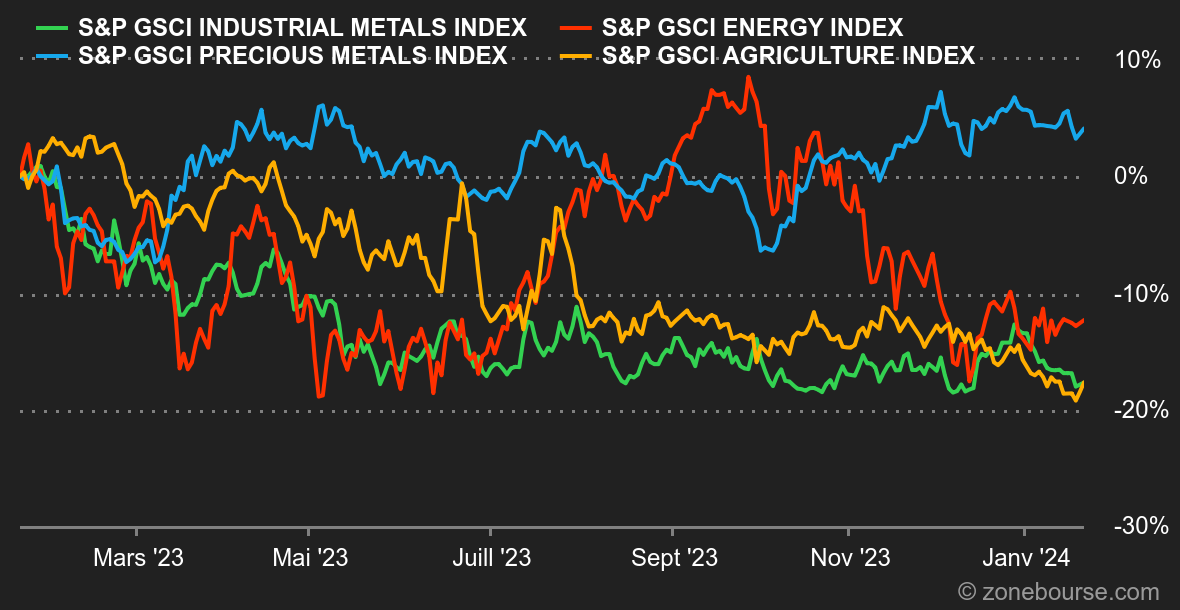

Energy: Oil prices rose slightly last week, but remain stuck below USD 80 a barrel. Tensions continue unabated in the Red Sea, where the United States is carrying out new strikes against the Houthis in Yemen. Fundamentally, the latest report from the International Energy Agency is rather pessimistic, as it expects the market to be well supplied this year, especially if OPEC+ maintains its production cuts. On the other hand, the IEA has once again raised its forecast for growth in world demand, which should increase by 1.24 million barrels per day (mbpd) in 2024, a slowdown compared with 2023 (+2.25 mbpd) . In terms of prices, Brent crude is trading at around USD 79, while WTI is trading at around USD 73.70. In natural gas, the European benchmark continues to fall, to 26 EUR/MWh for the Rotterdam TTF.

Metals: The mood is no better for industrial metals, which are continuing their downward trend. A tonne of copper fell to almost USD 8,200 in London, aluminum lost ground to USD 2,130, while zinc continued its slide to USD 2,440. It has to be said that the latest Chinese economic data remain mixed. Annual GDP growth has reached 5.2% in 2023, while economists were expecting a little better. Gold is also losing ground, weighed down by the rebound in bond yields. An ounce of gold is trading at around USD 2025.

Agricultural products: The US Department of Agriculture revised upwards its production estimates for corn in the United States, which weighed on the price. It sank to a new 3-year low. A bushel of corn is trading at around 445 cents. Wheat is trading below 600 cents. The S&P GSCI Agriculture Index is down almost 20% year-on-year.

By

By