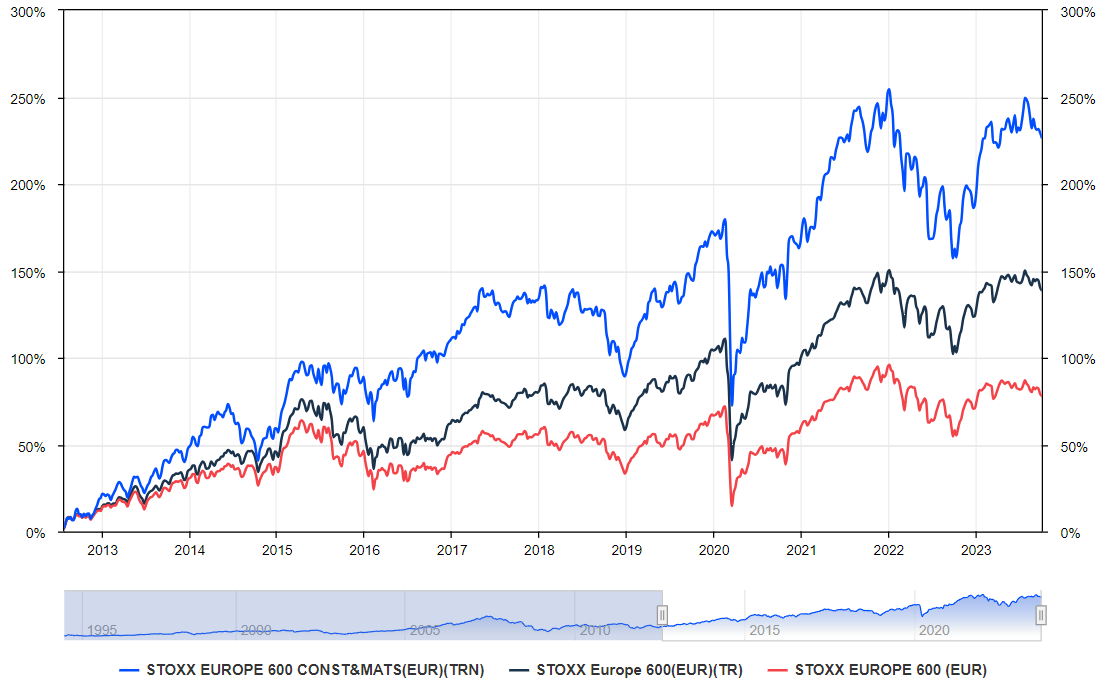

Construction is being boosted by two major trends. Firstly, new construction (76% of Kingspan's end market) is being driven by considerable residential needs linked to urban expansion and the emergence of new infrastructures. Renovation is also benefiting. Environmental standards are increasingly stringent, and massive investment plans are being put in place to improve the energy efficiency of buildings. The needs are considerable. All the more so as Kingspan operates in a key area within these vast projects: insulation, recognized as the viable solution for eliminating "energy flaws". These trends are reflected in the stock market. The sector's main index in Europe, the Stoxx Europe 600 Construction & Materials Index, is outperforming other European indices, as shown in the chart below.

The construction sector is doing rather well (source: MarketScreener)

Unrestrained external growth

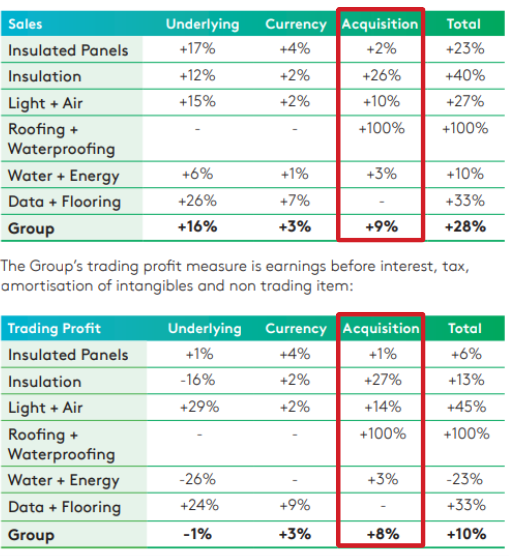

Kingspan has a big appetite. On a regular basis, the company acquires companies that are mostly niche specialists. The most recent investment, in Nordic Waterproofing, enabled the Group to expand its presence in the waterproofing services sector. Another recent example is the purchase of a 51% stake in Steico, a promising specialist in wood-fibre insulation. Earlier, in April 2022, the Group acquired Troldtekt, a Danish producer of acoustic insulation. In September 2022, Ondura, a supplier of waterproofing membranes, came under the Group's scrutiny. Last year, external growth operations totaled 887 MEUR. Of the 28 growth points achieved by 2022, 9 came from external growth. In terms of EBITDA, it's even more representative: 80% of operating profit came from M&A. But do these acquisitions create value?

Illustration of the above (source: Kingspan)

Acquisitions already far outstrip actual profits, i.e. free cash flow. In 2022, 887 MEUR of acquisitions and only 392.5 MEUR of free cash flow. The same applies to 2021: 540 MEUR of acquisitions and 127.1 MEUR of free cash flow. Clearly, these operations are not self-financing. So Kingspan uses two levers: first, debt. It has risen sharply in absolute terms (633MEUR in 2019 versus 1.54 MdEUR last year). But in relative terms, it remains well under control, at 1.5 times EBITDA. On the other hand, the company has seen its number of shares increase as a result of various small capital increases (170 million shares in 2013 vs. 181.9 million in 2022). Admittedly, over 10 years, the increase is rather meagre (+7%), but in a world where share buybacks have become king, it is significant. The fact remains that earnings per share are rising linearly. The increase in the number of shares therefore had no impact on EPS.

Margins are also rising sharply over the decade: from 6.4% to 9.4% for the operating margin between 2013 and 2022. In short, management is skilful. Value creation is on the agenda, an excellent point not given to many companies fond of external growth.

Evolution of the income statement excluding sales. Note the increase in profitability and earnings. (source: MarketScreener)

Successful succession from father to son

Kingspan 's major strength undoubtedly lies in the rigor of its management. Management is proactive in order to gain growth points. So far, this has been done wisely, in the general interest of the company and its stakeholders. Kingspan is a family-owned group. Founder Eugene Murtagh is the main shareholder with 14.8% of the capital. His son, Gene Murtagh, took over the reins of the company in 2005. Gene took the company into another dimension, that of the large caps, with a capitalization in excess of EUR 10 billion. Revenues have exploded over the past decade, rising from 1.8 billion euros in 2013 to 8.3 billion euros last year. A job well done.

The father-son duo have made Kingspan one of Europe's leading construction companies (source: Kingspan).

The outlook for the future is reassuring. Forecasts are not quantified, but the order book continues to grow at a steady pace, despite a very high basis for comparison. Raw material prices may finally ease by the end of the year. On the other hand, macroeconomic tensions (inflation, high interest rates, geopolitical issues, etc.) are weighing on the stock. Valuation is rather lower than historical levels. The PER is 19.8 times for this year, compared with an average of 23.9 times over the last ten years. Admittedly, the Group is facing relatively weak demand in the residential sector in Western Europe. Nevertheless, these factors do not call into question the Group's long-term growth, which should benefit from strong growth in renovations and new construction.

By

By