Block 1: Essential news

- Ledger: a crypto wallet with a touch screen

At the Op3n in Paris, French unicorn Ledger presented a brand new technological toy: the Stax. Designed by the creator of the Apple Ipod, Tony Fadell, the wallet 3.0 will be as thin as a credit card and will have a touch screen. It will even be possible to set a non-fungible token (NFT) as a lock screen. It will nevertheless cost 279 euros in pre-order for a delivery scheduled for March 2023.

- Goldman Sachs does its Christmas shopping on cryptos

Goldman Sachs said this week that it is seeing some "very interesting opportunities at a more reasonable price" and that the underlying technology of cryptocurrencies "continues to perform well." The American bank sees bitcoin reach 100,000 dollars within five years? Will the prophecy come true?

- Renault gets onto the Web3 for the 50 years of the Renault 5

In homage to its iconic Renault 5 of the years 70-80, the French car manufacturer decided to launch a collection of NFTs called "genR5" allowing fans of the brand to enter "a new era". With Renault, NFTs holders will be able to access private events, privileged car tests, meetings with experts, and more. It will be possible, from December 15, to obtain NFTs at a price "accessible to all" with payment by credit card, therefore with authentic euros, or directly in cryptocurrencies.

- Binance reveals its BTC reserves after an external audit

After the collapse of FTX, cryptocurrency exchange platforms wanted to reassure users. The largest cryptocurrency exchange platform, in terms of trading volume, hired French firm Mazars to audit its bitcoin reserves. According to the statement, Binance holds 575,742 bitcoins, or a total of $9.6 billion on its platform, which are 101% sucollateralized. However, this is only the reserves in bitcoins, not all the cryptocurrencies that are offered on the platform, which number in the hundreds. But Mazar announced that it would continue the verification on other assets. Nevertheless, it would be interesting, beyond the holding of assets, to verify the debts of Binance in order to have an overall view of the accounting statements of the crypto giant. Remember, like FTX, Binance is not listed on the stock market and has, in recent years, invested heavily in external companies.

Block 2: This week's Cryptic Analysis

1) I still do not have access to much of my data -- professional or personal. So there is a limit to what I will be able to say, and I won't be as helpful as I'd like.

— SBF (@SBF_FTX) December 9, 2022

But as the committee still thinks it would be useful, I am willing to testify on the 13th. https://t.co/KR34BsNaG1

So far, Sam Bankman-Fried has not been charged with anything, but the FTX founder is facing numerous investigations. After declining an invitation to testify before the House Financial Services Committee in Washington DC, saying he wanted to wait to "see what happens" to the companies he owned, SBF reversed his decision, probably with the advice of his lawyer Marc Cohen. Also because a letter sent by senators threatened Bankman-Fried with a congressional appearance if he refused to cooperate.

"I still don't have access to a lot of my data - professional or personal. So there's a limit to what I'll be able to say, and I won't be as helpful as I'd like," SBF tweeted, adding, "But since the committee still thinks it would be helpful, I'm willing to testify on the 13th."

Specifically, leaders of the House Financial Services and Senate Banking committees - both of which are holding hearings next week on the FTX collapse - want Bankman-Fried, now based in the Bahamas, to testify about the implosion that has left customers facing billions in potential losses.

But lawmakers aren't stopping there. Regulators are becoming more and more a part of the conversation, as everyone tries to figure out how it's possible for a company as large as FTX to have slipped through the cracks for so long.

Banking regulators are also having concerns related to the ties between the crypto-currency industry and lenders, which seem closer than previously thought. Senators Elizabeth Warren and Tina Smith have asked officials at the Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency to shed light on SBF's relationship with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Both of these agencies have been heavily criticized for their lack of vigilance related to the FTX issue. We are therefore not safe from seeing shocking revelations on obscure links between these organizations and Bankman-Fried. To be continued... The FTX episode has revealed just how pervasive the lack of oversight is in the cryptocurrency ecosystem. Next week's testimony in Washington will shed more light on the regulatory gaps that exist, nevertheless on the FTX case, and compel lawmakers to strengthen consumer protections and corporate governance standards for the industry. This is essential for the survival and development of the ecosystem. The trick will be to put the cursor in the right place, between freedom for market players and suffocation of the ecosystem.

At least, the hearings - as well as any enforcement action by federal prosecutors against SBF - will help ensure that stronger safeguards are finally put in place to protect investors.

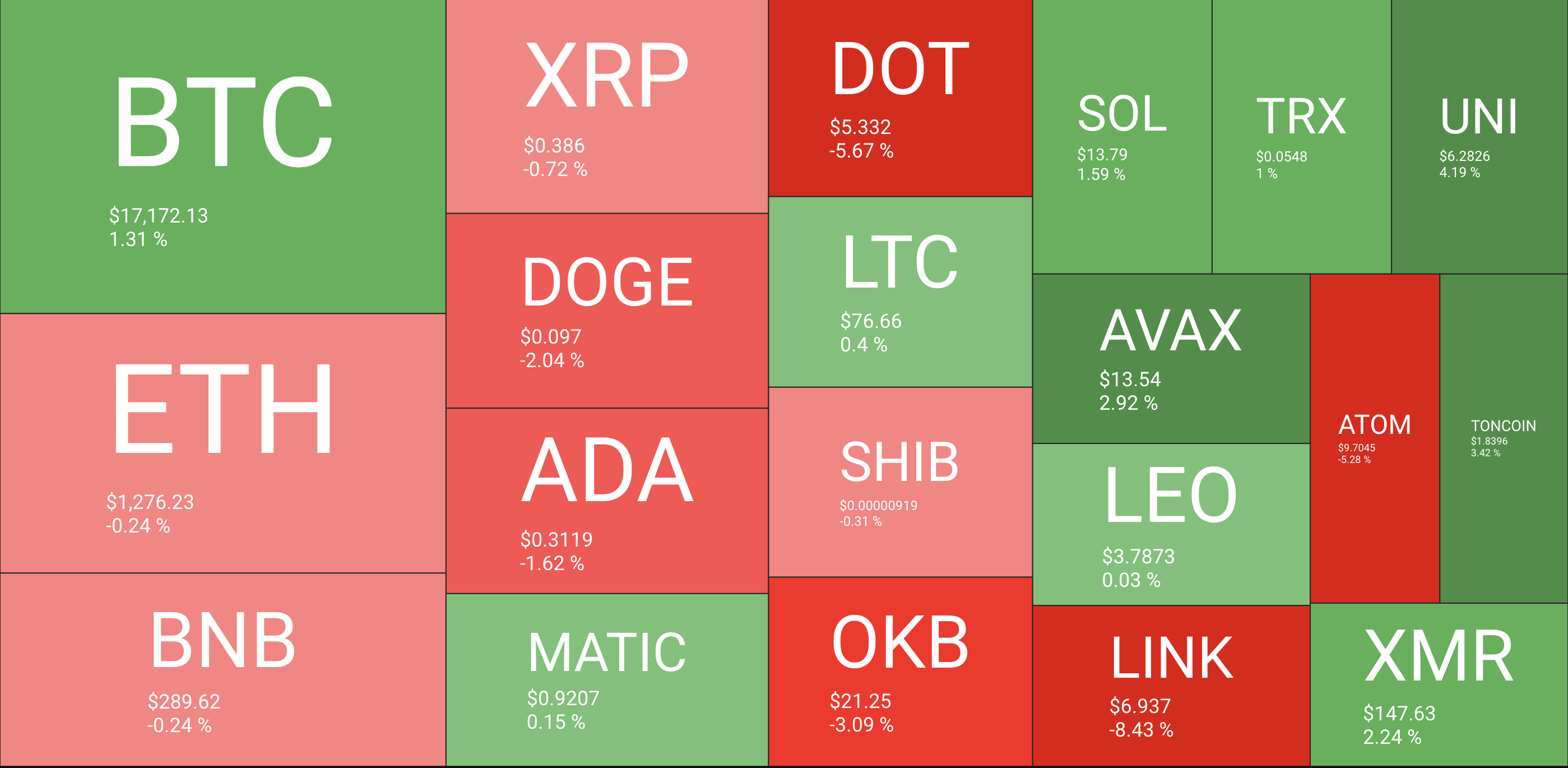

Block 3: Gainers & Losers

The evolution of the Top 20 cryptocurrencies in terms of capitalization over one week.

(Click on the heatmap above to better visualize the variations)

Quantify

Block 4 : A few things to read this week

Is there social value in digital currencies? (Bruegel, in English).

How to decarbonize crypto (The Atlantic).

SEC asks listed companies to provide more information about their exposure to crypto-currencies (Wall Street Journal).

A typical ARKK-problem (Klement on Investing).

By

By