Yesterday's release of the July leading PMI indexes indicates mediocre performance, particularly in Europe, and to a lesser extent in the United States. These indexes are crucial confidence surveys directly conducted with purchasing managers, providing valuable insights into the private sector's sentiment. Currently, the mood in the private sector is not very positive, as manufacturing PMIs are consistently declining and falling below the 50-point mark, indicating a contraction.

The recent performance of the leading PMI indexes is concerning for the real economy, but it has a positive impact on central banks as their monetary policy measures are proving effective. Consequently, equity indexes remained relatively stable yesterday. The S&P 500 in the US recorded a modest 0.40% increase, while the Stoxx Europe 600 traded within a narrow range and closed almost flat. Even the Nasdaq 100, after its restructuring to reduce risks, showed little movement. On the bond front, the US 10-year yield encountered resistance around previous levels, suggesting that the market is less worried about a significant rise in key interest rates. Overall, investors' sentiment remains cautious but somewhat optimistic, as reflected in the steady performance of both equity and bond markets.

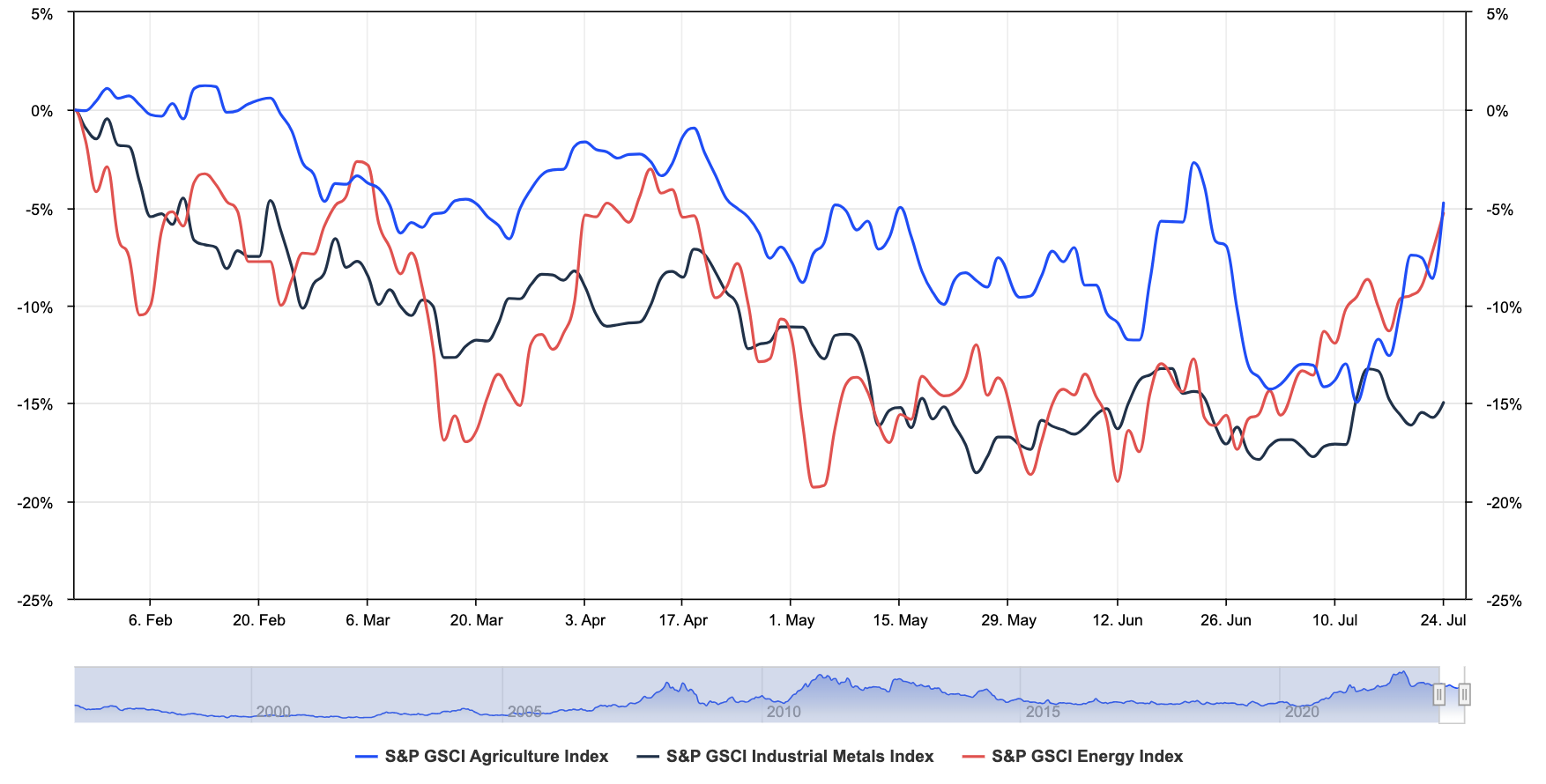

Upon reflection, I'd like to provide some nuanced insights by addressing a potential sticking point in the second half of the year: commodity prices. Over the past year, we've witnessed a breakdown in prices for various commodities like energy, metals, and agricultural products. This decline can be attributed to their sensitivity to economic cycles, and it has had a disinflationary effect, which is good news for central banks' battle against inflation. However, there are factors that could potentially reverse this trend. Firstly, the value of the US dollar plays a crucial role in dollar-denominated commodity prices. Any fluctuations in the dollar can impact commodity prices. Additionally, various factors are aligning to support a revival in commodities across different sectors. In the energy sector, OPEC's control over production is leading to a tightening of oil markets. Industrial metals inventories are also decreasing, potentially posing challenges, especially if Beijing's efforts to stimulate its economy succeed. Furthermore, recent spikes in cereal prices are a reminder of how geopolitical events, like Moscow's use of wheat as an economic weapon, can disrupt market equilibrium, similar to its actions with natural gas last autumn.

These factors have led to a rebound in prices since July 1, of around 12% for energy, 10% for foodstuffs and a 3% jump for base metals.

In the rest of the day's news, another series of corporate results, from the biggest to the smallest, on every continent. On Wall Street, Microsoft and Alphabet will take center stage after the close this evening, alongside Visa and Texas Instruments. In Europe, Unilever, EssilorLuxottica, Dassault Systèmes, Unicredit, ASM International and, of course, LVMH.

Based on leading indicators, investors seem to be taking a cautious approach ahead of the GAFAM releases. In Europe, the markets are expected to trade around equilibrium in the early morning, with a flurry of corporate results flooding in. Meanwhile, in Asia, Chinese stock markets are experiencing a strong rebound, primarily driven by the surge in the real estate sector. China has made commitments to bolster support for its economy, which is contributing to positive market sentiment. The Hang Seng index has gained over 3%, and the CSI 300 has risen by approximately 2.60%. On the other hand, the Nikkei is down 0.25% at the moment. Investors are closely monitoring these developments as they could influence market trends in the coming days.

Today's economic highlights

The German Ifo business climate report was the morning's main statistic; released at 4:00 a.m. In the US, the Conference Board's consumer confidence index and the Richmond Fed's manufacturing index will be released at 10:00 am. The full macro agenda here.

The dollar wins ground at EUR 0.9069 and GBP 0.7802. The ounce of gold remains unchanged at USD 1957. Oil gains ground, with Brent North Sea crude at 82.28 USD a barrel and WTI US light crude at 78.51 USD. US debt posted a 10-year yield of 3.869%. Bitcoin is trading at 29,300 USD.

In corporate news:

Analyst recommendations:

- Babcock International Group: Liberum downgrades to hold from buy. Price target set to 400 pence.

- Badger Meter: Argus Research raised the target to $182 from $151. Maintains buy rating.

- Bank of Hawaii: Keefe, Bruyette & Woods cut the recommendation to underperform from market perform. PT down 20% to $46.

- Capital One Financial: Argus Research raised the target to $132 from $111. Maintains buy rating.

- Coinbase: Citi maintains neutral rating. PT up to $65.

- Domino's Pizza: Bernstein raised the target to $330 from $275. Maintains underperform rating.

- Electronic Arts: HSBC initiated coverage with a recommendation of hold. Price target downgrades 7.1% to $128.

- F5: RBC Capital Markets maintains sector perform rating. Price target upgrades 15% to $173.

- Huntington Bancshares: J.P. Morgan upgrades to neutral from underweight. Price target set to $13.

- Incyte: Citi reinstated coverage with a recommendation of buy. PT set to $82

- Moneysupermarket.com: Peel Hunt increases price target by 5% to 290 pence.

- Nike: BNP Paribas downgrades to underperform from neutral. New PT set to $92.

- On Holding: KeyBanc Capital Markets initiated coverage with a recommendation of overweight. New price target set to $42.

- Progressive: Morgan Stanley cut the recommendation to underweight from equal-weight. Price target decreases 9% to $114.

- Sierra Bancorp: Hovde Group raised the target to $22.50 from $18.50. Maintains market perform rating.

- Walmart: Piper Sandler raised the recommendation to overweight. PT set to $210, implies a 32% increase from last price.

- Watsco: Mizuho Securities initiated coverage with a recommendation of neutral. PT set to $360.

By

By