Fir Tree Partners ("Fir Tree"), manager of certain funds that reported collective beneficial ownership of approximately 6.1% of the outstanding shares of Kyushu Railway Company ("JR Kyushu" or the “Company") (TSE ticker 9142) in the amendment to their large shareholding report disclosed on March 22, 2019, today reminded JR Kyushu shareholders that the deadline for casting votes at the 2019 Annual General Meeting of Shareholders (the “Annual Meeting”) is quickly approaching.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190605005295/en/

(Graphic: Business Wire)

Although the Company has stated it will accept shareholder votes up to 5:30pm JST on June 20th, the deadline for non-Japan holders may be significantly earlier, with some custodians’ voting deadlines falling as soon as Friday, June 7th. Fir Tree urges all shareholders to check with their clearing brokers and determine their specific deadline to ensure that their votes count.

For a detailed presentation outlining Fir Tree’s proposals and rationale for such proposals, in addition to other information, please visit www.ABetterWayforJRK.com.

Shareholders who have questions about Fir Tree’s proposals or how to vote are encouraged to contact the firm’s investor relations advisor, Innisfree M&A Incorporated at +1 (212) 750-5833.

Fir Tree has made the following proposals to address key challenges facing JR Kyushu:

1. Agenda Item 7: Issue debt to repurchase 10% of the Company’s outstanding shares in order to lower the Company’s Cost of Capital and increase Return on Equity.

2. Agenda Item 8: Implement a three-committee Board structure to improve JR Kyushu’s corporate governance.

3. Agenda Items 9 &10: Elect three outside independent industry experts to the Board (either under the proposed three committee structure or existing one committee structure).

4. Agenda Items 11 & 12: Implement a restricted stock compensation plan for internal and outside directors on the Board to better align the all Board members with the Company’s performance.

Fir Tree’s director nominees would bring valuable skills to complement the existing Board.

The firm’s independent director candidates are as follows:

- Toshiya Kuroda is CEO of TJK Partners in Tokyo where he advises institutional clients on cross-border acquisitions. He has over 25 years of investment experience including private equity, real estate, distressed assets and non-performing loans, both in Japan and abroad. Mr. Kuroda served for over a decade as the Managing Director in Japan for Oaktree Capital Management. In addition, from 2009 to 2016 he served as Executive Director of Japan Rental Housing REIT and under his leadership, the listed REIT’s shares appreciated nearly 600%.2

- Keigo Kuroda is President and CEO of Crosspath Advisors, overseeing Japanese real estate investment for a variety of foreign institutional investors. He has over 20 years of experience in real estate, including financing, origination and acquisition of many property types. Previously, Mr. Kuroda served as a Director at the Blackstone Group, focusing on the acquisition and asset management of their Japan loan and real estate portfolios. Prior to Blackstone, Mr. Kuroda was focused on acquisitions of hotels, golf courses, office and residential properties at Lone Star in Japan.

- J. Michael Owen is the Chairman and CEO of Transpacific Enterprises, a firm specializing in communication and investor relations for Japanese companies. He has developed a particular focus on investor relations and capital raising activities of J-REITs, including the Fukuoka REIT. Mr. Owen was born in Japan and is fully bilingual. He also serves as Executive Director of the Urban Land Institute of Japan.

These nominees have significant professional and strong personal ties to Japan and possess superior experience in the specific areas that we believe are critical to the Company’s success. If elected to the Board, these three individuals will work towards growing JR Kyushu’s long-term potential and helping the Company continue on its path towards incorporating corporate governance best practices and ultimately improving shareholder value.

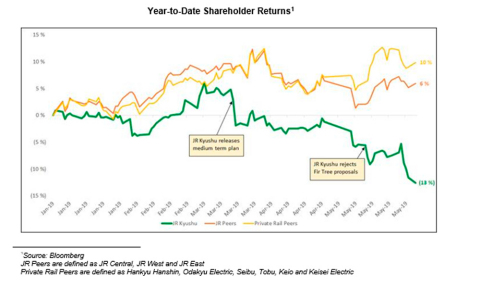

The Company’s share price performance indicates that shareholders are disappointed.

JR Kyushu’s share price has significantly underperformed since the release of its Medium-Term Business Plan and its rejection of Fir Tree’s proposals. While the Company has made strides to improve governance, it is clear shareholders would like to see more.

Fir Tree believes in JR Kyushu’s management and applauds the Company for its robust capital plan to ensure the continued safety of its railway passengers. Fir Tree’s proposals are complementary to the management team’s operational plans and would address shareholder dissatisfaction without limiting JR Kyushu in any way.

Fir Tree encourages shareholders to take action and vote in favor of its proposals, which will complement JR Kyushu’s Medium Term Plan to drive value for all stakeholders.

The deadline for proxy voting for foreign shareholders is coming in the next few days.

Please vote “FOR” on the Shareholder Proposals as follows:

# 7 – Approve Purchase of Own Shares (10% share buyback).

# 8 – Amend Articles of Incorporation (Change to a Three Committee Structure).

# 9 – Appoint Directors Toshiya Justin Kuroda, Keigo Kuroda and J. Michael Owen.

# 10 – Appoint Directors Toshiya Justin Kuroda, Keigo Kuroda and J. Michael Owen.

# 11 – Approve Adoption of Restricted-Share Compensation to be received by Directors.

# 12 – Approve Details of the Compensation to be received by Outside Directors (to ensure that

compensation doesn’t decline if the number of independent “outside” directors increases).

Very important: Since JR Kyushu proposed two additional Board members this year but did not expand the number of Board seats, shareholders that vote in favor of Fir Tree’s nominees need to vote against two Board members in Company Proposals # 2 and 4 to ensure that shareholders only vote in favor of a total of 12 Board members.

___________________________________________________________________________________

For any questions, please contact Fir Tree’s advisor, Innisfree M&A Incorporated at +1 (212) 750-5833.

About Fir Tree Partners

Fir Tree Partners, founded in 1994 and located in New York City (HQ) and Miami, is a value-oriented investment manager that invests on behalf of endowments, charitable and philanthropic foundations, pension funds and other institutional and private investors. The firm has successfully applied its opportunistic approach across a wide array of asset classes, industries and geographies, including in Japan where it has been actively investing for nearly a decade. Fir Tree Partners has adopted Japan's Stewardship Code.

Important Notice

This press release should not be construed as asking for an agreement on Fir Tree’s proposals or soliciting any person to authorize Fir Tree or any third party to exercise voting rights on such person’s behalf with respect to the election of directors of JR Kyushu or any other matter to be presented to shareholders at the Annual Meeting. Fir Tree intends to encourage fellow shareholders to cast their votes against certain proposals by JR Kyushu and in favor of Fir Tree’s proposals by either attending the Annual Meeting or using the voting card enclosed with the convocation notice that will be sent by JR Kyushu. This press release is not intended and should not be considered to solicit, encourage, induce or seek for fellow shareholders to authorize Fir Tree or any other third party as their proxy in exercising their voting rights on their behalf.

This press release is based solely on Fir Tree’s own analysis and information made publicly available by JR Kyushu.

2 Source: Bloomberg (December 2008 – October 2015)

View source version on businesswire.com: https://www.businesswire.com/news/home/20190605005295/en/