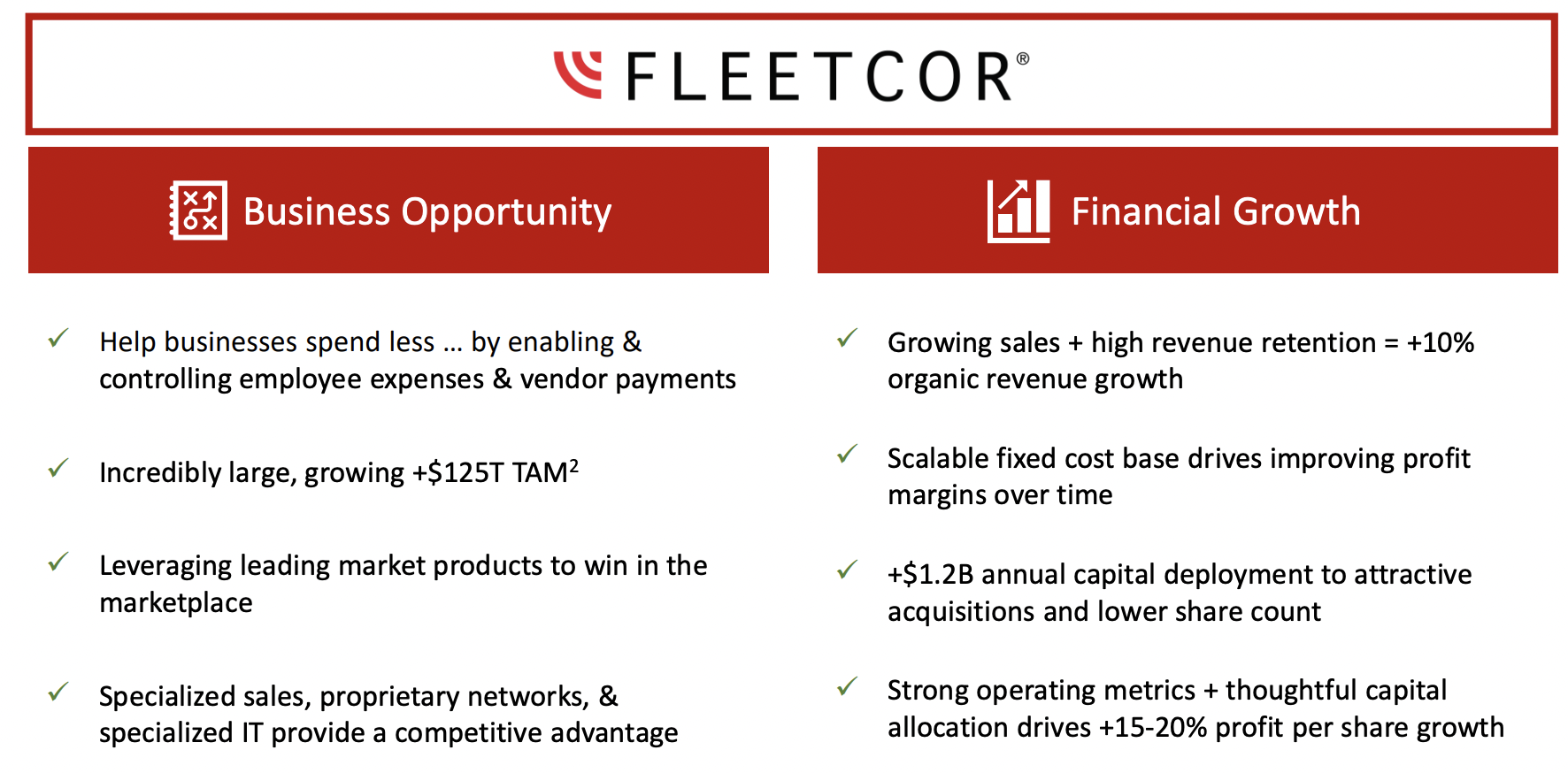

Fleetcor is a global company that offers solutions for managing business expenses and vendor payments. The company's services aim to reduce overall spending by improving expense management processes. Many businesses struggle to effectively track their purchases and often rely on other methods to approve and make payments, which can lead to wasted time and money due to unauthorized or unnecessary spending, fraud, or data entry errors. In essence, the company specializes in providing B2B payment solutions designed to help clients tackle these challenges and, in the end, cut costs by better controlling their purchasing and payment processes.

The Group's business model is divided into 3 divisions:

- Corporate Payments (23% of revenue): designed to help businesses streamline the back-office operations associated with making outgoing payments to vendors.

- Vehicle & Mobility Payments (57% of revenue): enabling business and consumer customers to pay for vehicle and mobility-related expenses, while providing greater control and visibility of employee spending

- Lodging Solutions (13% of revenue): for people who travel overnight for work purposes, to airlines and cruise lines

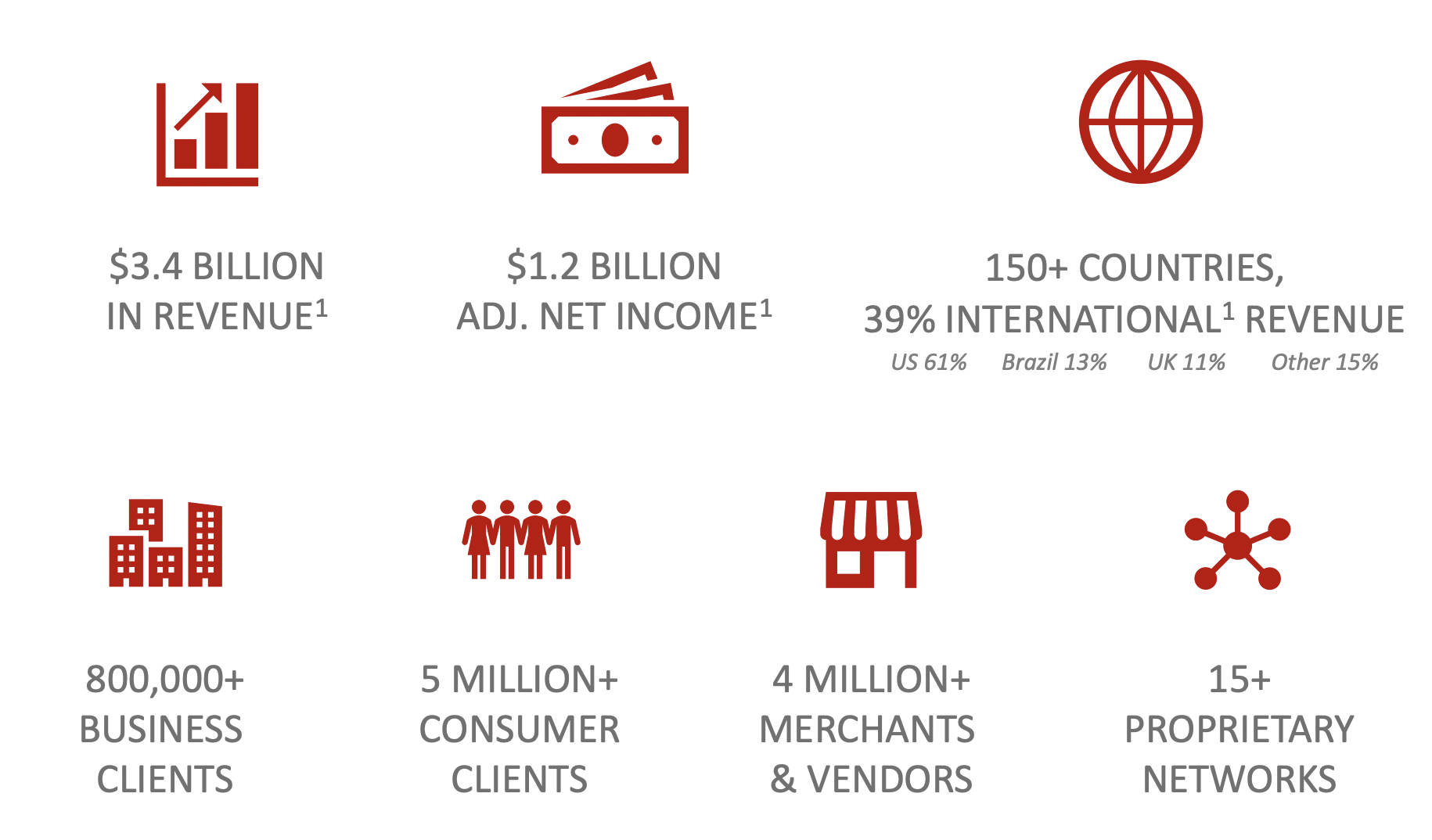

The Group's services are available in more than 150 countries, with the United States the 1st source of revenue (61%).

The company therefore evolves in a very competitive landscape competing against giant such as PayPal, Square, and Stripe. PayPal offers a comprehensive platform facilitating secure online payments for both businesses and consumers. Square, specializing in user-friendly point-of-sale systems, caters to small businesses, enhancing their operational efficiency with seamless payment solutions. Stripe stands out for its robust payment infrastructure tailored to online businesses, ensuring frictionless transactions and efficient subscription billing.

Fleetcore has proactively pursued strategic initiatives to foster growth, focusing on areas such as corporate payment automation and diversifying its business to mitigate risks associated with the decline of fossil fuels in its Fleet segment. As part of its ongoing strategic review, there is a possibility of optimizing the corporate structure, potentially leading to the spinoff or sale of specific business units. With an annual free cash flow of approximately $1 billion, the company is well-equipped for continuous share buybacks and strategic investments in acquisitions. The recent appointment of CFO Tom Panther, known for his expertise in transactions, is expected to facilitate accelerated deal-making.

Additionally, Fleetcor's strategic review, in collaboration with activist investor D.E. Shaw, presents avenues for expansion within core businesses and potential divestment of non-core assets. Noteworthy recent developments include the sale of its Russian operations to a local investment group in August and the initiation of an accelerated share repurchase program amounting to $450 million, with plans to utilize the proceeds by the end of the third quarter.

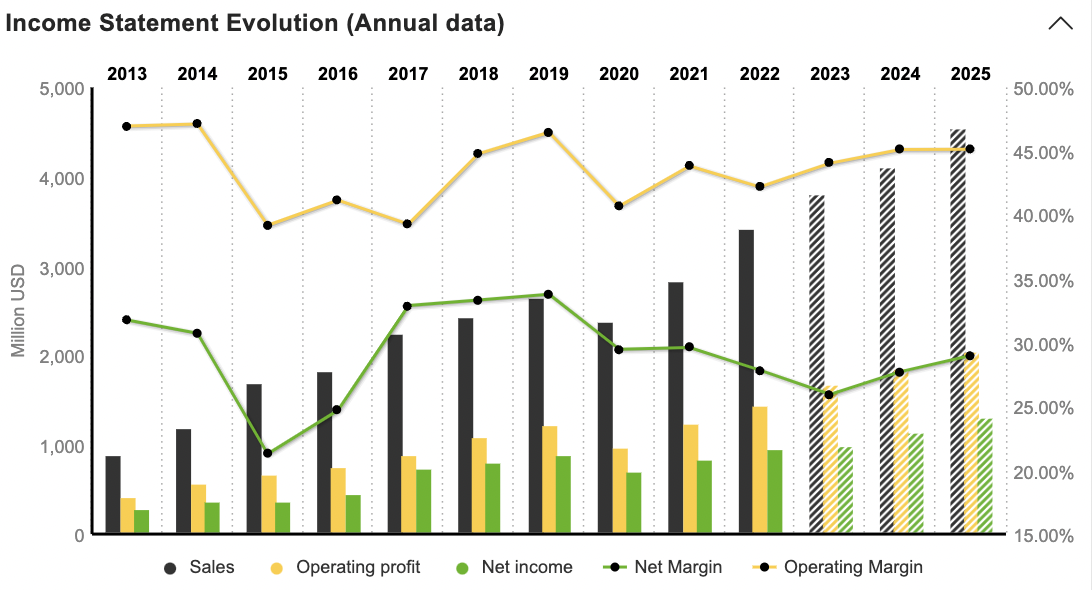

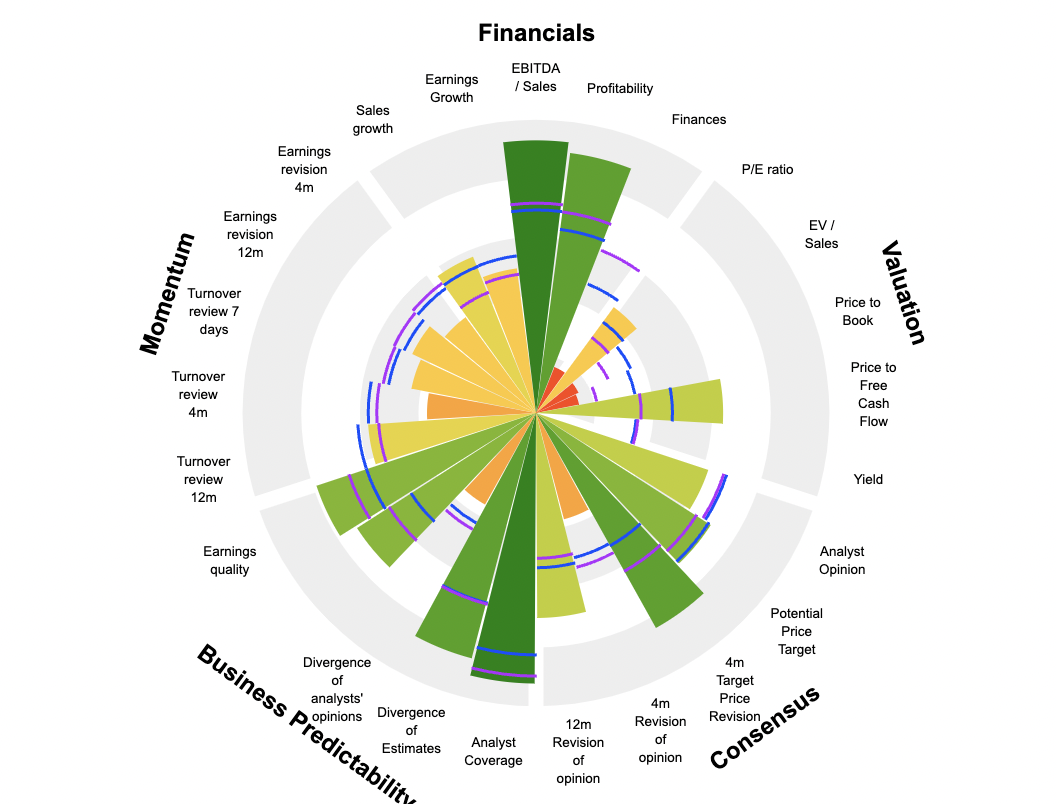

The company's financial performance has shown consistent growth since 2010, with sales increasing from $0.4 billion to $3.4 billion, indicating a Compound Annual Growth Rate (CAGR) of 19% and Cash EPS with a CAGR of 21% over the same period; increasing from $1.66 to $16.10. Notably, the operating margin for 2022 stood at a robust 42.2%, aligning with its 5-year average, and the net margin was 27.8%. Additionally, the number of outstanding shares decreased from 92.1 million in 2015 to 73.7 million in 2022.

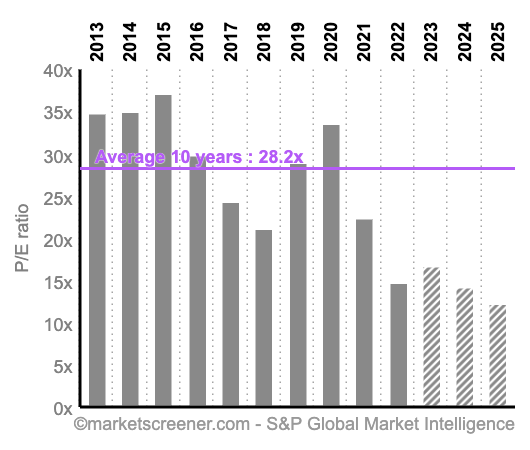

For the year 2023, the expected free cash flow (FCF) is $1.483 billion, with FCF Conversion from EBITDA and Net Income at 39% and 73.5% respectively, both exceptionally high figures. Furthermore, the company boasts impressive financial profitability metrics, including a Return on Equity (ROE) of 45.7% and Return on Assets (ROA) of 9%, indicating its status as a highly profitable entity. It's worth noting that the company's current valuation at 14.8x is currently below its 10-year average of 28.2x.

In the second quarter of 2023, FLT demonstrated robust financial performance, reporting a revenue of approximately $948 million, reflecting a commendable 10% organic growth. The adjusted earnings per share stood at $4.19, surpassing consensus estimates and aligning closely with the upper end of guidance. Despite challenging fuel market conditions and stringent credit standards, Fleetcor's Fleet segment exhibited resilience, with credit losses mitigating some adverse impacts. The Corporate Payments segment experienced organic growth due to strategic shifts toward higher-yield products and channels. Other segments performed in line with expectations.

Fleetcor revenue streams, diverse in nature, provide a degree of resilience during shorter economic downturns. However, if the current trend of low fuel prices and a prolonged decrease in lodging and corporate payment activity persists, it could impede the company's growth trajectory. Notably, approximately 13% of its revenue is directly influenced by fuel prices. While the company possesses the necessary resources to accommodate mixed and electric vehicle (EV) fleets, the widespread adoption of EVs, especially within the Fleet sector, poses long-term challenges that require careful consideration.

The business is poised for substantial growth in both overall revenue and adjusted EPS until 2024, primarily fueled by advancements in the Fuel business. Additionally, it maintains a robust financial position, boasting an annual free cash flow of approximately $1 billion, enabling sustained share buybacks and strategic acquisitions. However, it's essential to note that the current stock valuation reflects a significant premium compared to the sector average.

By

By