The pan-European STOXX 600 index rose 0.5%, after worries about the fast-spreading Delta coronavirus variant and slowing economic growth had knocked 2.3% off the index on Monday.

Miners, among sectors that bore the brunt of Monday's bruising selloff, rose 1.5% after BHP Group and Anglo American provided upbeat production numbers.

Swiss bank UBS climbed 5.3% on posting a 63% jump in second-quarter net profit, helped by a booming wealth management business. Peers Credit Suisse and Julius Baer also rose.

"We expect European (economic) growth to peak this summer (but) continue to favour risk assets over a 12-month horizon," analysts at BCA Research wrote in a note.

"The UK is a case in point -- broad-based vaccinations are keeping hospitalisation rates there low despite the sharp jump in COVID-19 infections. Thus, the market impact of the Delta variant may ultimately prove fleeting in developed economies."

British airline easyJet gained 0.9% after saying it plans to fly 60% of its pre-pandemic capacity in the July-September period, while Carnival rose 3.3% as it expects to have resumed cruises with 65% of its total fleet capacity by the end of 2021.

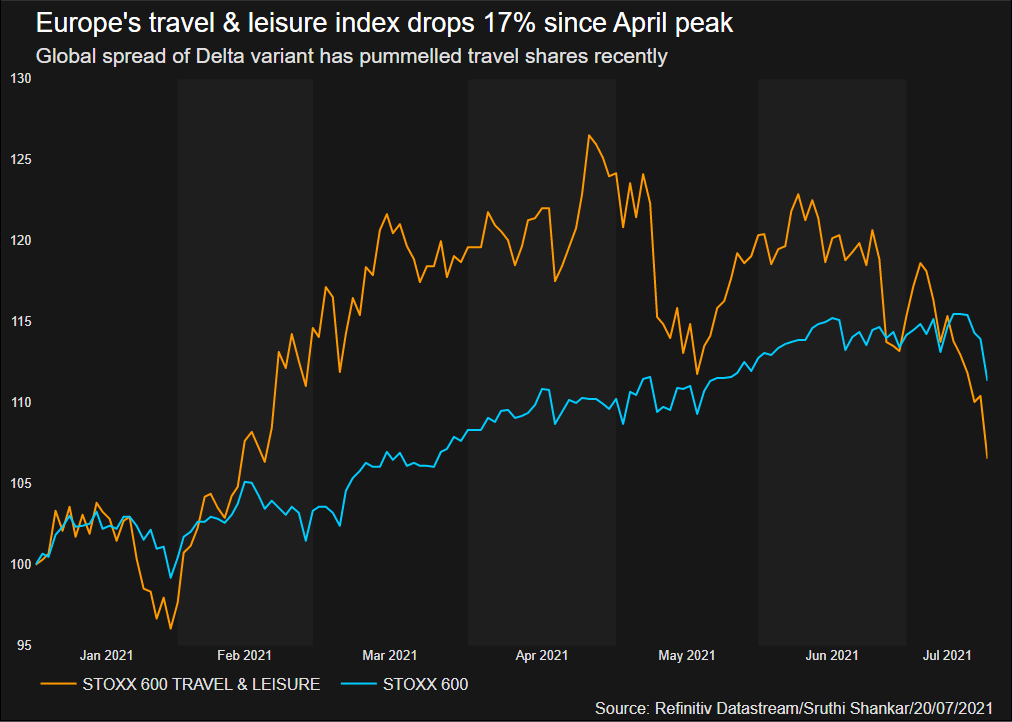

Europe's travel & leisure index has fallen sharply from its April record highs, with travel-related stocks getting hit by soaring infections across the continent and last-minute changes to travel rules.

Europe's travel % leisure index drops 17% since April peak

After hitting an all-time high just a week ago, fears that surging coronavirus cases will topple a nascent economic recovery has seen the STOXX 600 slide more than 3% from that level. A continued decline in bond yields showed worries remained. [GVD/EUR]

Home appliances maker Electrolux tumbled 6.4% after it reported a lower-than-expected second-quarter operating profit and warned global supply chain woes would worsen in coming months.

But "healthy incomes growth and elevated household saving rates in developed markets should mean that goods spending slows rather than slumps," said Jennifer McKeown, head of global economics service at Capital Economics.

Norwegian telecoms operator Telenor rose 3.8% after it raised its full-year revenue outlook.

Analysts expect profit at STOXX 600 companies to jump 115.2% in the second quarter versus a year ago, according to Refinitiv IBES estimates, as COVID-19 restrictions eased across Europe.

Sweden's AB Volvo fell 2.5% as it warned of further production disruptions and stoppages this year due to chip shortages.

(Reporting by Sruthi Shankar in Bengaluru; Editing by Alex Richardson and Bernadette Baum)

By Sruthi Shankar and Susan Mathew