EARNINGS/SALES RELEASES

The building-related activities (DOM & MAC) could not escape a sudden softening in the market even though they enjoy the nominal steadiness of renovation markets. The industry-related activities shone but accounted for less than 30% of revenues. The management is worried about H2 and slashed its sales guidance to €680m which now looks like a floor. We have cut our 2023 earning forecast by c.30%.

FACT

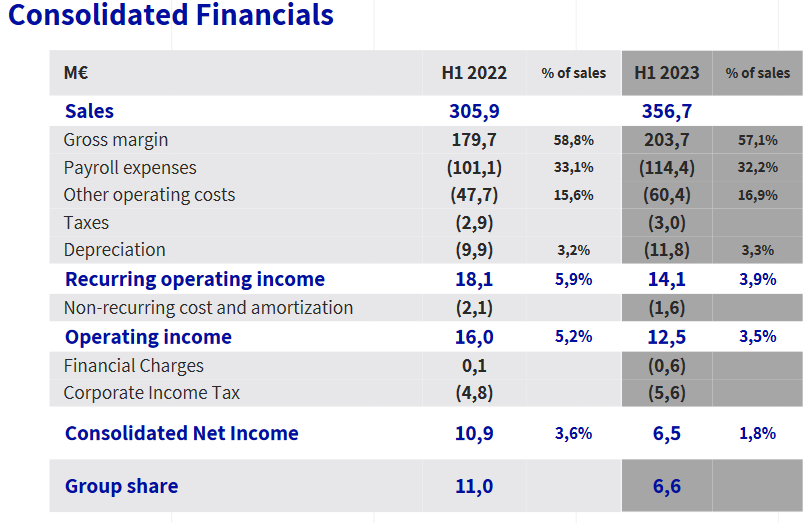

Strong organic sales (up 7.5%) were accompanied by a 200bp drop in the operating margin to 3.9% and a contraction in net earnings to €6.6m from €11m.

With a still-demanding working capital requirement, the net cash situation (as per the SFPI definition) was down to €11.4m vs. €25.5m a year earlier. The balance sheet remains extremely sound with net cash expected to improve as excess inventories are run down.

ANALYSIS

The H1 earnings were not expected to be good as European building markets have hit the buffers of fast rising rates. Building is always the first to be impacted. Industry is unlikely to escape a degree of slowdown somewhat later. For 2023, SFPI’s industrial units are doing remarkably well in meeting the solid demand with a lean industrial base.

The negative surprise was the drop in the gross margin to 57.1% from 58.8%. This came from the building side and confirmed that demand has become price sensitive. With the renovation markets accounting for 80%-90% of revenues, MAC (mostly windows and doors) sales were somewhat cushioned but it is reasonable to expect that this segment will tank as well at a later stage

Solid cost control at the payroll level was sadly not enough to offset the extra layers of miscellaneous costs including the in-depth reorganisation of the industrial bases of MAC. This was well flagged when SFPI released its 2022FY accounts thus should be regarded as costs incurred for a good cause.

The Industrial units were the H1 positive with MMD posting sales up 37% and Neu-JFK up 11.5%. There is no shortage of demand for heat exchangers and air treatment but these are businesses where order books are not very long so that the more than 6 months of business ahead is great to have.

As with many other manufacturing businesses, SFPI has had to face a supply scarcity in the post-Covid recovery period. Building up inventories was unavoidable and presumably at higher costs than the going prices. This shows up in an increase of working capital requirement of c. €10m yoy but was contained to €2m vs. the close of 2022. After allowing for dividends and acquisitions in the H1, the gross cash position remains very healthy at €117m. This is largely due to strong cash from operations (€21m)

IMPACT

The ever-cautious SFPI has slashed its sales guidance from €715m to €680m – a strong statement about the changing visibility. We see €680m as a floor that we have not adopted for our reduced forecast with sales resetting at €695m. Pressuring sales down further would probably imply a collapse of profits. On sales at €695m, our earnings forecasts reset 30% lower for 2023 and c.8% to 10% lower for the following 2 years. This does not change our target price that much (provided that the dividend does not take a hit). The news flow is however unlikely to be positive for the next few quarters.