|

|

| This week's gainers and losers |

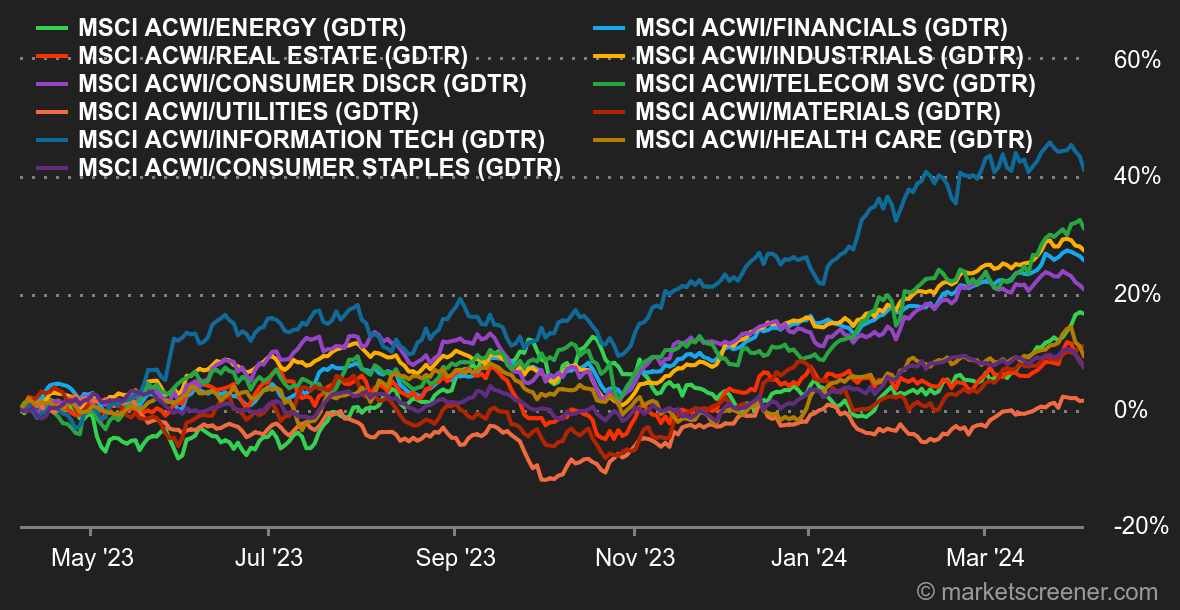

| Gainers: First Majestic Silver Corp (+29%), Fortuna Silver Mines (+23%), Mag Silver Corp (+11%): Our focus is on Canadian precious metals miners. Driven by the strength of gold (+11% since the start of the year, and on an all-time high of $2,300 an ounce) and silver (+12%), all three are trading on annual highs, supporting their benchmark index, the TSX. It's worth remembering that the yellow metal is buoyed by its safe-haven status in these times of geopolitical tension, by the maintenance of interest rates and by very strong demand from China. Cameco Corporation (+14%): The Canadian uranium specialist soars on the back of a hedge initiation from Goldman Sachs. The analyst firm has issued a buy rating and a price target of $55, up from around $47 at the time of writing. It is also benefiting from the good performance of the Canadian TSX index. Eni (+6%), TotalEnergies (+5%), Shell (+5%), Aker (+5%): European oil groups are benefiting from tensions in the Middle East which, combined with solid Western and Chinese demand, are pushing up the price per barrel. This week, an Israeli air strike on the Iranian embassy in Syria rekindled concerns about production in the region. On the sidelines, Eni has announced a share buyback program worth at least 1.1 billion euros and up to 3.5 billion this year. Meta (+5%): Two vectors of growth for the American social networking giant. Facebook's parent company thwarted an attempt by the FTC (the US trade regulator) to tighten the group's privacy rules. In addition, the company benefited from a recommendation upgrade by analysts Jefferies, which raised its price target from $550 to $585. The latter believes that the group is in a position to gain market share in advertising revenues, and even overtake Amazon. Losers: Lamb Weston Holdings (-25%): The champion of processed potatoes disappoints. It reported higher quarterly sales, but below expectations, due to weaker demand for its frozen products and a drop in restaurant visits. In response to this downturn, the group also lowered its annual sales and earnings forecasts. E.L.F beauty (-17%), Ulta beauty (-14%): David Kimbell, Ulta beauty's managing director, threw a spanner in the works by reporting a slowdown in demand across all product categories. He dragged his counterparts in the beauty retail sector, ELF beauty, Estée Lauder and Coty, in his wake. Already that month, Ulta reported lower-than-expected margins, eroded by rising supply chain costs and increased promotions. GE Aerospace (-16%): The aerospace equipment manufacturer, which resulted from the break-up of the General Electric conglomerate into 3 entities, is now flying on its own. After GE Healthcare and GE Vernova, the engines and turbines specialist had a very mixed performance on the stock market, dropping more than 23% on its first day as an independent company. Last month, however, it confirmed its annual targets, promising an operating profit of around $10 billion by 2028. 3M Company (-15%): The American conglomerate (owner of the Scotch brand, among others) has reached a multi-billion-dollar settlement with the courts in response to allegations of water contamination by eternal pollutants (PFAS). The group, which had set aside $10.3 billion, expects to pay $2.9 billion in 2024, with payments due to begin in Q3. The company also completed the demerger of Solventum, its healthcare business. |

|

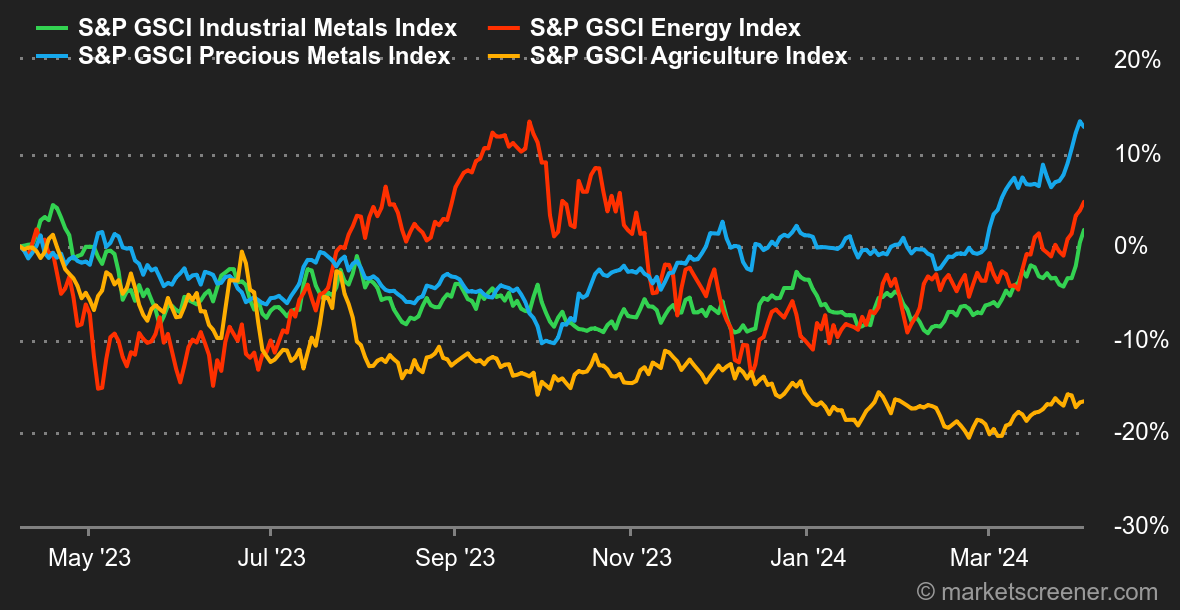

| Commodities |

| Energy: Oil rises for the fourth week running, pushing Brent above the USD 90 a barrel mark. Oil has risen by an impressive 18% since January 1, a performance that could complicate the task of central bankers working to curb inflation. OPEC+ held its Joint Ministerial Monitoring Committee (JMMC) meeting this week and, unsurprisingly, the enlarged organization did not alter its production quotas, maintaining its grip on global supply. At the same time, Saudi Arabia raised its official selling prices for Asian buyers. Finally, geopolitical tensions remain high in the Middle East following Israeli strikes in Syria targeting Iranian interests. Metals: The price of copper reached a new annual high this week at USD 9256 per tonne. China intends to reduce its copper production in order to eliminate the surplus which is penalizing its smelters. The rest of the compartment remains well oriented in London: aluminum rose to USD 2400, zinc advanced to USD 2550 and lead recovered to USD 2040. Gold also set a record, but an all-time record, as it broke the USD 2300 barrier for the first time. The price of gold is extremely sensitive to the direction of the Fed's monetary policy. In this respect, the slightest hint that a rate cut is on the horizon in June is a major boost for gold. Agricultural products: After cocoa (which remains high), it's coffee's turn to make news. Its price jumped 10% in just 5 days. As with cocoa, concerns are mounting over supply, as lack of rainfall and rising temperatures are threatening harvests in South-East Asia. |

|

| Macroeconomics |

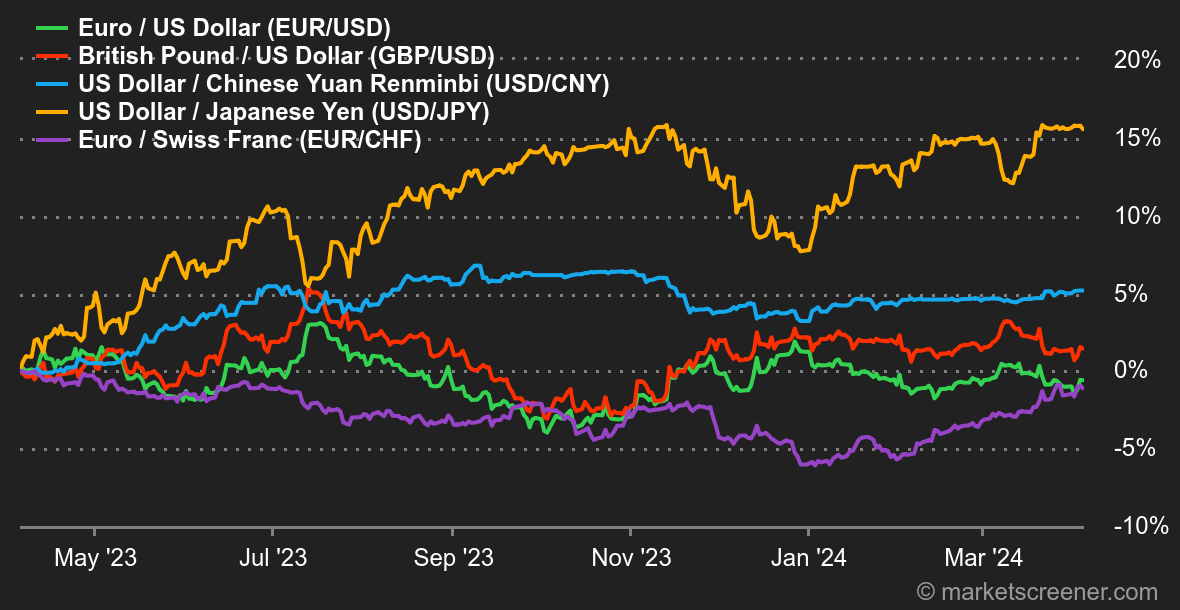

| Rates. Between rising oil prices due to heightened tensions in the Middle East and uncertainty over the first rate cut, the world's stock markets are having a hard time keeping their heads above water this week. It has to be said that things got off to a bad start with the publication of an ISM manufacturing index for March in expansionary territory for the first time in 16 months in the United States. Investors were on the lookout for any statistics that would thwart the prospect of the first monetary easing in June. And unfortunately, central bankers did not reassure, quite the contrary, believing that they were in no (further) hurry to act given current levels of price rises. Fortunately, Friday's monthly employment report painted a mixed picture, with higher-than-expected non-agricultural job creation, but unemployment and wage growth in line with consensus. Nonetheless, US Treasury yields refuse to capitulate, and remain stuck at around 4.40% on the 10-year. Crypto. Bitcoin is down more than 5% this week, and is back in contact with $67,000 at the time of writing. Despite this fall, Bitcoin Spot ETFs continue to accumulate positive net flows, albeit significantly less than in March. The funds issuing these ETFs, led by Grayscale, BlackRock and Fidelity, have accumulated over $57.56 billion in assets under management, or 4.31% of bitcoins in circulation. As is often the case, bitcoin dictates the market's trajectory, and within this framework, the other crypto-currencies have followed the crypto-asset leader's downward trend. Ether (ETH) is down over 10% to the $3,250 level, Solana (SOL) is down 14% to around $170, Binance Coin (BNB) is down 4% to $580, and Cardano (ADA) is down 13.5% to $0.57. More generally, the entire crypto-asset market is down, but its valuation is still up by more than 55% since the start of the year. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By