Block 1: Essential news

- Celsius: An (un)happy ending?

After 18 months of legal proceedings, Celsius Network has announced its emergence from bankruptcy, having repaid over $3 billion to its creditors, despite an initial deficit of $1.2 billion. The platform will cease operations, but its bitcoin-mining arm, renamed Iconic Digital and managed by Hut 8 , will continue to operate to help repay creditors. On the other hand, Celsius founder Alex Mashinsky is awaiting trial on charges of financial fraud and market manipulation.

- FTX: towards repayment of all creditors

At a court hearing on January 31, 2024, FTX's lawyer, Andrew Dietderich, announced that the platform's creditors should be reimbursed in full, but asserted that a relaunch of the exchange was impossible. Dietderich stressed that, despite efforts and negotiations, financial and organizational obstacles, exacerbated by the fraudulent actions of founder Sam Bankman-Fried, made a resumption of operations unthinkable. Before its final closure, FTX will examine claims to reimburse those who can prove their losses.

- Coinbase hires big names

Coinbase strengthens its board of directors by recruiting former political figures from the USA and the UK, including former UK Finance Minister George Osborne and former US Secretary of Defense Mark Esper, among others. These hires are clearly aimed at improving Coinbase's public image and strengthening its relationships in a tense regulatory environment for the cryptocurrency sector in the US.

- Google advertises Bitcoin ETFs

Google has updated its policy on cryptocurrencies and related products to allow advertising of Bitcoin spot ETFs in the US, helping to democratize cryptocurrencies. The new policy, which came into force on January 29, now allows the promotion of "Cryptocurrency Coin Trusts" on US territory. Google' s importance in online search, with 8.5 billion searches processed daily, makes this update particularly influential for the visibility and adoption of crypto ETFs in particular.

Block 2: Crypto Analysis of the week

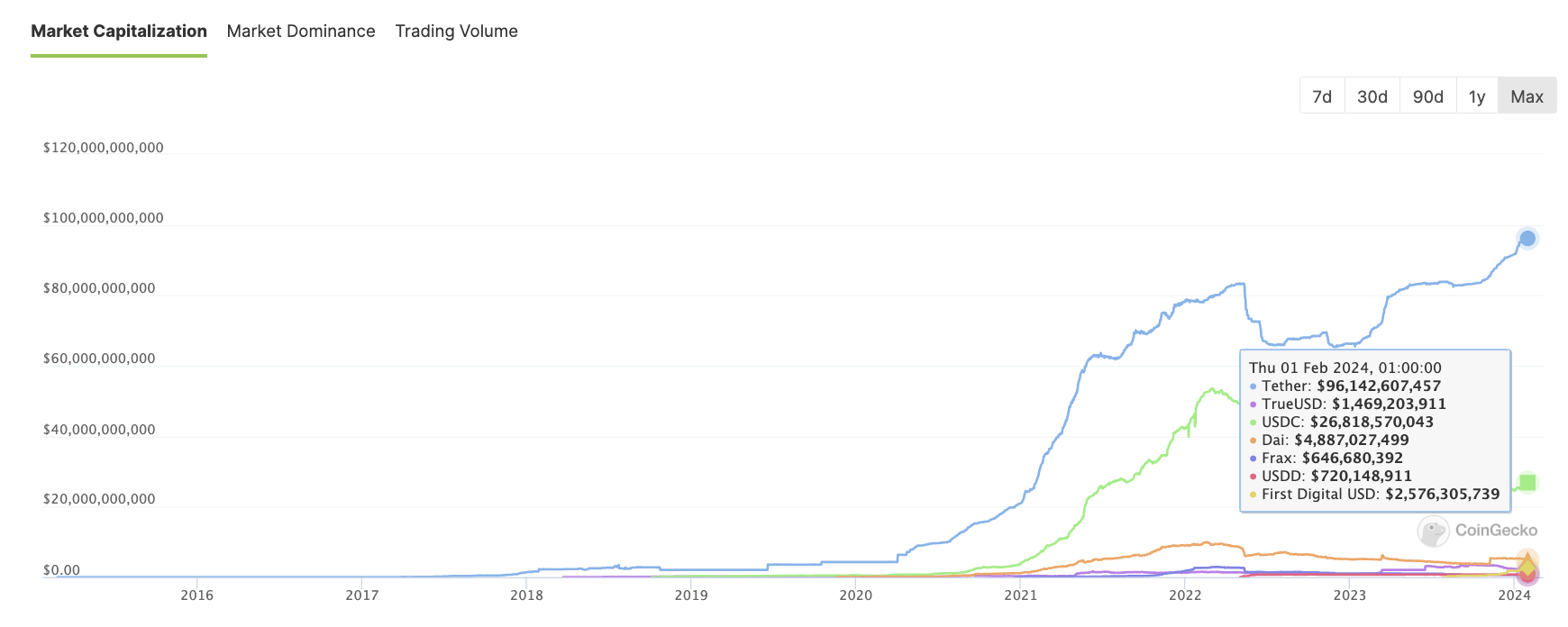

Tether, the issuer of stablecoin USDT, has marked 2023 with an impressive financial performance. With a capitalization approaching $100 billion for USDT - a record for the company - Tether consolidated its position as the undisputed market leader, capturing 71% of the total valuation of all stablecoins.

CoinGecko

Before we continue, let's take a quick look at how stablecoin works in theory. In the context of USDT for example, USDT tokens are created when users and businesses deposit dollars on their cryptocurrency platform in exchange for USDT. The 1:1 ratio of this asset is therefore created by exchanging US dollars for USDT. Conversely, when USDTs are deposited in exchange for US dollars, the USDTs are "burned" to ensure that the number of USDTs in circulation matches the amount of fiat currency on hand at all times. Back to Tether

Last year, the stablecoin leader benefited from the SEC's regulatory assault on Binance, which simply signed the death warrant for the BUSD stablecoin.

The loss of confidence in Coinbase and Circle's stablecoin, USDC, also contributed to USDT's surge. As a reminder, when the banking crisis hit the U.S. in 2023, Circle, the company behind USDC, was one of the tech companies hit. After the collapse of Sillicon Valley Bank (SVB) in March 2023, Circle revealed that it had $3.3 billion in cash reserves backing the USDC in the bank. The USDC then de-indexed from the dollar - or lost its stable 1:1 value against the dollar. Since then, the capitalization of the USDC has fallen steadily, to the benefit of the USDT.

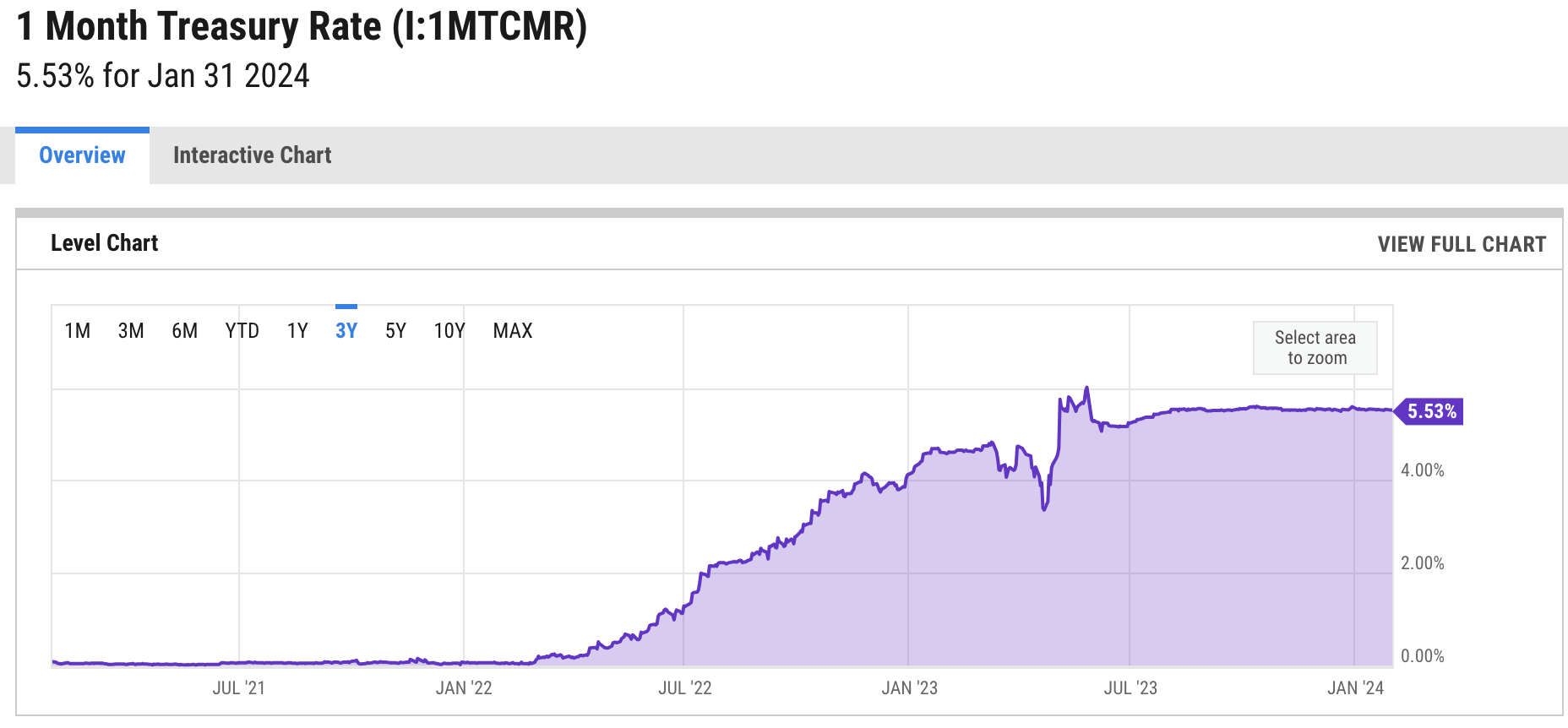

In the fourth quarter of 2023, Tether posted a record profit of $2.85 billion. This exceptional result was largely due to the company's strategic investments, notably in US Treasuries, bitcoin and gold.

Prevailing interest rates played a key role in Tether's booming profitability. Last year saw a significant rise in interest rates, and Tether, thanks to its strategic moves, found itself in the right place at the right time to take advantage of Treasury yields.

Y Chart

Given that USDT offers no yield, Tether has cleverly positioned itself to pocket interest with the genuine dollars provided by customers in exchange for their USDT. A strategy that becomes exponentially lucrative given their considerable holdings of Treasury bonds.

These investments have not only generated substantial operating profits, but have also contributed to strengthening Tether's liquidity and solvency. Annual net income of $6.2 billion testifies to Tether's financial strength and ability to generate significant returns on its investments.

BDO Italia

The company also highlighted its prudent management of reserves. With 90% of all tokens issued now covered by cash and cash equivalents, Tether offers a solid guarantee of the value of its USDT. Excess equity, at $5.4 billion, exceeds secured loans, underlining the company's conservative risk management policy.

Tether.io

Nevertheless, Tether is not without controversy. Criticism has been levelled at the potential use of USDT in money-laundering activities, as well as at the company's decision to freeze crypto addresses sanctioned by OFAC, a branch of the US Treasury.

These issues raise important questions about the regulation and oversight of stablecoins, in a context where trust and regulatory compliance are crucial to the sustainability of these financial instruments.

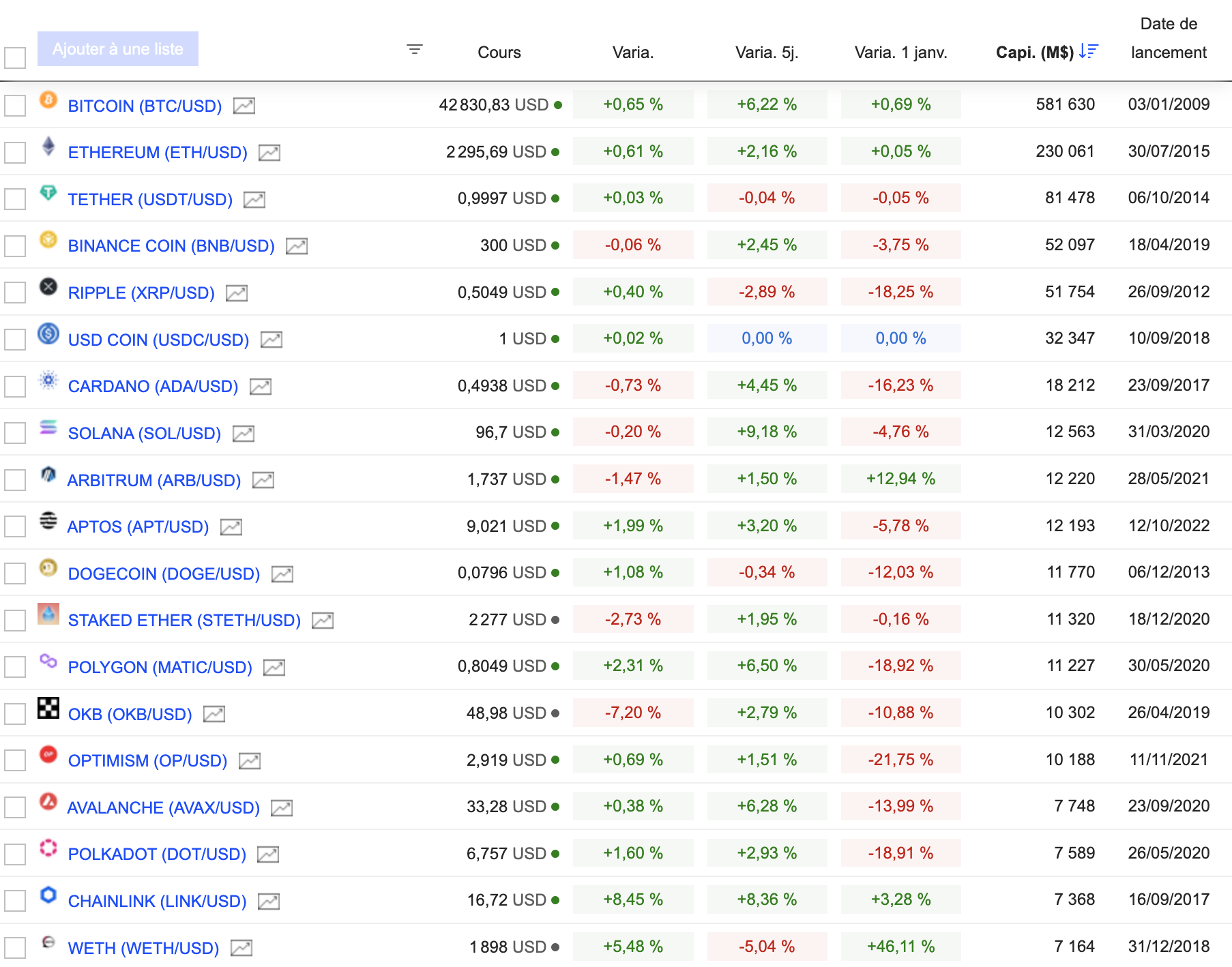

Block 3: Gainers & Losers

(Click to enlarge)

Block 4: Things to read this week

A last-chance plan to save the crypto industry (Wired)

FTX was never really bankrupt (Project Syndicate).

Thou shalt return to dust (Bitcoin Magazine)

By

By