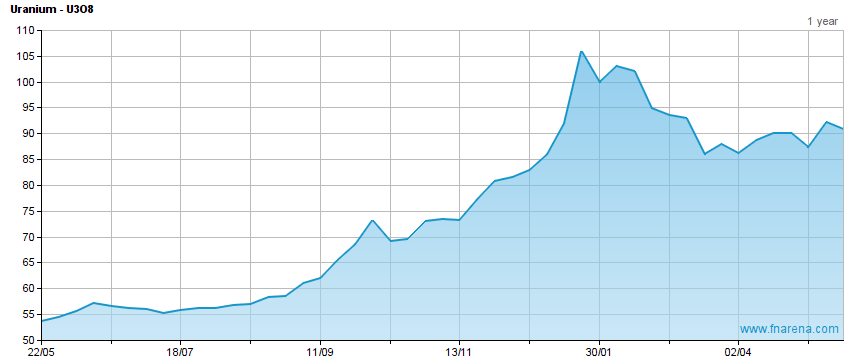

Russia is facing difficulties in shipping its uranium out of St Petersburg, pushing up the spot price.

-St Petersburg uranium shipments delayed

-Poland looking to join nuclear club

-Lotus and A-Cap to merge

Last Friday news agencies reported a depleted uranium canister was dropped in the Ural Electrochemical Plant in Russia, killing one person. The news followed reports that shipments from the port of St Petersburg are delayed due to the inability to secure adequate insurance and bonding for the shipment.

Both Kazakhstan's mostly state-owned uranium producer Kazatomprom, and Russian state-owned Tenex, which is the world's largest exporter of initial nuclear fuel cycle products, have indicated they are working on alternative arrangements and that deliveries will be made, industry consultant TradeTech reports.

These developments highlight the primary fundamentals facing today's nuclear fuel market participants, TradeTech notes. Demand is expected to grow and the supply chain for uranium, conversion, and enrichment is under increasing strain due to concerns about continued reliance on fuel supplies from Russia.

Sanctions on Russian entities and individuals across various countries and jurisdictions, including the EU, US, UK and Canada, represent the potential to ripple through the industry and affect scheduled and future deliveries that must go through the port of St Petersburg.

Although the majority of buyers are focused on securing uranium delivery in the mid-term, the increase in buying interest combined with renewed logistical concerns exerted upward pressure on the spot price last week.

Three transactions were concluded and TradeTech's weekly spot price indicator rose US55c to US$55.85/lb.

TradeTech's term price indicators remain at US$58.50/lb (mid-term) and US$56.00/lb (long).

Demand

Plans for new reactor builds continued to advance last week with the Polish government granting a decision-in-principle for the country's first nuclear power plant to be built, using US technology.

In addition, Polish and South Korean officials last week signed six memoranda of understanding for Polish and Korean companies to together develop and introduce micro modular reactors in Poland.

Supply

US-based Uranium Energy Corp said last week it is working to resume production at its Christensen Ranch in-situ recovery project in Wyoming.

Australian-listed Lotus Resources ((LOT)) and A-Cap Energy ((ACB)) have announced plans to merge.

"The merger will create a leading African-focused uranium player with significant scale and resources by combining production-ready asset, [Lotus' 85% owned] Kayelekera Project in Malawi, [acquired from Paladin Energy ((PDN))], with future large-scale growth asset, [A-Cap's fully owned] Letlhakane Project in Botswana," the companies noted in a joint statement last week.

Uranium companies listed on the ASX:

| ASX CODE | DATE | LAST PRICE | WEEKLY % MOVE | 52WK HIGH | 52WK LOW | P/E | CONSENSUS TARGET | UPSIDE/DOWNSIDE |

|---|

| AGE | 17/07/2023 | 0.0360 |  9.09% 9.09% | $0.08 | $0.03 | | | |

| BKY | 17/07/2023 | 0.7000 |  6.06% 6.06% | $0.80 | $0.25 | | | |

| BMN | 17/07/2023 | 1.6100 |  3.68% 3.68% | $2.49 | $1.19 | | $3.200 |  98.8% 98.8% |

| BOE | 17/07/2023 | 3.0700 |  2.68% 2.68% | $3.29 | $1.92 | | $3.440 |  12.1% 12.1% |

| DYL | 17/07/2023 | 0.7000 |  2.19% 2.19% | $1.25 | $0.48 | | $1.040 |  48.6% 48.6% |

| EL8 | 17/07/2023 | 0.3100 | 0.00% | $0.64 | $0.27 | | | |

| ERA | 17/07/2023 | 0.0400 |  16.67% 16.67% | $0.30 | $0.03 | | | |

| LOT | 17/07/2023 | 0.2000 |  11.11% 11.11% | $0.30 | $0.15 | | $0.530 |  165.0% 165.0% |

| NXG | 17/07/2023 | 6.7600 |  - 0.88% - 0.88% | $7.21 | $0.00 | | | |

| PDN | 17/07/2023 | 0.7600 |  1.33% 1.33% | $0.96 | $0.52 | -22.2 | $1.080 |  42.1% 42.1% |

| PEN | 17/07/2023 | 0.1800 |  12.50% 12.50% | $0.21 | $0.12 | | $0.340 |  88.9% 88.9% |

| SLX | 17/07/2023 | 3.7400 | 0.00% | $5.32 | $2.56 | | $5.800 |  55.1% 55.1% |

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2023 Acquisdata Pty Ltd., source FN Arena

9.09%

9.09% 6.06%

6.06% 3.68%

3.68% 98.8%

98.8% 2.68%

2.68% 12.1%

12.1% 2.19%

2.19% 48.6%

48.6% 16.67%

16.67% 11.11%

11.11% 165.0%

165.0% - 0.88%

- 0.88% 1.33%

1.33% 42.1%

42.1% 12.50%

12.50% 88.9%

88.9% 55.1%

55.1%