|

|

| This week's gainers and losers |

| Tops / Flops Up:

Down:

|

|

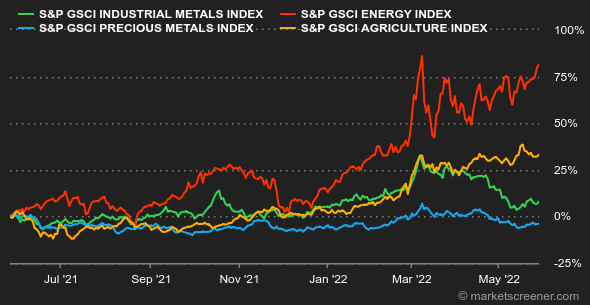

| Commodities |

| Oil: Oil prices continue to rise, supported by a tightening gasoline market in the U.S., whose inventories fell again this week. The buying appetite remains intact, despite efforts by the US to release oil from its strategic reserves. In terms of prices, Brent crude is trading near USD 117 per barrel while the US benchmark, WTI, is trading around USD 113. Metals: The base metals segment is still on hold, weighed down by growing fears of a global economic slowdown. As evidence of this, copper is approaching USD 9,000 per metric ton, its lowest level of the year. Nickel, aluminum and tin have also been on a similar path and have declined overall over the past five days. In precious metals, gold recorded a buying impulse, taking its price up to USD 1,870, a rebound that was however hampered at the end of the week by the sudden return of risk appetite with the advance of the stock market indices. Agricultural products: Grain prices declined overall in Chicago, with traders keeping a close eye on protectionist measures by exporting countries, which tend to multiply given supply concerns and inflationary pressures. Wheat is trading at 1150 cents a bushel, compared to 765 cents for corn. |

|

| Macroeconomics |

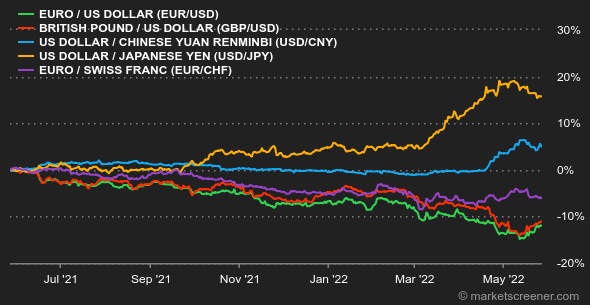

| Atmosphere: Rate hikes have been integrated by investors, who seem to be more comfortable with central banks' strategies. The economic statistics are still less favorable than expected. These are still small signals, but they should be watched: when a number sporadically misses the consensus, it's an accident. When below-expectation data starts to multiply, it's a trend. Note that the Chinese government is still blowing hot and cold on its stimulus efforts. There are still many bottlenecks for international trade. Rates: U.S. Treasury yields have clearly been down in recent days, with the 10-year maturity paying 2.73%, ten points lower than the previous week, which was itself ten points lower than the previous week. Translation: investors have a good idea of what the Fed will do in the coming months and do not think it will go beyond its announced efforts to curb inflation. In Europe, yields did not experience the same correction over the week, probably because the ECB confirmed that it is considering raising rates in the coming weeks. The Bund is at 0.94% on 10 years and the French OAT at 1.46%. Swiss bonds are still the cheapest at 0.69%. Currencies: Expectations of a Fed rate hike appear to be a bit more focused, which has reduced the strength of the greenback. The dollar index, which measures the strength of the U.S. currency against a basket of currencies, has fallen from 104.75 points mid-month to 101.75 points currently. The ECB's more aggressive stance on policy rates is also helping to push the euro back above $1.07. The greenback has also retreated against the Australian dollar and even the British pound, despite a UK economy facing difficulties. Cryptocurrencies: The week is not ending positively for bitcoin, which is hovering around $29,000 at the time of writing. After signing an eighth consecutive week of declines, the digital currency could well close a ninth if it fails to regain the $30,300 mark soon. Unprecedented successive weekly declines that may not be over yet in this macroeconomic context where it is difficult to detect real bullish catalysts for risky assets. Calendar: The week will start with a holiday in the United States (Memorial Day). It will not be the only one as China will be affected on June 2 and the UK will lower the curtain on Thursday 2 and Friday 3 June 2022. The big weekly statistic will be on Friday with the US employment figures for May. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By