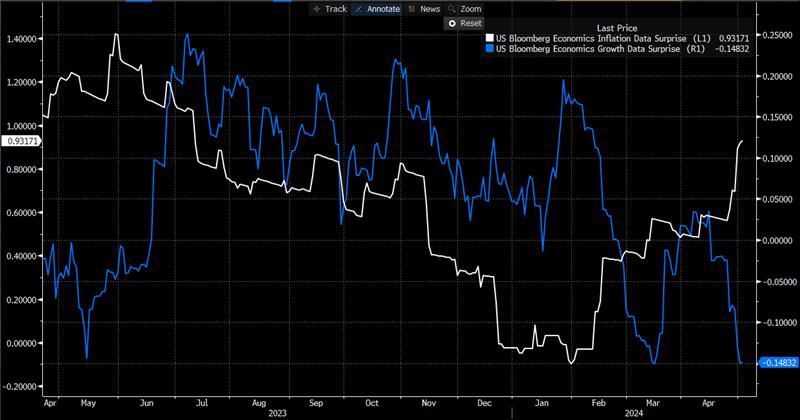

Depending on whether you see the glass as half empty or half full, the US inflation figures will be interpreted differently: CPI came out slightly below expectations with a 5.0% and 0.1% increase in annual and monthly rates respectively, compared to +5.2% and +0.2% expected. However, excluding energy and food, the Core CPI rose by +5.6%, exceeding the CPI for the first time in two years. In other words, the efforts of the U.S. central bank have not yet had their full effect. In fact, 88% of investors expect a 25 basis point rate hike at the next policy meeting scheduled for May 3, followed by a final hike in June before starting to cut rates this summer.

Copyright: Bloomberg

The ECB's expected path is significantly different: the European central bank is expected to continue its tightening cycle marked by multiple rate hikes until September/October before initiating further easing there too from the end of the year.

Copyright: Bloomberg

In fact, the spread between the US 10-year and the European 10-year continues to narrow and is now only a short distance away from the target posted last December in our special article on this spread.

US 10Y CASH

US 10Y CASH  By

By