Talking Points:

- EUR/USD Threatens Bullish Momentum as ECB Pursues Covered-Bond Purchases.

- USD/CAD Topside Targets Remain Favored Ahead of BoC Policy Meeting.

- USDOLLAR Bearish RSI Momentum Remains in Focus Amid String of Lower-Highs.

For more updates, sign up for David's e-mail distribution list.

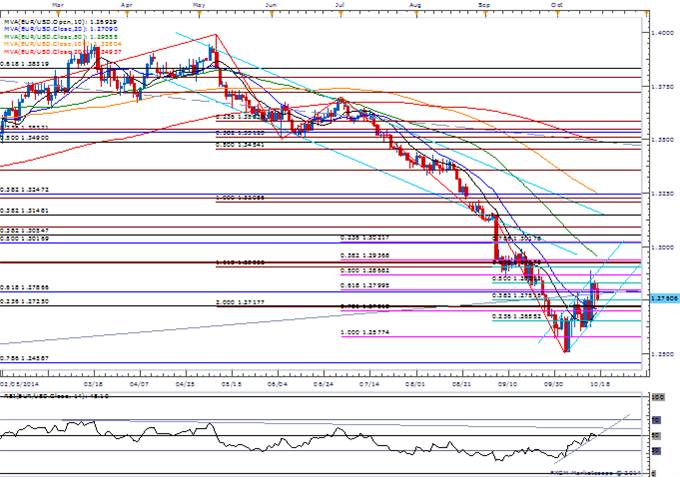

EUR/USD

- EUR/USD may enter a near-term topping process as the European Central Bank (ECB) gets ready to launch covered-bond purchase program in the coming days.

- With the lack of momentum to push above the 1.2900 handle (61.8% retracement), a bearish break in the Relative Strength Index (RSI) may highlight a lower-high in EUR/USD.

- Continue to see increased volatility in the DailyFX Speculative Sentiment Index (SSI) as retail-crowd turns net-short on EUR/USD, with the ratio currently standing at -1.02.

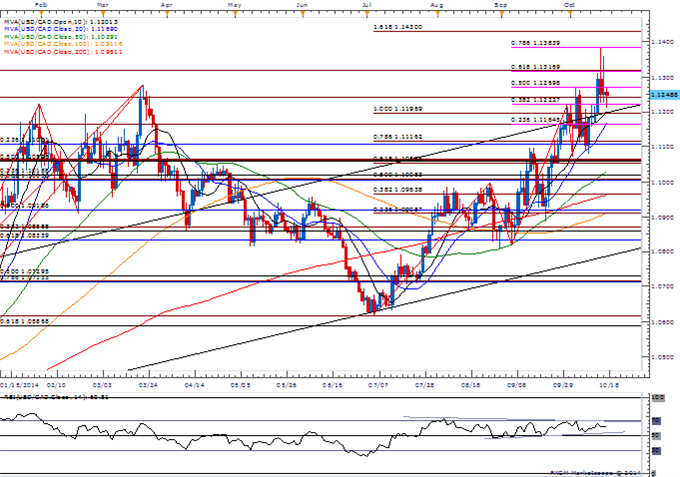

USD/CAD

- Bullish outlook remains favored for USD/CAD as Canada’s Consumer Price Index (CPI) slows to an annualized 2.0% in September.

- Despite the stickiness in core inflation, the Bank of Canada (BoC) is widely expected to retain the current policy as Governor Stephen Poloz sees a period of interest rate stability.

- Will continue to watch former resistance zones for new support, but the next topside objective comes in around the 1.1400 pivot to 1.1430 (1.618% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

USD Failure?

Dollar Hobbled, Equities Bolstered by Bullard’s QE Comments

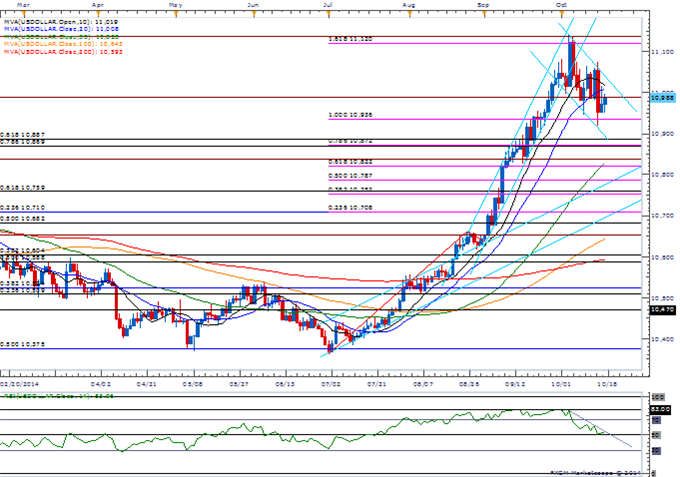

USDOLLAR(Ticker: USDollar):

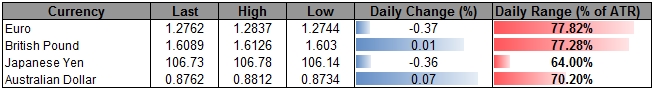

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10988.86 | 10998.02 | 10953.33 | 0.13 | 63.34% |

Chart - Created Using FXCM Marketscope 2.0

- Despite the ongoing series of lower-highs, the Dow Jones-FXCM U.S. Dollar Index may regain its footing should the RSI break out of the bearish formation.

- May see growing arguments to delay the Fed’s QE exit as the headline reading for U.S. inflation is expected to slow to an annualized 1.6% from 1.7% in August.

- Nevertheless, will continue to watch the bullish flag pattern as the U.S. dollar continues to search for key support; 10,869 (78.6% retracement) to 10,887 (61.8% retracement) remains on our radar.

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source