H1 sees contracting margins

EARNINGS/SALES RELEASES

SFPI sales gains in H1 (+8%) were marred by declining gross margins and rising inventories, typical of post-Covid input cost pressures. This is transitory. The allowance for the Wo&Wo acquisition from Q4-2022 is a positive for forward-looking earnings. A potential recession is not allowed for in our forecasts.

FACT

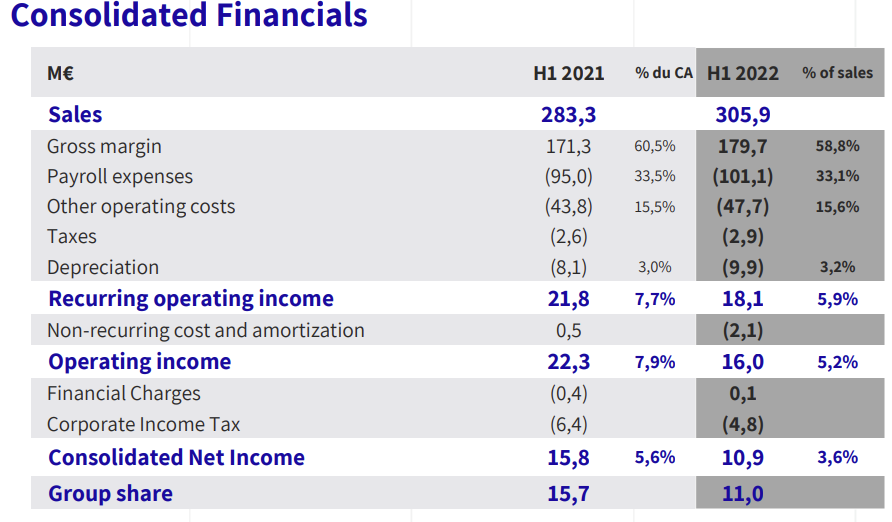

SFPI published H1 net earnings down 31% on sales up 8% (see table) which was a slight disappointment.

Its balance sheet is not affected with net cash at €53m, after allowing for a surge in working capital requirement (+€22m).

Post H1 and separately, SFPI has added a €60m revenue business by acquiring Wo&Wo, an Austrian expert in awnings and related equipment for solar protection.

ANALYSIS

The overall H1 theme was rising input costs for all key 4 industrial entities, higher staffing costs to meet demand and higher capex.

The locking & access control unit, DOM, is recording strong growth and booming costs. Price increases (+4% price effect in H1) should develop into H2 and help the gross margin revert to the 70% target (68% in H1). Inventory depreciation also marred H1 operating income and should be a one off. The strategy is unchanged to fast forward all sorts of digital based access controls.

MAC which specialises in windows experienced superb price effects (+11%) on flattish volume gains. It needs more to offset input price rises. Efforts to rebuild gross margins after a 330bp decline to 52.6% include streamlining and standardising even more components so that there are fewer suppliers/better bargaining power. This will also help contain a surge in inventories.

Moving on to units supplying industrial equipment, NEU JFK managed to impose sharp price rises for air cleaning devices and saw a 160bp bump in its gross margins. Its success was contained by transportation/delivery issues that should disappear by H2. The efficient standalone air cleaning unit for offices should do well as Covid fears persist. NEU JFK is testing a web-based selling effort on this occasion.

MMD faced delayed deliveries on client requests for its sterilisation equipment unit (Steriflow) while its heat exchangers are doing well. The combined businesses saw an 8% drop in revenues which should be offset in H2

For the group, the rise in inventories (volumes needed to pre-empt shortages + prices) was the main impediment to FCF generation but came as no surprise. The gross cash position remains very strong at €137m, leaving the group with ammunition to swoop on opportunities. This has already happened with the acquisition of Wo&Wo, presumably acquired for a bit less than €30m on an EV basis and using cash & fresh debt. Wo&Wo offers 6% Ebit margins which are not far from those of the group and in any case amply cover the funding costs of the acquisition.

IMPACT

After allowing for the H1 slow start earnings wise and keeping a positive eye on H2 2022, our eps are marginally trimmed for 2022. The 2023 eps benefits from the full impact of Wo&Wo full. The valuations remain very attractive presumably as, like its peers, the stock is discounting a substantial slowdown as a result of the energy crisis in Europe. For now, such worries are not being reflected in orderbooks.