Operational performance

If JB Hunt's success is meteoric, and is also implicitly linked to Walmart' s - or Walmart's success is implicitly linked to JB Hunt's - everyone will interpret this relationship as they see fit. The two groups were both born in Arkansas at the same time, and they quickly developed a special partnership that is still relevant today. Beyond the attractive storytelling, the group also has undeniable factual qualities, notably an exceptional footprint on the North American continent with a complete territorial network of more than 400 depots and logistics sites in addition to the largest fleet of trucks owned by the company.

Another great quality of JB Hunt is the excellence of its strategic choices, which have been criticized in many ways by commentators. Unlike its competitors, which are diversified in almost all logistics businesses, JB Hunt has chosen to remain a pure player in road transport. The group has also set up a so-called "intermodal" activity. In other words, the group has set up its own logistics bases at all the country's rail hubs, thus promoting rail-road transit and limiting loading costs and times. As a result, JB Hunt is known to have very close relationships with all the major U.S. railroads and particularly with Burlington Santa Fe - owned by Berkshire Hathaway and the largest intermodal carrier specializing in containers and chassis.

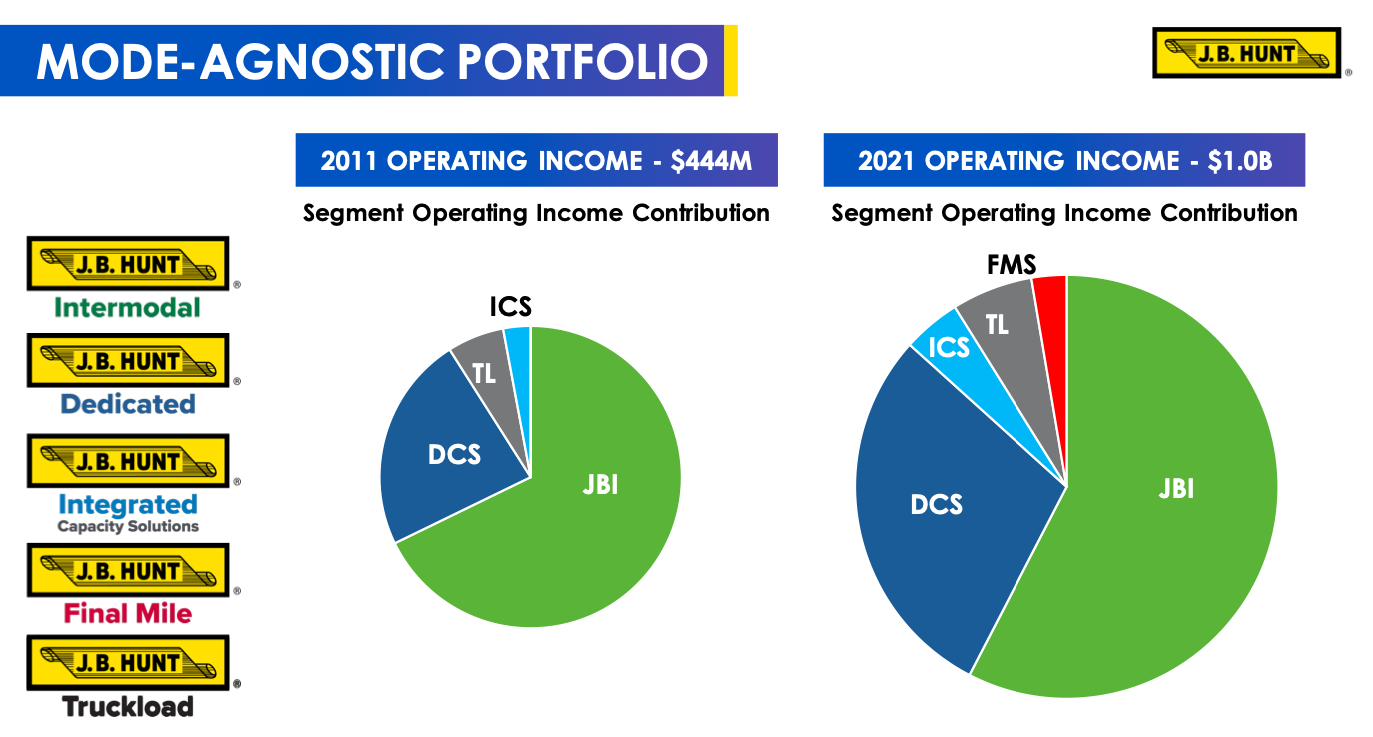

Breakdown of JB Hunt's activities by operating income

JB's activity is therefore directly linked to the economy, but also entirely present on the national market, with the exception of international road transits - TIR - with Canada and Mexico - ACEUM zone. This strategy is in total opposition to the other major American logistics companies - UPS, FedEx and XPO - which have all diversified internationally. JB Hunt's other potential competitors, TFI International, Knight Swift and Old Dominion, remain far behind in terms of turnover.

Finally, related to the group's operational performance, the intermodal segment remains the group's cash cow, accounting for roughly half of the group's revenues and EBIT - Earnings Before Interests and Taxes. The last decade has been marked by a remarkable increase in the single-account transport activity, known as "dedicated", which allows large industrial companies to subcontract all their road transport. JB Hunt then became a real fleet manager for these groups. The group has also made a successful entry as a service provider in the formidable and hyper-competitive field of last-mile delivery.

In short, JB Hunt is a highly diversified delivery group, with strong partnerships and a sprawling footprint in the U.S. thanks to a strong strategic geographic focus.

Financial Performance

Related to the group's financial performance, highlights include:

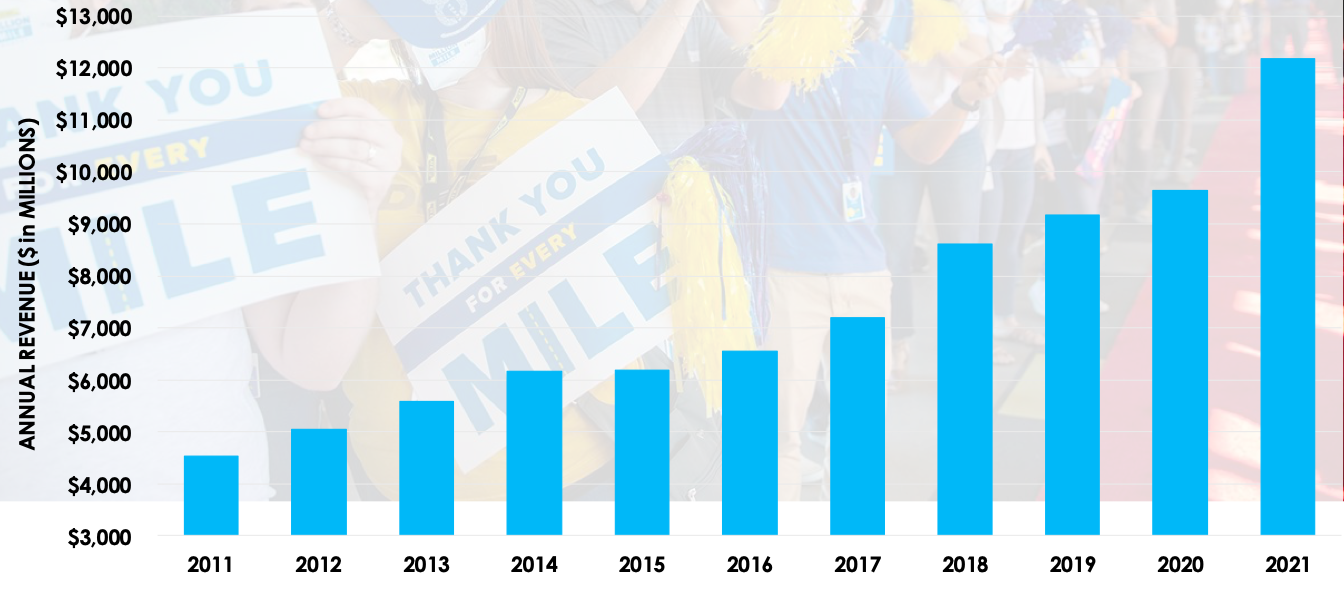

Revenues tripled over the last decade (2011-2021) with almost completely organic growth, in an industry where consolidations are nevertheless more the norm.

Revenue growth - JB Hunt

Margins are slightly lower than those of its direct competitors, but profitability is overall higher than the industry average. This is despite the fact that the financial leverage is almost zero. However, this characteristic does not really distinguish JB Hunt from its competitors, who are all very well managed. A financial characteristic that is most expected in a sector that, let's not forget, can be highly cyclical.

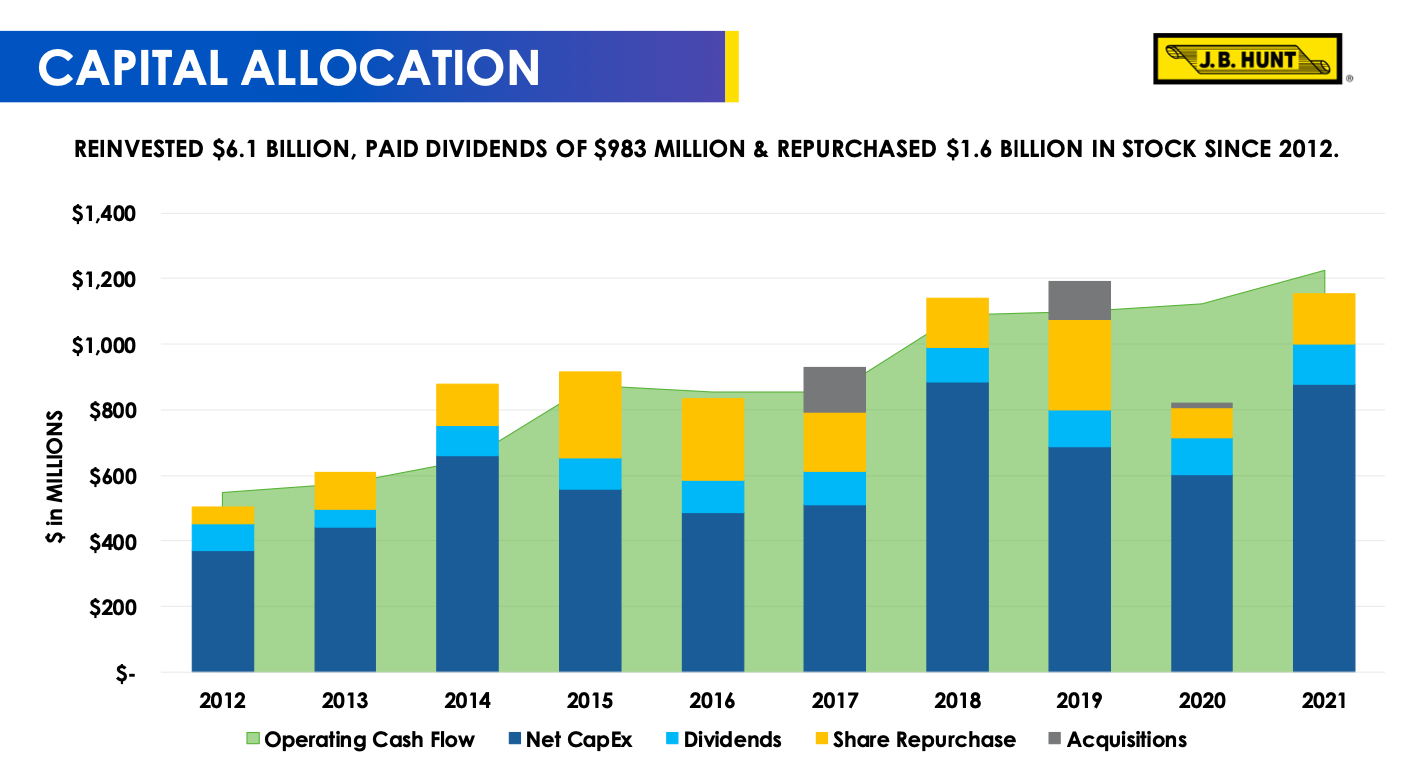

There is, however, one very important competitive advantage. The territorial network and the fleet of vehicles that enable it are assets that are very difficult to reproduce, which gives JB Hunt a very interesting moat. The other side of the coin is obviously a high fixed cost structure and the capital-intensive nature of the business. For example, over the 2011-2021 period, CapEx's expenses were $6.5 billion while operating cash flow was $9.5 billion over the same period. This has not prevented the group and its shareholders from prospering for several decades. Of the remaining $3 billion in free cash flow, $2 billion was returned to shareholders through share buybacks, while the rest was paid out in dividends.

The American group is also an example of communication with its shareholders, as the following slide shows the company's capital allocation over the last 10 years. An initiative in terms of communication that many companies could learn from.

Capital allocation - JB Hunt

*Comparative basis (JB, TFI, KS and Old Dominion)

Conclusion

If the company is indeed a company we would have liked to have had in our portfolio over the last 40 years, is it still the case today? In terms of valuation, the company is not necessarily the most attractive. The market capitalization is close to 17 billion dollars for a profitability of around 400 to 500 million dollars over the last two years. These amounts do not offer a very attractive valuation, unless JB Hunt manages to triple its turnover over the next decade. In which case it's another matter, but that scenario remains very optimistic. Everyone will find their own answer to this question, but we are personally relatively skeptical about such a development. At the very least, JB Hunt will have to find certain growth vectors, whether they be geographical or operational. This could involve some interesting strategic changes to follow.

For investors wishing to conduct a more in-depth analysis of the stock, it is important to understand that the last two years have been exceptional for the trucking industry with record daily rates due to a combination of driver shortages and high fuel prices. The incredible momentum of the last few years seems to us to be difficult to sustain in the longer term, especially in a context of looming recession.

MarketScreener ratings - JB Hunt

By

By