Here is roughly how the company presents itself to retail investors (individuals):That this is the only producer of rare earths in the United States and the only producer of neodymiums in the West (China controls most of the world production). These strategic metals are essential for almost all industries, in particular for defense, technology and new industrial applications such as batteries for electric vehicles. In the current era of ecological transition, but also at a time when energy independence is critical, MP Materials is an essential actor to keep America safe and thriving. MP Materials has just received the support of the Pentagon, which strengthens an already perfect pitch to a clientele of retail investors.

Alas, there are many red flags : an asset with an inglorious history (Mountain Pass), a CEO with no experience in the mining industry, the involvement of two hedge funds (one of which is headed by said CEO), a listing via a SPAC sponsored by Chamath Palihapitiya, an close relationship with the Chinese shareholder linked to the CCP, a crazy valuation, massive insider sales, an ongoing judicial investigation, and embracing the "green technology" and "electric vehicles" wave.

So... Let's start with rare metals.

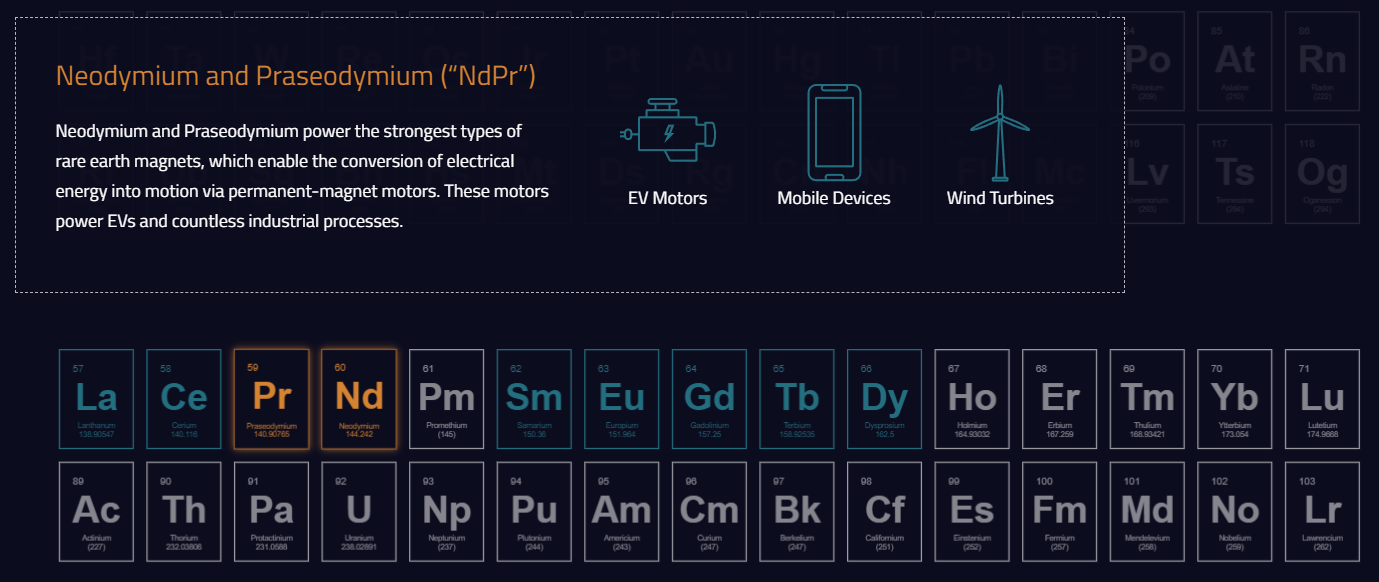

We often hear this term without really understanding what makes them so rare. Tin, iron, cobalt, lithium, silicon but also metals less known to the general public such as yttrium, terbium, indium, europium, praseodymium, etc. These metals, more or less rare, are all found on the periodic table of elements.

The term "rare metals" is inspired by the name "rare earths", which in the 18th century referred to a grouping of 17 metals with similar chemical properties in the periodic table of elements, the extraction of which was complicated at that time. However, today, the term rare metal does not refer to any universal criterion of rarity. It all depends on the parameter considered (difficulty of extraction, concentration in the soil, production, etc.). Some of these rare metals are not very present in the earth's crust (e.g. platinum, whose average concentration in the soil is about 0.005 mg/kg). Others are not (cerium for example is considered as rare, whereas it is more present than copper which is not considered as rare). Rare earths are often mixed together and obtaining them in purified form is difficult and very polluting. A metal can also be considered as rare just because it is not produced much, it is the case of palladium for example whose production is 7000 times lower than iron. Finally, instead of talking about rare metals, it is more accurate to talk about strategic metals. Of the 47 strategic metals listed, there are 42 ore metals, including 17 rare earths.

Despite their name, many rare earths are in abundance and in oversupply. There is a lot of fluctuation - mostly speculative - but the long-term dynamics are clearly tilted in favor of a balance of power that favors demand over supply. Moreover, new deposits are constantly being discovered and large areas remain unexplored. Extraction is not profitable anywhere except in China where labor conditions and environmental standards are much lower than in North America. It is not so much the extraction of rare earths that is sensitive but their refining - which is an ecological disaster. For the moment, the main sites are in Asia, notably in China and Malaysia (close to the large deposits that can be exploited economically).

To go further on this topic, I invite you to consult our Thematic List.

Now that you know what we are talking about, let's get back to MP Materials. Its main asset, the Mountain Pass deposit in California, near the border with Nevada. This site has been operated since 1951 by various owners: Molybdenum Corp of America, then Unucal from 1977, Chevron took over from 2005, then MolyCorp from 2010 until its bankruptcy in 2015 and finally MP Materials since then.

The history of the previous owner MolyCorp is quite disturbing. MolyCorp went bankrupt in 2015 after never being able to make its rare earth mining business profitable. The Mountain Pass site was sold at a discount each time: various private equity funds bought it from Chevron for $80 million before it came to MolyCorp (MolyCorp then proceeded to an IPO and raised 400 million). JHL Capital (the hedge fund led by James Litinski, the current CEO and chairman of MP Materials) then bought it back for only $20 million in the summer of 2017. A few crumbs for an asset presented as "hyper profitable and strategic".

.

After its incorporation, MP Materials repositioned itself on the extraction of neodymium and praseodymium (two metals classified among the 17 rare earths that exist and used in the manufacture of batteries and wind turbines) but also of cerium (used in automotive catalysts, glass polishing and LEDs), lanthanum (used in rechargeable batteries, photographic lenses and night vision tools) and europium (used in lasers, medical imaging and electric car engines).

Questionable management

MP Materials was listed via a SPAC called Fortress, and sponsored by Chamath Palihapitiya and Softbank for $1 billion in the summer of 2020.

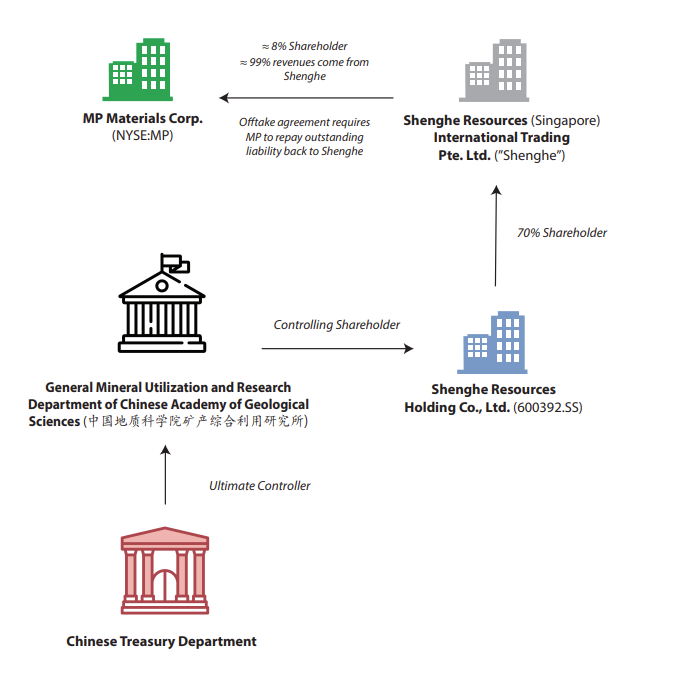

Chinese rare earth specialist Shenghe Resources Holding (partly controlled by the Chinese government) owns 7.5% of MP Materials and brings the technical expertise that MP Materials' management team lacks, since they are coming from hedge funds and have no experience in the mining industry.

A contract was signed at the time of the listing of MP Materials stipulating that the company was to sell all of its production to Shenghe, which would provide the refining. This contract was alledgedly signed just before MP was listed via a SPAC. Now there is a lawsuit over it. A report from Bonitas Research explains the lawsuit in detail. Basically, Shenghe alledgedly overpaid MP Materials because they are accused of exaggerating rare earth concentration levels in Mountain Pass soils, artificially inflating the company's potential profits and allowing insiders to sell at artificially high prices. To read more, click here

.

Dependent on a Chinese player

There is another damning report about MP Materials and this time from Grizzly Report. According to them, MP Materials is allegedly completely under the control of Shenghe and by extension the Chinese government. The report goes into great detail about how unrealistic MP Materials' financial projections are. It also raises serious doubts about the quality of the reserves at the Mountain Pass site.

.

The refining of strategic metals and more particularly rare earths is an extraordinarily complex, costly and environmentally sensitive process. So it may seem difficult to believe that a startup like MP Materials (launched by financiers with no priori mining experience) would have control of these processes.

Those thinking of betting on an American rare earth producer (which makes sense in the tense geopolitical climate between the US and China) must realize that 100% of MP Materials' revenue is generated via its Chinese customer Shenghe, which buys all of its production from it.

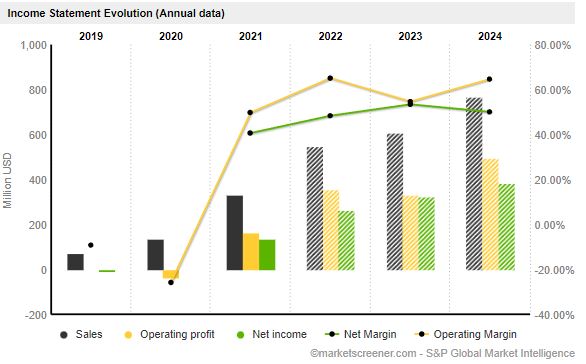

For now, the exponential increase in revenues is linked to a real bubble in the price of rare earths and the exclusive taming agreement signed with Shenghe. But despite the promises, production at the Mountain Pass site is stagnating at 10,000 tonnes per quarter: a volume that is completely insufficient to pay for the large refining infrastructure that MP has promised its investors to develop and bring on stream this year. If the speculative rare earth bubble deflates (as it always does), it could be the end of the road.

Source: MarketScreener

My advice is to remain cautious when it comes to well-crafted storytelling about the tensions between China and the US and the demand for rare earths that will explode with electric vehicles. In the stock market, this narrative is often used - "The future is beautiful, don't miss the train". There are many red flag here, so I personally would steer clear.

By

By