|

|

| This week's gainers and losers |

Gainers: The Gap (+31%), Abercrombie & Fitch (+15%): Both US retailers are benefiting from a rebound in consumer spending. They reported robust, better-than-expected quarterly results, and raised their full-year forecasts in the process. Abercrombie shares are up more than 100% since the start of the year. Chewy (+27%): Chewy did better than expected. The pet supplies specialist reported quarterly sales of $2.88 billion, up 3%, and significantly improved adjusted EPS, both boosted by record sales from the Autoship subscription program. The Group raised its annual guidance and announced a $500 million share buyback. Burlington Stores (+17%): The low-price retailer is benefiting from strong demand and its cost-cutting efforts. For the first quarter, it reported sales up 11%, adjusted EPS up 68% and gross margin ahead of expectations. The Group has therefore raised its margin and EPS forecasts for the coming quarter and for the full year. Dick's sporting goods (+16%): The sporting goods specialist exceeded expectations. It reported solid first-quarter results, with sales up 6.2%, driven by higher transaction volumes and average ticket sales. Several analysts, including Morgan Stanley and BofA, have raised their price target on the stock, as it has revised its annual outlook upwards. The share price has risen by over 52% since the beginning of the year. Marathon Oil (+12%): Merger activity in the oil sector continues. US operator Marathon Oil has accepted a $22.5 billion all-stock takeover offer from major ConoCoPhillips. The latter is delighted to be adding complementary zones to its onshore portfolio. Losers: UiPath (-37%): The US automation software company reported quarterly sales up 16%, but missed the consensus. It also unveiled a lower-than-expected full-year outlook. Investors are concerned about macroeconomic pressures on the group, execution problems on major contracts, and the resignation of the CEO, who has held this post since February. Several analysts have revised their recommendations on the stock, which has lost 50% since the start of the year. Nutanix (-26%): The enterprise cloud computing group did not disappoint. For the quarter just ended, it reported a 17% increase in revenues, as well as a sharp rise in operating margin, operating profit and free cash flow. But its outlook for the coming quarter and the year is disappointing. The market also deplores the fact that sales cycles are getting longer, a trend that is set to continue, and the absence of forecasts for 2025. Salesforce (-20%): The CRM software giant disappoints. It reported lower-than-expected sales for the past quarter, and made timid forecasts for the current quarter, presenting the weakest growth in its history. And its artificial intelligence solutions have yet to prove their worth. The market fears that high interest rates and competing AI offerings will penalize the Group in the long term. American Airlines (-18%): The airline sharply cut its earnings guidance for the current quarter, lamenting its weak pricing power. The group has sought to move away from business travel to increase its market share in other markets, but this strategy does not seem to be bearing fruit, according to analyst Jefferies, who downgraded its recommendation. In the same vein, other analysts have downgraded their recommendations on the stock. Draftkings (-15%), Flutter (-7%), Entain (-5%), : A blow for online gambling and betting players: the US state of Illinois has announced an increase in taxes on sports betting. The tax rate, initially 15%, will be progressive and may rise to 40% depending on adjusted annual gross revenues. Irish company Flutter has completed the transfer of its main listing to the US and announced the resignation of its CFO, while US company Draftkings is considering buying Simplebet. |

|

| Commodities |

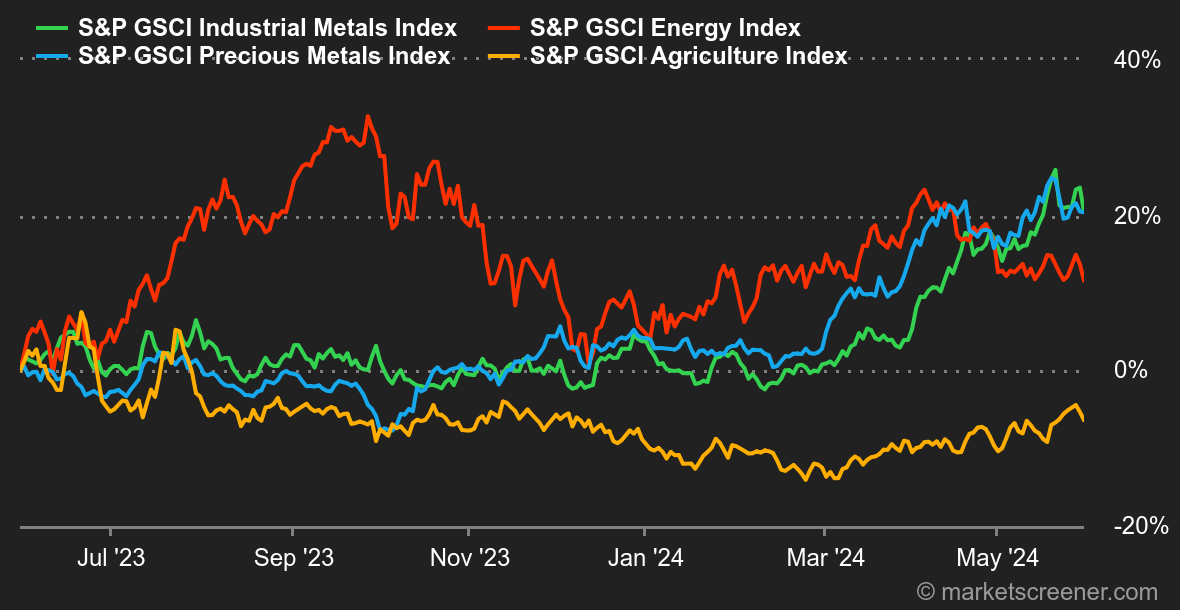

| Energy: The mood on the oil markets isn't exactly rosy, as they continue to brood for a variety of reasons. Firstly, there's that pesky Fed monetary policy, which may not turn out to be as lenient as the financial community had hoped. Secondly, it was the US Energy Agency's latest report on weekly inventories that weighed on the trend. Although crude oil inventories fell by 4.6 million barrels, refined product stocks rose quite significantly. It should be pointed out that refinery throughput increases as we approach the summer period, when fuel consumption is higher. Will the market be able to count on OPEC+ to give it a buying boost? The answer is this weekend, as the enlarged cartel holds a policy summit. Experts expect OPEC+ to fully renew its production quotas until the end of the year. Metals: Copper continues its decline on the London Metal Exchange, trading not far from the USD 10,000 line for its cash price. The rise in the dollar, the unwinding of speculative buying positions and, above all, the latest mixed data from China (the Chinese manufacturing PMI fell back below 50 points in May, copper inventories rose in Shanghai, etc.) are causing prices to return to average levels. Gold, for its part, is treading water at around USD 2345. Agricultural products: coffee and cocoa are on a tangent in the soft commodities segment, rising by around 10% in 5 days. In cereals, wheat is back on track in Chicago at 684 cents per bushel. |

|

| Macroeconomics |

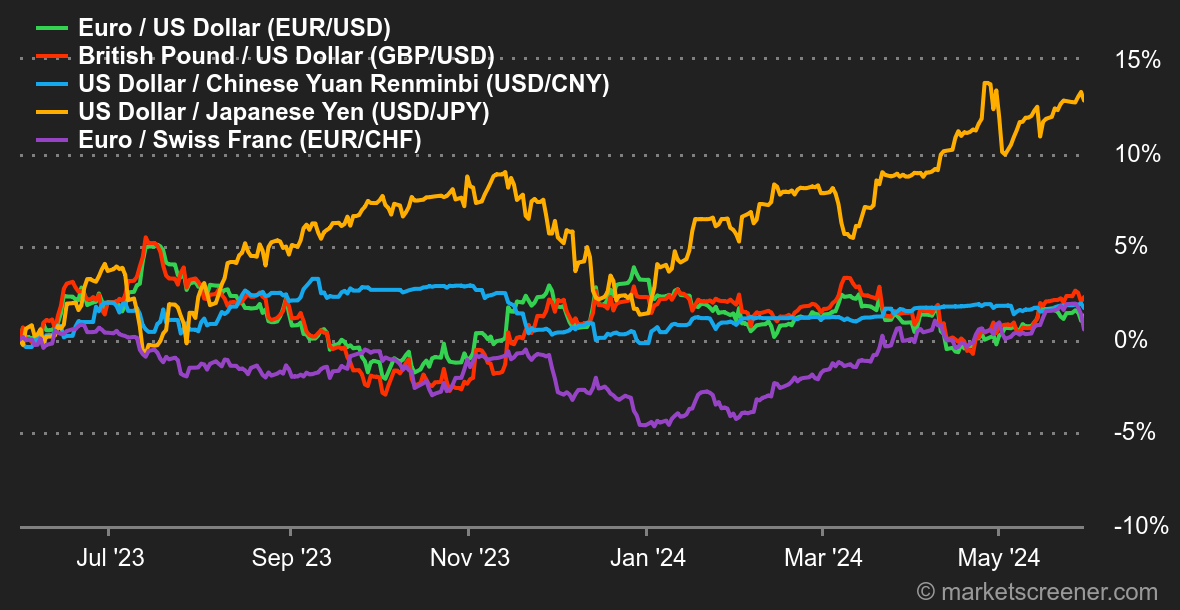

Atmosphere: These things happen. We had to wait until Friday and the publication of the PCE Core index to have something substantial to sink our teeth into. This measure of US inflation reassured the financial community insofar as it came out in line with expectations, i.e. +0.2% at a monthly rate and +2.8% at an annual rate. Personal spending in the US continues to decline, a sign that the economy is slowing somewhat. And as a reminder that, in the current context, bad news is good news, it didn't take much to send bond yields into a tailspin. As a result, the US 10-year is back on track at 4.51%, while its European counterpart is at 2.66%. So far, so good. However, we'll be on the lookout for a possible tipping point when inflation fears give way to fears of a recession, with the corollary of lower earnings forecasts. But that's another story, and for the time being, let's not deny ourselves the pleasure of seeing the fixed-income markets relax a little. Crypto: After rebounding by 11% over the past two weeks, the price of bitcoin (BTC) has stabilized since Monday at around $68,500, up 0.4%. BTC thus remains within striking distance of its all-time high of 73,800 reached last March. The same is true of ether (ETH), up 0.12% over the same period, following last week's 24% rise in the wake of the SEC's green light to market Ethereum Spot ETFs. Although these ETFs are not yet open for trading in the US, many have positioned themselves ahead of the curve, waiting to see whether or not Wall Street's fresh money will trickle into these exchange products. Many are hoping that the same scenario as the Bitcoin Spot ETFs at the start of the year, which helped BTC break its previous all-time highs, will be repeated for ether this time around. More generally, the cryptocurrency market as a whole remains in equilibrium this week, with the total valuation of crypto-assets remaining glued to the $2490 billion mark this week. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By