Snap-on maintains a strong competitive position rooted in economic factors and consumer behavior. Recognized for offering tools and services in the automotive technician sector, particularly through the van distribution model, the company benefits from economies of scale, scope, first-mover advantages, and network externalities.

Economies of scope reduce transaction costs for technicians who prefer obtaining all their tools from a single vendor, fostering relationships with franchisees for industry insights. The preference for human interactions over online sales is notable.

Franchise talent retention is supported by economies of scale, making it challenging for competitors to match service quality. Snap-on's emphasis on custom tool development benefits from scale, reducing overhead and improving net margins. The company consistently produces specialty tools based on user feedback.

With a diverse portfolio of over 29 distinct brands, Snap-on provides an array of products designed to assist customers in automotive repair and business management. The expansion of this brand repertoire persists through strategic acquisitions, involving national sales teams and dedicated franchisees.

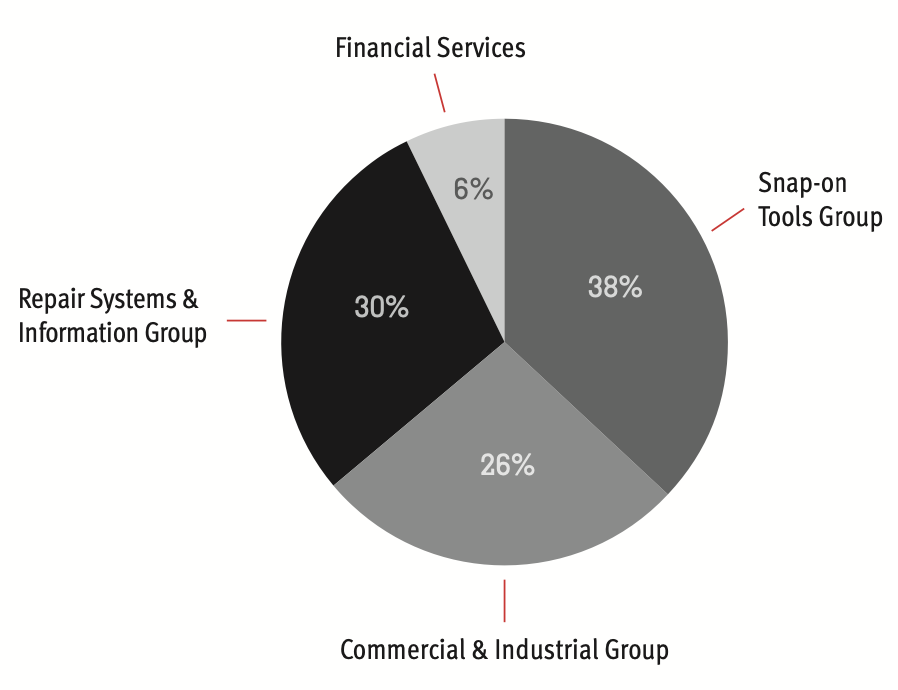

Revenue distribution by segment indicates the Snap-on Tools Group as the primary contributor with 38%, followed by RS&I Group at 30%, C&I Group at 26%, and Financial Services at 6%.

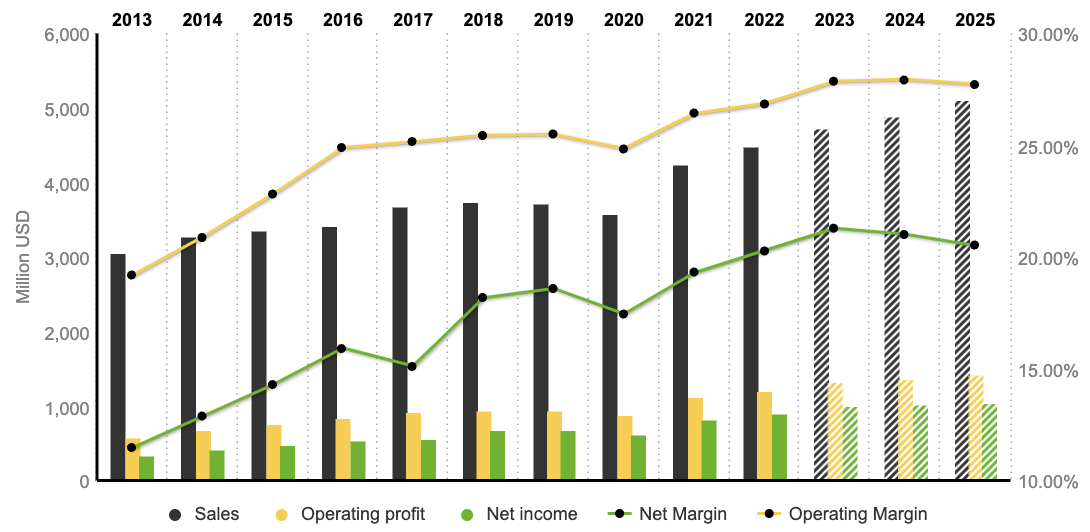

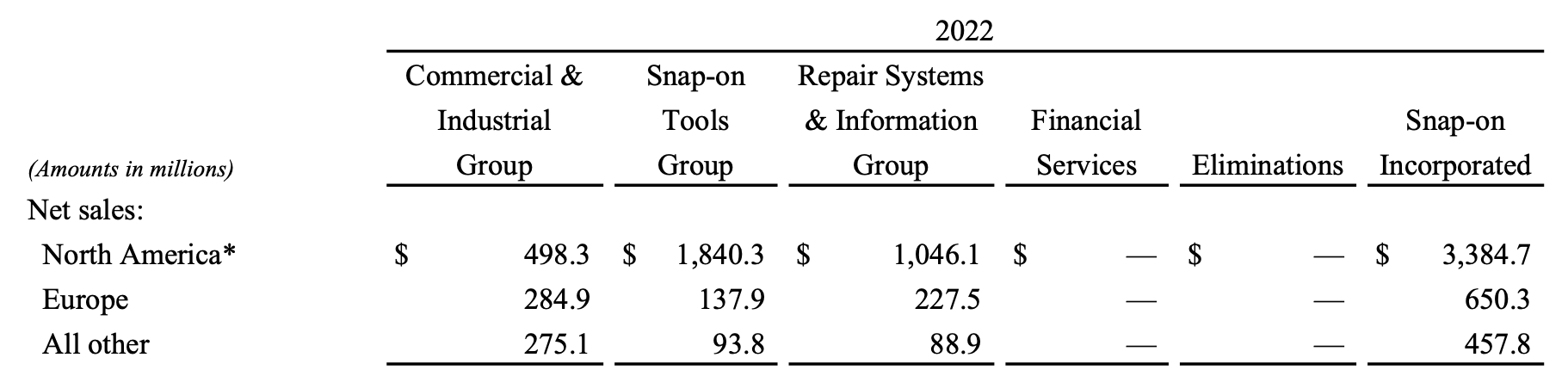

In the financial overview for 2022, Snap-on recorded its highest net sales in history, totaling $4,492.8 million—an increase of 5.7%. The Commercial & Industrial (C&I) Group experienced a slight decline in net sales by 0.5%, attributed to a 4.5% organic gain. Meanwhile, the group saw a notable uptick, reaching net sales of $2,072.0 million, a 6.9% increase primarily fueled by an 8.5% organic gain. The Repair Systems & Information (RS&I) Group demonstrated significant growth with a 10.9% increase in net sales, driven by a 12.8% organic gain. Financial Services reported operating earnings of $266.0 million on revenue of $349.7 million.

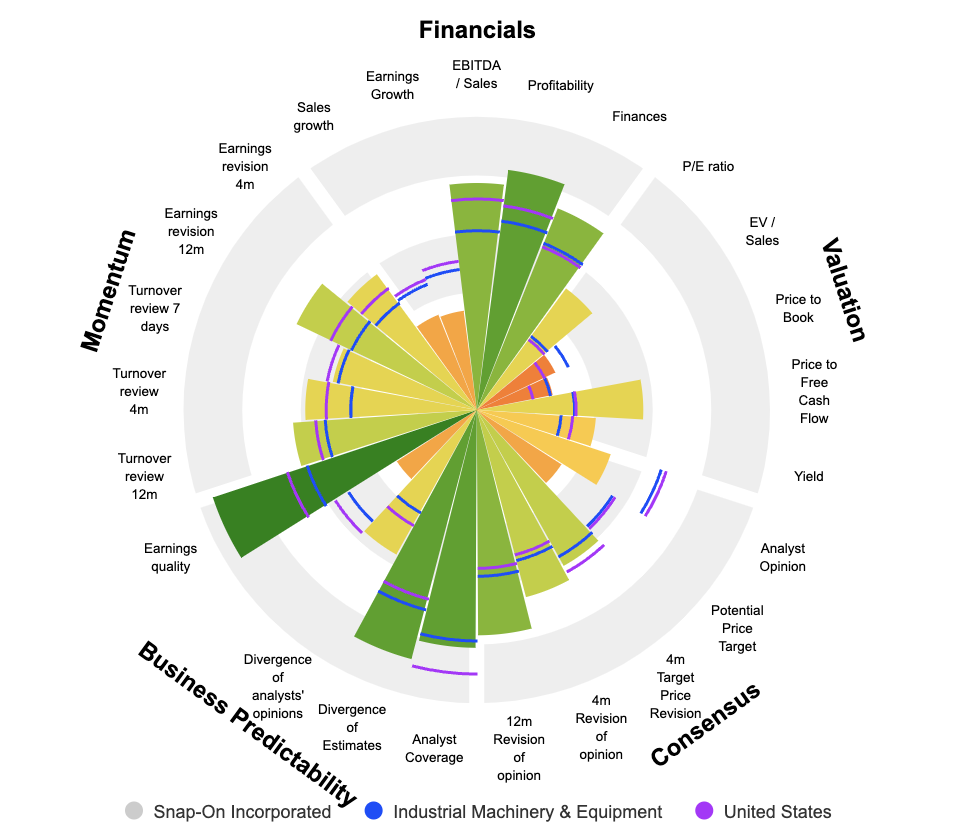

In fiscal 2022, the company demonstrated a favorable trend, paying below its 10-year average with a current P/E ratio of 13.6x compared to 16.5x earnings. The Group's financial performance is noteworthy, maintaining an impressive Operating Margin of approximately 25% since 2016, poised to reach nearly 28% in 2024. Net Margin consistently exceeds 20%. A key growth driver is the Group's adeptness at acquiring new businesses, evident in its Free Cash Flow of $591 million in 2022. Over the past decade, EBITDA surged by 97%, escalating from $662.9 million to $1,307 billion.

Following a brief dip in Return on Equity (ROE) in 2020 amid the COVID impact, it has rebounded to pre-pandemic levels, hovering around 21%, complemented by a Return on Assets (ROA) of 13%.

Share repurchases for the year amounted to 899,000 shares at $198.1 million.

Geographically, North America dominated the revenue stream with 75%, trailed by Europe at 14.5%, and other regions comprising 10.5%.

Since its establishment in 1939, Snap-on Inc. has maintained an impressive track record by consistently paying dividends without interruption or reduction. This accomplishment places Snap-on Inc. among the select group of Dividend Kings. Looking ahead, analysts project a dividend of $6.4 for the year 2023, with a further increase anticipated to $7.5 by 2025.

However, there are some risks, including the potential escalation of the China trade war, impacting Chinese sales with the possibility of limited tariffs on imports and increased costs due to tariffs on US steel. The threat of China knock-offs poses competition and counterfeit product risks, although it can serve as a gauge for brand perception. The emergence of genuine competitors in China is possible, but the favorable impression of American-made goods provides a buffer.

Concerns also extend to the automotive repair industry, where advancements in self-driving and electric cars could reduce repair rates, though this is unlikely in the near term. Rising Accounts Receivable and Inventory over the past 8 years may indicate weakening demand rather than expanding product lines, posing implications for long-term growth and sales.

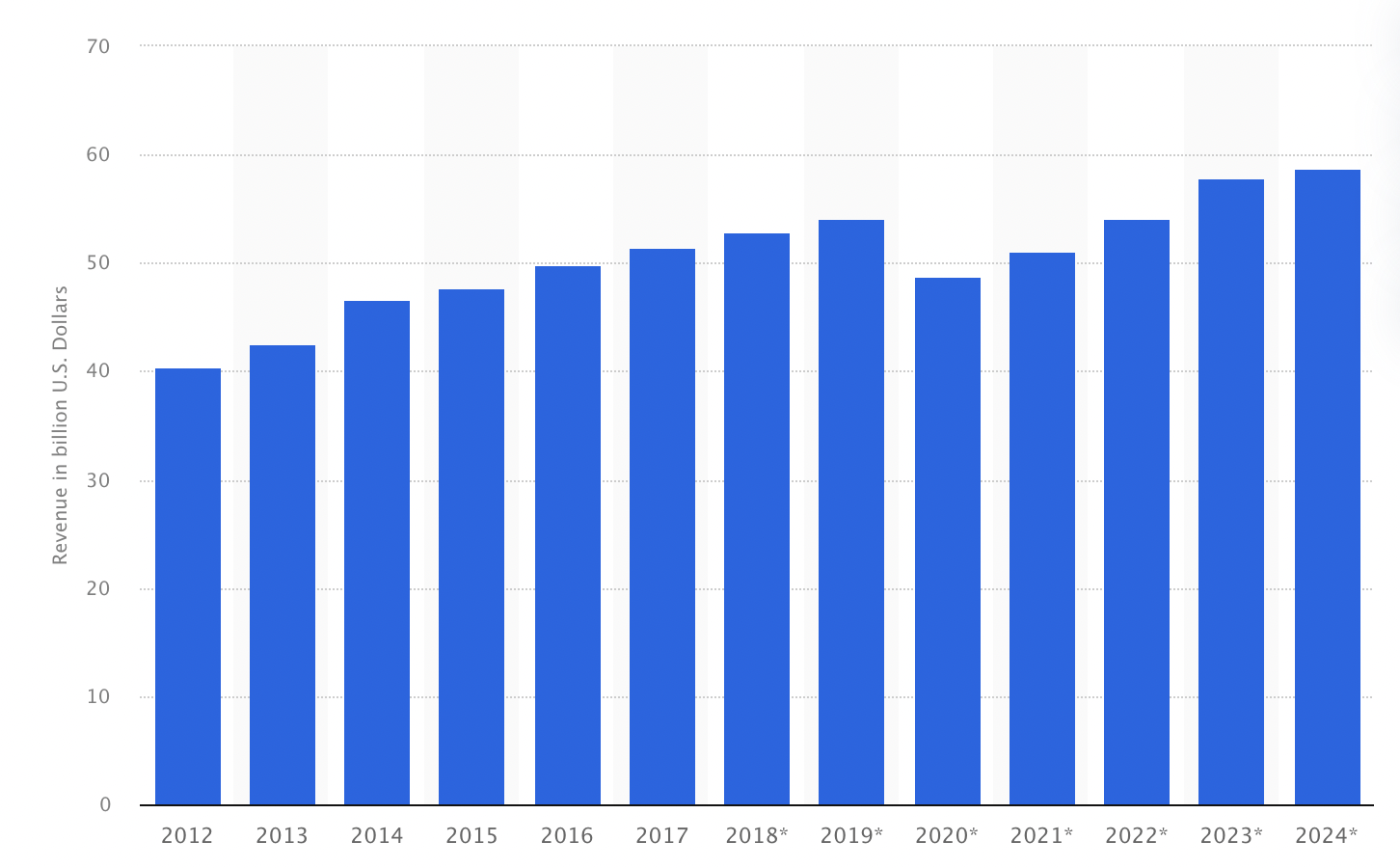

US General Automotive Repair Industry Revenue from 2012 to 2024

Operating in a competitive arena, Snap-on confronts major players such as Stanley Black & Decker and Matco Tools. Stanley Black & Decker, a global industrial giant, provides a diverse range of tools and storage solutions, while Matco Tools only focuses on professional automotive tools.

The company's valuation holds substantial value with promising potential for significant expansion in the future. In the highly improbable event of growth coming to a halt, the investment would still yield robust returns, surpassing those typically associated with most bonds, thanks to its reliable dividend yield.

By

By