Kerry derives most of its sales (84%) from the supply of taste and nutritional solutions. The range is wide: flavors, starches, colorants, sweeteners, etc. Applications are diverse. The food market dominates (66%), followed by beverages (27%) and pharmaceuticals (7%). The Group is also present in the dairy sector (yoghurts, butter, milk, milk protein concentrates, etc.) in Ireland (16%).

Geographically, Kerry has an international presence. The Americas are very dynamic (48.5% of sales), with significant growth potential, as are emerging countries (19.9%). Europe (31.5%) - including Ireland - is tending to stagnate.

Kerry Group in figures (source: Kerry)

Sustainable growth

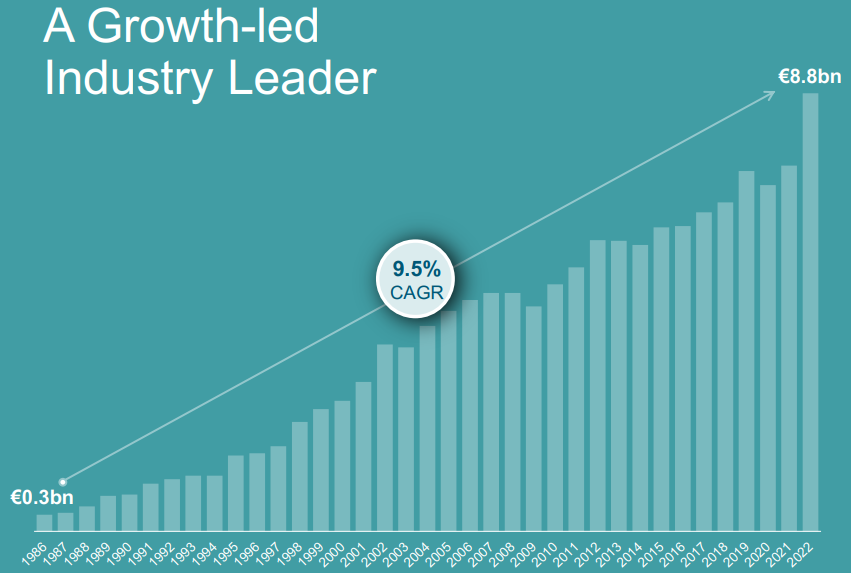

Kerry stands out for exceptional growth that has lasted for several decades. Since 1986, revenues have grown at an average annual rate of 9.5%. This development has been achieved while retaining the company's traditional activities of milk processing and treatment. The original shareholder, Kerry Cooperative Creameries, remains the leading shareholder with 11.3% of the capital.

Sales between 1986 and 2022 (source: Kerry)

Kerry is one of the main players in a gigantic sector that is already highly concentrated. Taking into account all the fields of application in which the Group is involved, the market is worth 80 billion euros. The growth of the food industry, fast-food outlets and ultra-processed products all contribute to a strong demand for functional ingredients.

Solid management and a context that doesn't weigh heavily

Of course, a company's success in a given market cannot be explained solely by its favorable market dynamics. Kerry Group is run by a highly competent management team. CEO Edmond Scanlon didn't hesitate to take bold steps in 2017 when he arrived to reorganize the company's portfolio. This resulted in asset disposals worth €1.4 bn and acquisitions worth €1.1 bn. Although most external growth operations are small, they are numerous (4 by 2022), enabling the Group to strengthen its presence in specialized fields.

Kerry operates in a market which, on the whole, is relatively immune to crises. There's a simple reason for this. People don't stop eating. On the contrary, in difficult times such as 2008 and 2020, households tend to prefer ready meals, fast food and "processed" products, as they are cheaper than eating out, easy to use and quick. Consequently, there is little risk that the current macro-economic context will cause problems for Kerry Group, especially as demand remains buoyant. Last year, the Group increased its volumes by 6.1% and its prices by 11.7%.

Finances at attention

As mentioned above, Kerry's income statement is marked by strong revenue growth. On the other hand, profitability remains stable, averaging around 8.5% for the net margin. Nevertheless, this translates into an increase in profits, which evolve almost in parallel with sales. Over the period from 2014 to 2022, these have risen from €480 million to €606 million.

Although earnings per share are rising less rapidly than sales, they have nevertheless increased from EUR 2.73 to EUR 3.41 over the period under review. The number of shares outstanding remains stable. Consequently, it is reasonable to assume that acquisitions have created value, especially as debt remains close to historical levels (around 1.8 times EBITDA), and acquisitions have mainly been self-financed by free cash flow. Although the latter is volatile, it amounts to around 400 million euros per year. This is a satisfactory level to cover most of the Group's needs, including the payment of a dividend (185 million euros in 2022) that has been rising steadily since 2013, again a sign of rigorous management.

The company's outlook is relatively cautious, but remains in line with the performance of previous years. For the current year, Kerry forecasts growth in profitability and adjusted net income (ANI) of between 1% and 5%. To achieve this, the Group has a solid portfolio of new products, particularly in retail, foodservice and snacking. The large inventories built up in North America are being reduced, which means lower future costs. Finally, the peak of inflation has passed. In the longer term, the Group is aiming for an EBITDA margin of over 20% by 2026 (compared with 16.5% in 2022), excluding dairy-related activities.

Kerry is a step below the sector's behemoths, both in terms of margins and size. Indeed, companies such as Switzerland's Givaudan and Germany's Symrise are positioning themselves in higher value-added segments, notably in fragrances and beauty. France's Robertet, although in the same category, is considerably smaller, with sales of less than a billion euros. But we're not talking about underperformance here, since the competitors in question are not positioned in the same specialties.

As far as valuation is concerned, it's logical that the PER multiple is lower than that of the industry giants. Nevertheless, the discount seems excessive. Kerry's current P/E is 19.5x, a number well below the average of 27.6x since 2014. Yet the outlook is consistent with the group's track record, but investors seem to be punishing the normalization phase underway after the excellent 2022 results. The 35% drop in share price, which began in mid-2021, seems exaggerated.

By

By