Smartphones have admittedly reduced the TAM for action cameras, but the latter do retain their place in the market as specialized, fit-for-purpose content production devices. Creators purchase action cameras exactly for the same reason that joggers buy running shoes, even though they already own sneakers.

GoPro has a very strong moat thanks to its superb mindshare and original content creation online ecosystem. On the operations front, it has revamped its business model, paving the way for higher margins, recurring revenue and ubiquity in the content creation space.

In effect, the company has pivoted from being a straightforward seller of hardware to providing a subscription-based online service to creators. It includes unlimited cloud storage of footage, camera replacement and a 50% discount on gopro.com. Many users have argued that the cloud storage alone is worth the annual subscription.

The service now hosts up to 2 million subscribers, vs. just 250,000 two years ago. This online platform is an avenue through which GoPro can continue to provide high margin digital service, for instance in video editing, marketing or distribution. Meanwhile, rising selling prices for GoPro's devices—with over 3/4 of cameras sold for an ASP above $300—are a testament to the company's strong customer franchise.

A new business orientation

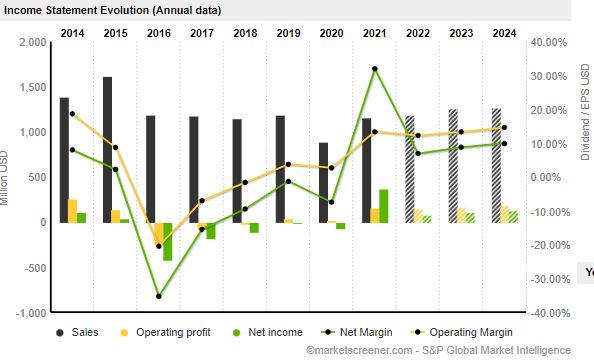

The turnaround is gaining traction and there are already signs of improvement with operating margins back in the black and reaching levels they haven't seen for almost a decade.

Source: MarketScreener

The balance sheet is rock solid with all liabilities covered by current assets alone and interest expense covered over x7 by EBITDA. Inventory turnover is increasing slightly. Cash generation has been weak in the past—GoPro was effectively hemorrhaging cash between 2016 and 2019—but it shot up dramatically last year, among other reasons because the new business model freed up big amounts of working capital.

The turnaround and new business orientation should be credited to the expert management of CFO Brian McGee, who effectively became both the COO and de facto head of the company. Founder Nick Woodman has lucidly taken the back seat on operations, focusing instead of building the brand and its service—areas when he shines.

At $5.4 a share, GoPro's enterprise value of $700M represents a multiple of just x0.6 revenue revenue and x3 last year cash earnings, a.k.a free cash-flows. The company looks remarkably cheap in light of a strong franchise, long growth runway and successful transformation of its business model.

The main negative, even though it may not necessarily warrant hasty conclusions, is that insiders have been heavy sellers over the last months.

By

By