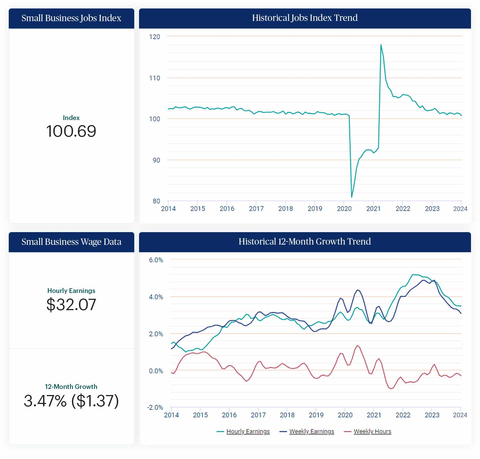

According to the Paychex Small Business Employment Watch, January marks the 34th consecutive month of job growth for U.S. small businesses. Wage growth for workers continues to stabilize in the new year with hourly earnings growth remaining essentially unchanged since November at 3.47%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240130198054/en/

January marks the 34th-straight month of continued job growth for U.S. small businesses. Hourly wage growth for workers remains unchanged since November. (Graphic: Business Wire)

“As we begin 2024, job growth in small businesses is continuing at a steady pace,” says John Gibson, Paychex president and CEO. “Nationally, wage growth remains stable despite 65 minimum wage changes taking effect in various states and localities on January 1. Small and medium-sized businesses remain resilient in the face of many challenges, including a tight labor market for qualified workers, the cost of and access to capital, rising employer regulations, and cost of providing benefits to attract and retain employees.”

“Several macroeconomic data sources point to a strong close to 2023,” adds Gibson. “Gross domestic product (GDP) increased 3.3% in the fourth quarter while the annual unemployment rate hit its lowest point since 1969, signaling federal policymakers have managed to bring down inflation and secure a ‘soft landing’ without major repercussions for workers or the economy. Policymakers need to address the cost and access to growth capital for small businesses, as well as the long term-issues impacting the labor market — including the participation rate and the quality of the workforce — to support the continued growth of small businesses, which drives the U.S. economy.”

Jobs Index Highlights:

- At 100.69, the national index indicates continued job growth but at a slower pace.

- With indexes above 100, all regions continue to report positive job growth in January. The South (101.12) leads the pace of regional job growth in January and has ranked first among regions for 16 of the last 17 months.

- Leading the South, Tennessee (102.19), Texas (102.06), and Virginia (102.01) are all reporting index levels above 102 in January.

- Ranked first among top U.S. metros in January, Dallas jumped 1.60 percentage points to 103.30 and has now increased its job growth rate for three-straight months.

- Education and Health Services (101.91) leads industries for small business job growth to start 2024. Indicating strong, sustained job growth, this sector’s jobs index was above 102 for 33 consecutive months leading up to January 2024.

Wage Data Highlights:

- At 3.47%, hourly earnings growth has stabilized and is essentially unchanged over the past three months (3.48% in December 2023, 3.49% in November 2023).

- At 4.03%, the West leads regional hourly earnings growth for the eighth consecutive month. The South (3.33%) has the lowest hourly earnings growth rate among regions.

- Washington’s 5.17% hourly earnings growth in January is the highest among states for the sixth consecutive month.

- Seattle reports 5.27% hourly earnings growth in January, the fifth consecutive month over five percent, and ranked first among top U.S. metros.

- Construction has the strongest weekly hours worked among sectors for January, up 0.32% since December. Leisure and Hospitality also experienced strong one-month hourly earnings growth (5.10%).

The complete Small Business Employment Watch results for January 2024, including interactive charts detailing the data at a national, regional, state, metro, and industry sector level are available at www.paychex.com/watch. Learn more and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with less than 50 workers, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the U.S. economy.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves approximately 740,000 customers in the U.S. and Europe and pays one out of every 12 American private sector employees. The more than 16,000 people at Paychex are committed to helping businesses succeed and building thriving communities where they work and live. Visit paychex.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240130198054/en/