Whether it's big pharma, small pharma, biotech or equipment, healthcare stocks in the broad sense of the term have faced many headwinds over the past year.

In addition to the difficulties that beleaguered all companies (inflation, economic slowdown, rising interest rates, restricted financing, conflicts), healthcare groups (with the exception of Novo Nordisk and Eli Lilly, of course) had to endure the end of the covid era, the de-trending of the financial markets, and the loss of their market share.re covid, the destocking of distributors, the weak performance of small and mid caps (which affected small, innovation-driven companies), and a substantial reduction in investor exposure to the sector, focused instead on the promise of tech and AI. Evidence of this can be seen in the falling share prices of behemoths such as Pfizer (-51%) and Moderna (-38%) over 2023.

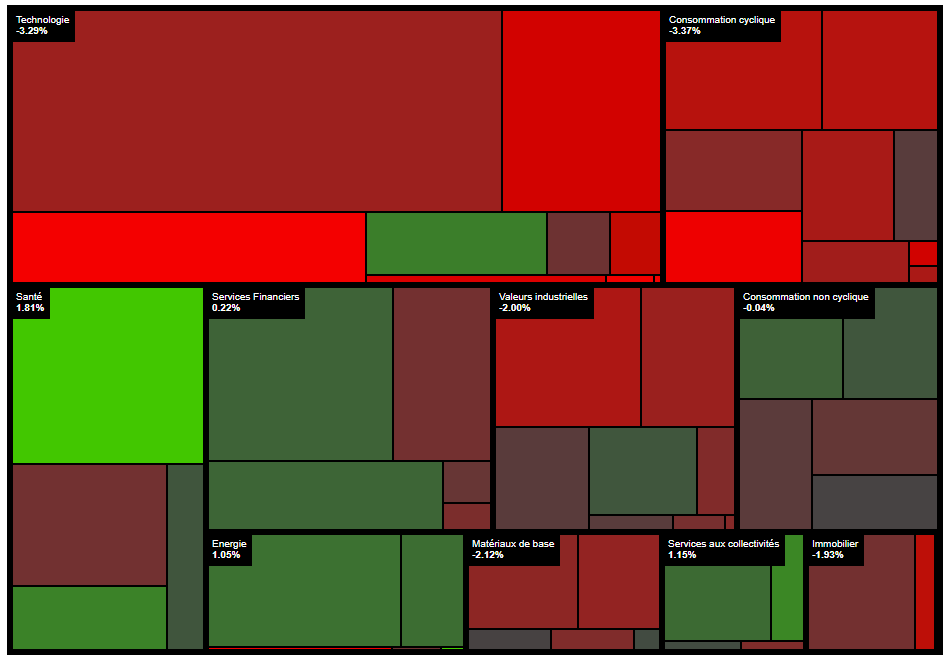

The pathology seems cured. The headwinds are fading, biotechs have a myriad of promising treatments in the pipeline, and valuation levels are once again attractive. As a result, in both the US and Europe, the skies are clearing over the healthcare sector, while clouds are gathering over the others.

On the index side, the SMI has benefited greatly from this recent upturn. Overweighted in healthcare stocks (Roche, Novartis, Alcon, Lonza, Sonova), the Swiss index has been enjoying a notable recovery since November 2023.

By

By