The spot uranium market fell victim last week to general financial market weakness following the latest US CPI data.

-Hot CPI sparks Wall Street sell-off

-Uranium stocks caught in the tide

-Term markets unmoved

-Bell Potter initiates coverage of Lotus Resources

Since financial entities moved in and made spot uranium a speculative plaything as much as an end-use consumable, the uranium market has become as much beholden to macroeconomic impacts on financial markets in general as it is to physical supply/demand. So it was last week when a "hot" US inflation print sent Wall Street tumbling.

Industry consultant TradeTech reports the stocks in its uranium "StockWatch" basket fell an average -4.5% for the week.

Which has little to do with the current global supply/demand imbalance and uncertainty within the uranium market. It did serve to force sellers into quickly lowering their offer prices.

There was not much response from buyers. Activity in the uranium spot market was down significantly last week, TradeTech reports. TradeTech's weekly spot price indicator fell -US$1.00 to US$102.00/lb, continuing to exhibit volatility around the magic 100 level (magic simply because it is a round number).

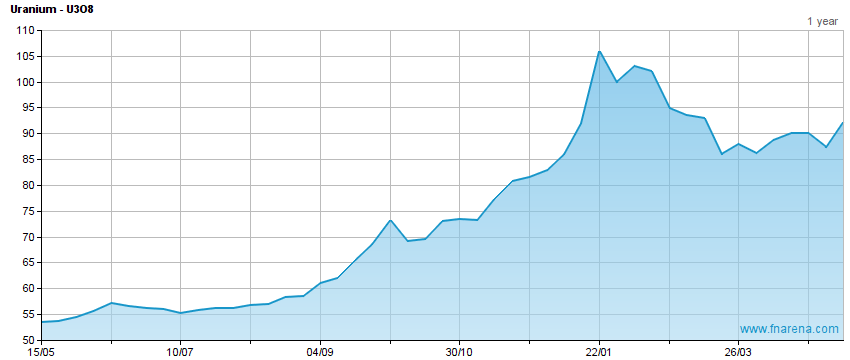

The spot price has nevertheless still doubled from a year ago and is up 11% year to date.

The term uranium market remains steady nonetheless, with both buyers and sellers striving to find common ground around pricing as they confront the reality of a future market characterised by growing demand and the need for new production sources.

TradeTech's term price indicators remain at US$103/lb (mid-term) and US$72/lb (long).

Under the Big Top

Last week the US Senate passed a US$95bn foreign aid package for Ukraine, Israel and Pacific nations, as well as delivering a bipartisan endorsement of the legislation after months of negotiations.

The package was originally part of a wider bill which included action on border control, as the Republicans had insisted, but that was voted down because Mr Trump does not want to give President Biden a win.

House Speaker Mike Johnson is not going to bother sending the aid bill to the House, despite bipartisan support from the Senate, because Mr Trump told him not to.

The bill also includes a national security appropriations package that would increase the US Department of Energy's radiological safety efforts in Ukraine.

The DOE would receive funding for the National Nuclear Security Administration to address issues in Ukraine in addition to US$2.72bn in repurposed funding to support domestic [US] uranium enrichment to bolster production of civil nuclear fuel and advanced nuclear fuel.

Lotus Resources

Lotus Resources ((LOT)) is an Australian-listed uranium developer that acquired the Kayelekera mine in Malawi after previous owner Paladin Energy ((PDN)) shut down the mine when uranium prices were too low to be commercially viable. Paladin divested of the asset while retaining the Langer Heinrich mine in Namibia which, after also being shut down, is now due for imminent restart.

Paladin is a key pick among uranium analysts, along with Boss Energy ((BOE)), which is about to restart the Honeymoon mine in South Australia. Last week local broker Bell Potter initiated coverage of Lotus Resources with a Speculative Buy rating and a 50c price target (last close 32.5c).

Potential upcoming catalysts for Lotus include a final investment decision on the Kayelekera restart, binding offtake agreement(s) for uranium production and project funding of US$125m, on Bell Potter's estimation.

Lotus also acquired the Letlhakane uranium asset in Botswana in its 2023 merger with previously Australian-listed A-CAP, which boasts a sizeable uranium resource. Bell Potter considers Letlhakane a long-term option.

With potential near term catalysts at Kayelekera providing immediate value accretion and a de-risking of Letlhakane providing long-term value, Lotus Resources provides immediate leverage to current tightness in the uranium market, the broker suggests.

Uranium companies listed on the ASX:

| ASX CODE | DATE | LAST PRICE | WEEKLY % MOVE | 52WK HIGH | 52WK LOW | P/E | CONSENSUS TARGET | UPSIDE/DOWNSIDE |

|---|

| 1AE | 19/02/2024 | 0.1400 |  -12.50% -12.50% | $0.19 | $0.05 | | | |

| AGE | 19/02/2024 | 0.0670 |  - 1.47% - 1.47% | $0.08 | $0.03 | | $0.100 |  49.3% 49.3% |

| BKY | 19/02/2024 | 0.3000 |  - 6.25% - 6.25% | $0.80 | $0.26 | | | |

| BMN | 19/02/2024 | 3.4400 |  - 3.64% - 3.64% | $3.99 | $1.19 | | $7.040 |  104.7% 104.7% |

| BOE | 19/02/2024 | 5.2100 |  - 2.98% - 2.98% | $6.12 | $2.02 | 187.5 | $5.720 |  9.8% 9.8% |

| DYL | 19/02/2024 | 1.5200 |  2.36% 2.36% | $1.76 | $0.48 | | $1.640 |  7.9% 7.9% |

| EL8 | 19/02/2024 | 0.5900 | 0.00% | $0.68 | $0.27 | | | |

| ERA | 19/02/2024 | 0.0590 |  5.36% 5.36% | $0.24 | $0.03 | | | |

| LOT | 19/02/2024 | 0.3250 | 0.00% | $0.38 | $0.15 | | $0.610 |  87.7% 87.7% |

| NXG | 19/02/2024 | 11.5000 |  - 2.46% - 2.46% | $12.99 | $5.11 | | | |

| PDN | 19/02/2024 | 1.2700 |  - 4.15% - 4.15% | $1.46 | $0.52 | 502.6 | $1.513 |  19.1% 19.1% |

| PEN | 19/02/2024 | 0.1200 |  - 7.69% - 7.69% | $0.20 | $0.08 | | $0.340 |  183.3% 183.3% |

| SLX | 19/02/2024 | 4.8200 |  - 5.86% - 5.86% | $5.78 | $2.92 | | $7.600 |  57.7% 57.7% |

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2024 Acquisdata Pty Ltd., source FN Arena

-12.50%

-12.50% - 1.47%

- 1.47% 49.3%

49.3% - 6.25%

- 6.25% - 3.64%

- 3.64% 104.7%

104.7% - 2.98%

- 2.98% 9.8%

9.8% 2.36%

2.36% 7.9%

7.9% 5.36%

5.36% 87.7%

87.7% - 2.46%

- 2.46% - 4.15%

- 4.15% 19.1%

19.1% - 7.69%

- 7.69% 183.3%

183.3% - 5.86%

- 5.86% 57.7%

57.7%