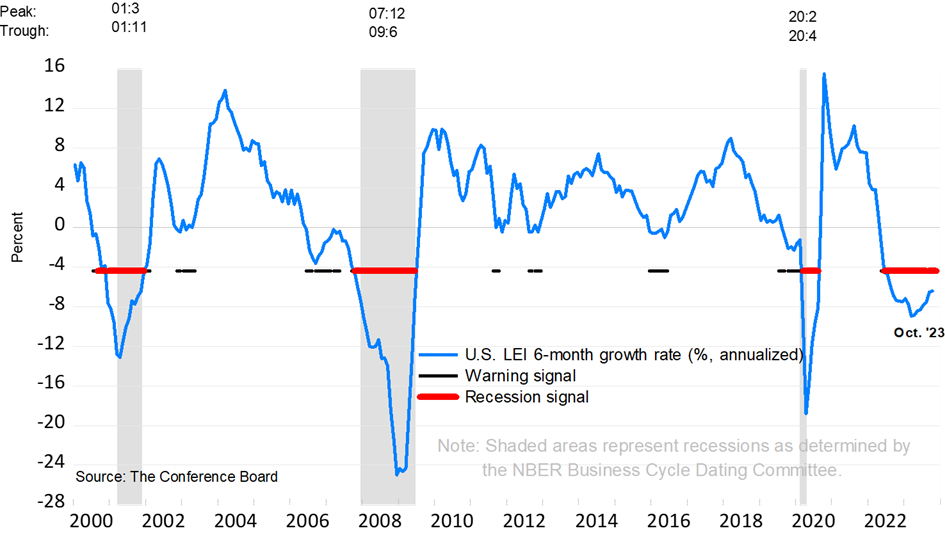

Due to a shortened week in the US, investors didn't have much to get their teeth into, with the notable exception of the traditional turkey. We'll simply note that the Leading Index published by the Conference Board came in slightly below expectations at -0.8% versus -0.7%. They still point to a recession in the months ahead.

Source : The Conference Board

One component is particularly interesting: consumers are more pessimistic about economic conditions, which could dampen their buying ardor, especially during Black Friday and Cyber Monday. For this reason, sales volumes will be the focus of attention. As a reminder, one of the pillars of the current narrative remains a soft landing for the US economy, which would therefore not be compatible with a sharp downturn in consumption.

In the meantime, the US 10-year yield is attempting to rebound from its 2022 peak of 4.34%. We'll be keeping an eye on 4.60% as initial resistance, which, if breached, could put a damper on the fine upward momentum seen in equities over the past month. In Europe, the German Bund has also stabilized above its 200-day moving average around 2.60/53%, with a first rebound target around 2.75/77%.

US 10Y CASH

US 10Y CASH  By

By