Brent, WTI, Dubai Light, what differences?

As a reminder, it is worth looking at oil itself. For the sake of simplicity, we tend to generalize the notion of "crude oil" to the point of implying that black gold is a homogeneous raw material that is identical at all points across the globe. The reality is obviously different. On the contrary, it would be more accurate to speak of oil in the plural, given its diversity in terms of quality. This is why no economic agent consumes crude oil directly. It must first be refined or transformed before being used or incorporated into our everyday objects.

More concretely, the quality of a petroleum product is assessed through two main criteria:

its density (or viscosity), expressed in API gravity. The degree of viscosity determines whether an oil is light or heavy. Thus, the higher the API, the lighter the oil and vice versa. To go further, a petroleum is considered light if its API degree is higher than 31.1°, medium if it is between 22.3° and 31.1°, heavy if it is between 10° and 22.3° and very heavy if its API is less than 10°. Its sulfur content, expressed as a percentage. This degree specifies if an oil is more or less corrosive. An oil can be qualified as sweet if its sulfur content does not exceed 0.5%. Otherwise, the oil is said to be sulphurous.

Classification of the different origins of oil by API and sulfur content - source: EIA

In the light of these criteria, it is easy to distinguish hundreds of different qualities. We could even argue that there is one per deposit. Within this great heterogeneity of quality, it is commonly accepted to take Brent and WTI as a reference. Brent and WTI or even Dubai Light as benchmarks for the price of oil in a given region. In this respect, although Brent and WTI have similar characteristics in terms of quality, they still have their own particularities.

WTI (or West Texas Intermediate), also known as Texas Light Sweet because of its properties (high API for a very low sulfur content) is a light, unsulfured crude oil sent by pipeline to Cushing. Its storage location, deep in Oklahoma, makes its transport and export costly in terms of logistics, so it is mainly refined domestically for American consumption. Brent is also a light and sweet oil (high API for low sulfur content). From various fields in the North Sea, the oil is delivered by pipeline to the Sullom Voe terminal in Shetland, Scotland, to be refined mainly in Northern Europe. However, due to the geographical position of its storage location, which has a deepwater port, large volumes are moved by tanker around the world, reinforcing its relevance as a global reference. Dubai Light is extracted from the Persian Gulf. It is a basket of crude oil from the fields of Dubai, Oman and Abu Dhabi. It is a heavier oil but also much more sulphurous (average API of 31° for a high sulphur content).Brent remains the benchmark for about two-thirds of the world's oil, with WTI being the dominant benchmark in the United States and Dubai Light for the Asian market.

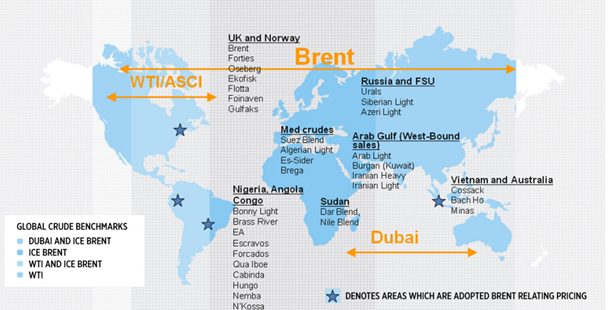

Use of benchmarks around the world - source: Intercontinental Exchange (ICE)

What about the spread? A story of quality but not only...

A plurality of quality necessarily implies a plurality of prices. Requiring more handling and energy, heavy crudes have a higher refining cost than light crudes. The same is true for sulfur-containing crudes. Sulfur is a pollutant that refiners must remove to comply with environmental requirements. In addition, each category of crude (in terms of density and sulfur content) produces a set of refined products (or "product mix"). In short, using low API heavy oils means producing more bitumen, heavy fuel oil or other fuels such as bunker fuel. On the other hand, sourcing high API (light) oils allows for the production of high-value light cuts such as gasoline, diesel or other distillate products. In other words, the quality of the oil used by a refinery determines the type of refined products it can produce. In short, light, low-sulfur oils are considered "superior" to heavy crudes and therefore "in theory" trade more cheaply.

However, it will not have escaped your attention that the price of WTI is a handful of dollars lower than that of its US counterpart, while it is the same price in the US.WTI is indeed lighter and more expensive than its U.S. counterpart, but it is also more expensive than its U.S. counterpart. WTI is indeed lighter and should therefore trade at a premium to European Brent. This was historically the case until 2011 when the WTI - Brent differential was on average positive. This means that other elements are taken into account, in particular the production and inventory levels on both sides of the Atlantic

.

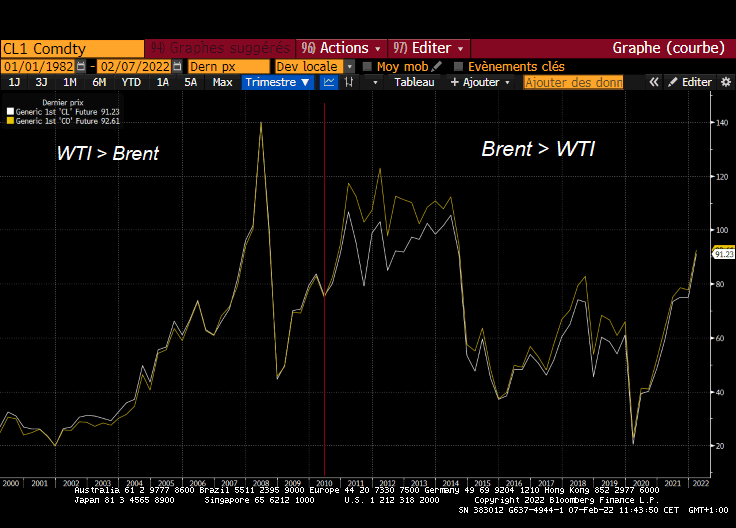

Historical evolution of Brent (yellow) and WTI (white) - source: Bloomberg

The price of oil does not escape the law of supply and demand. This is elementary - in a region where oil is flowing, there is a good chance that oil prices will be attractive and vice versa. If I were to give a tip to quickly grasp the mechanism that governs the Brent-WTI spread, I would advise you to study the level of congestion or de-congestion in the US oil market. This is precisely what has happened in the US with the shale oil revolution. The rapid growth in US production, made possible by the modernization of hydraulic fracturing processes, largely explains the stall of WTI against Brent from 2011, when the differential reached a peak of... USD 25!

To go into a little more detail, shale oil is a very light and sweet oil, with a very high API value and a low sulfur content. They have a very high API value with practically no sulfur content (see the first figure for the "Bakken" and "Eagle Ford" references). Unlike European refineries, the main American refineries were designed to process heavy oils. Prior to the development of American shale, they processed mostly medium and heavy oil from the Gulf of Mexico and Canadian oil sands, respectively, blended with WTI to lower the average API of their supply. The massive influx of very light oil thus posed serious problems for the US market, which was ill-equipped to absorb this excess supply of light oil. The problems of abundance quickly became apparent, resulting in an explosion of inventories at Cushing, which jumped by nearly 80% between 2010 and 2016. This excess crude oil has therefore had a depressing impact on the price of WTI relative to Brent.

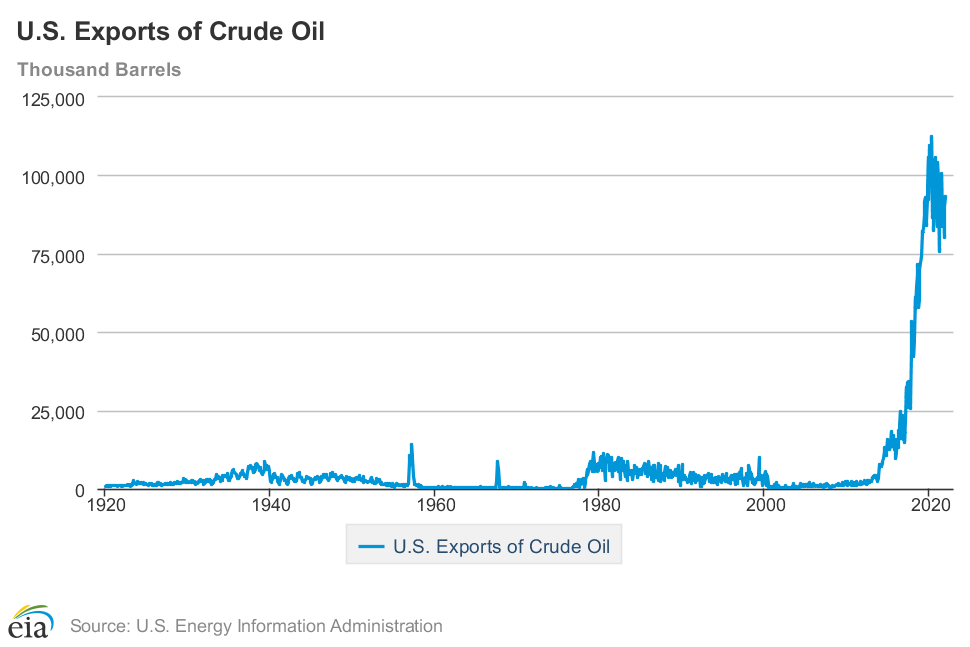

This problem has in fact prompted the US authorities to lift the export ban on US crude in December 2015. This historic decision, justified by the country's energy autonomy, was aimed more at unclogging the US market for its light oil to refineries. European refineries, which are equipped to process very light crudes. The spread between the two global benchmarks has therefore narrowed significantly since then.

While the balance between supply and demand in the US market is having an impact on the Brent-WTI spread for WTI, we should bear in mind that this is also the case for Europe, where the balance of its oil market weighs on this spread, but this time on the Brent side. For example, a production incident, caused by a violent hurricane or a faulty pipeline, will tend to widen or narrow this spread, regardless of what happens on the other side of the Atlantic.

To further complicate this already difficult equation, geopolitical frictions put pressure on this spread since Brent and WTI are not equally sensitive to them. WTI is an American oil, destined for the domestic market, while Brent is produced in the open sea, so it is easier to export it all over the world, which is why it is so important to have a good price. This makes it the perfect benchmark for international trade (as shown in Figure 2 on benchmarks used around the world). Therefore, any geopolitical incident large enough to disrupt oil production in various parts of the world (Africa, Middle East, Asia...) will generally have a stronger impact on the price of Brent than on WTI, mechanically increasing the spread between the two oil references.

Tightening of the Brent-WTI spread, why?

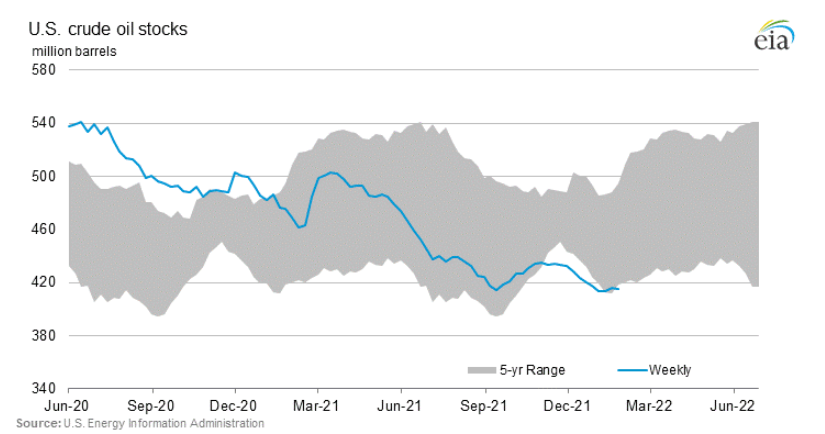

Now that we have seen the main factors behind the Brent-WTI spread, how can we explain its narrowing? At the time of writing, the spread is hovering around USD 1.3 First of all, it is worth recalling the general state of the oil markets, where the main producers are taking care not to fall back into their past failings, namely an overabundance of supply compared to demand. This is why, despite the recovery in demand, OPEC+ has introduced production quotas. In the United States, shale oil producers have also learned from their mistakes and the survivors must now show discipline in order to survive by shifting from a logic of productivity to a logic of profitability. Despite the recovery in demand, the US market is therefore less congested and this is clearly reflected in the evolution of domestic inventories, which are at abnormally low levels according to data compiled by the EIA. This phenomenon strengthens the price of WTI compared to Brent.

Evolution of weekly inventories in the United States - source: EIA

Another explanation is that the US market has matured since 2014. On the one hand, refineries are now better equipped to process very light shale oil and on the other hand, the United States has acquired logistical resources with new pipelines and oil terminals to export their oil. With this infrastructure, WTI is becoming as international as Brent, which tends to reduce the price gap between the two references. In this respect, it will be important to follow closely the evolution of US crude oil exports, especially to the world's largest importer, China.

By

By