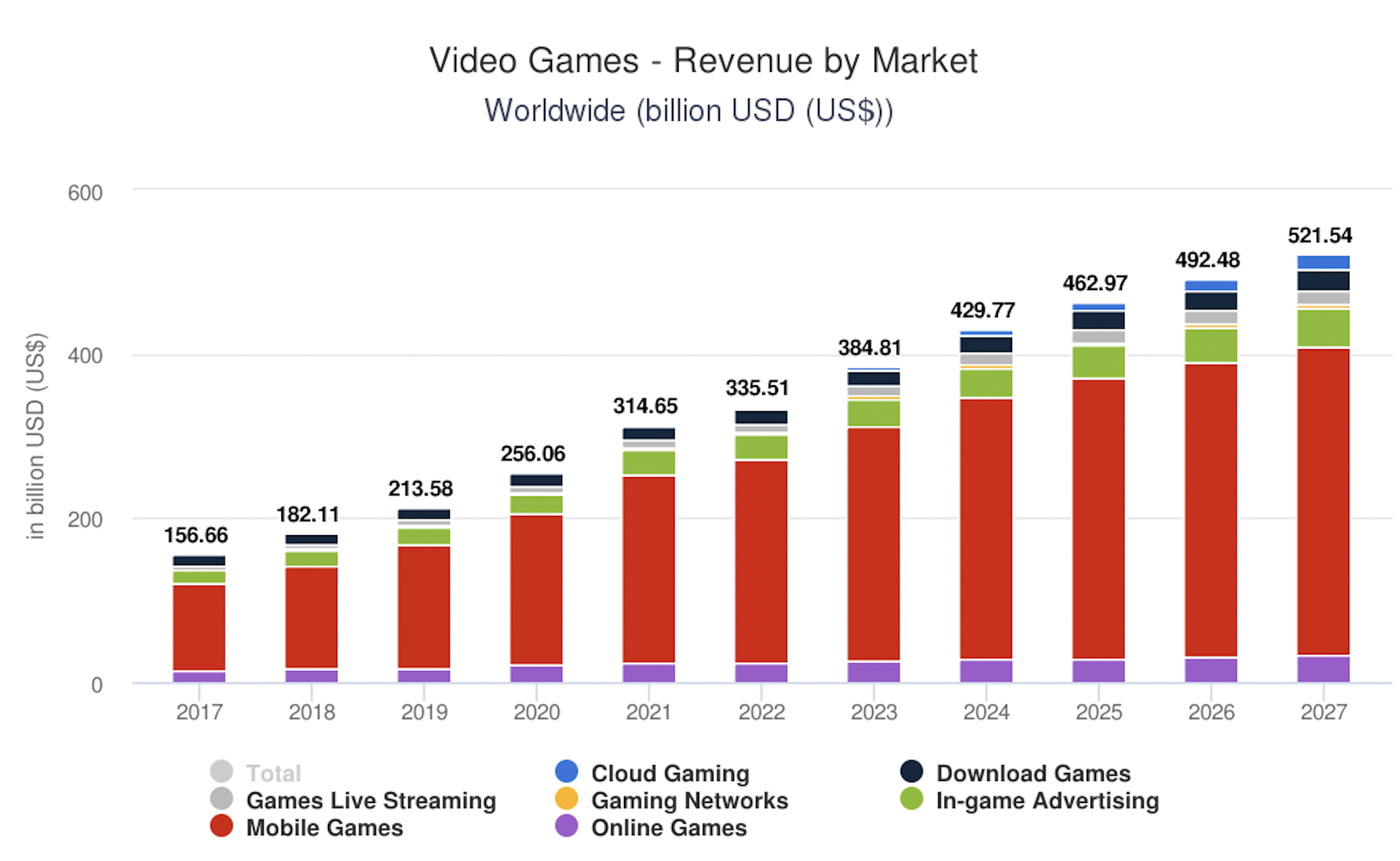

NetEase operates within one of the world's largest gaming markets. China's gaming industry holds the second spot globally, following the United States. Notably, it benefits from a substantial player base, with over 740 million users. The global gaming market is projected to exhibit significant growth, with an estimated market revenue of $385 billion anticipated by 2023.

The company derives a significant portion of its revenues from the sale of online video games, contributing 77.3% to its overall sales. This represents a noteworthy increase of 13.71% compared to the previous year. While the majority of games are targeted at the Chinese market, NetEase is actively expanding its presence in international markets. Notable successes include the game Knives Out, which achieved remarkable popularity in Japan. Additionally, the company has made strategic acquisitions of game development companies in the United States and Europe, further solidifying its global footprint. In August 2022, the business expanded its presence in France through the acquisition of Quantic Dream, one of the industry's most renowned video game studios.

Apart from gaming, its revenue streams comprise two main segments: learning services offered through its subsidiary Youdao, and Cloud Music, a streaming music company owned by NetEase. Youdao boasts a user base of over 110 million monthly active users (MAU) and provides translation tools, online courses, smart learning devices, and digital solutions to enhance education. On the other hand, Cloud Music, with 182 million MAU, operates a subscription-based streaming music service and generates additional revenues through the sale of virtual items during live-streaming music events. The remaining segment encompasses various "innovative businesses," including Yanxuan (an e-commerce platform), NetEase News, and NetEase Mail.From a revenue perspective, gaming is undoubtedly its primary driver, contributing 77.3% of total revenues, followed by Cloud Music at 9.3%, Innovative Business at 8.2%, and Youdao at 5.2%.

From 2008 to 2023, NetEase formed a significant partnership with Blizzard, a renowned game developer and publisher, to operate Chinese versions of their popular games, including World of Warcraft, StarCraft II, and Overwatch. This collaboration allowed the Chinese group to serve as the distributor and operator of these games in the Chinese market, leveraging their expertise and resources to ensure localized content and smooth gameplay experiences for Chinese players.

The Group has to buy intangible assets, which refer to the purchase of content and licenses to introduce video games developed by other companies to the Chinese market, such as the exclusive license agreed with Microsoft to distribute Minecraft in China, between 2016 and 2021.

Its success lies in its ability to develop new games and always attract more users, hence its growing expenditure on Research and Development (R&D). For June, NetEase has scheduled the release of 3 games: Badlanders (20 million pre-registered users), Racing Monster (20 million pre-registered users), and Justice Mobile (one of its best-selling franchises).

NetEase Annual research and Development Expenses (Millions of US $)

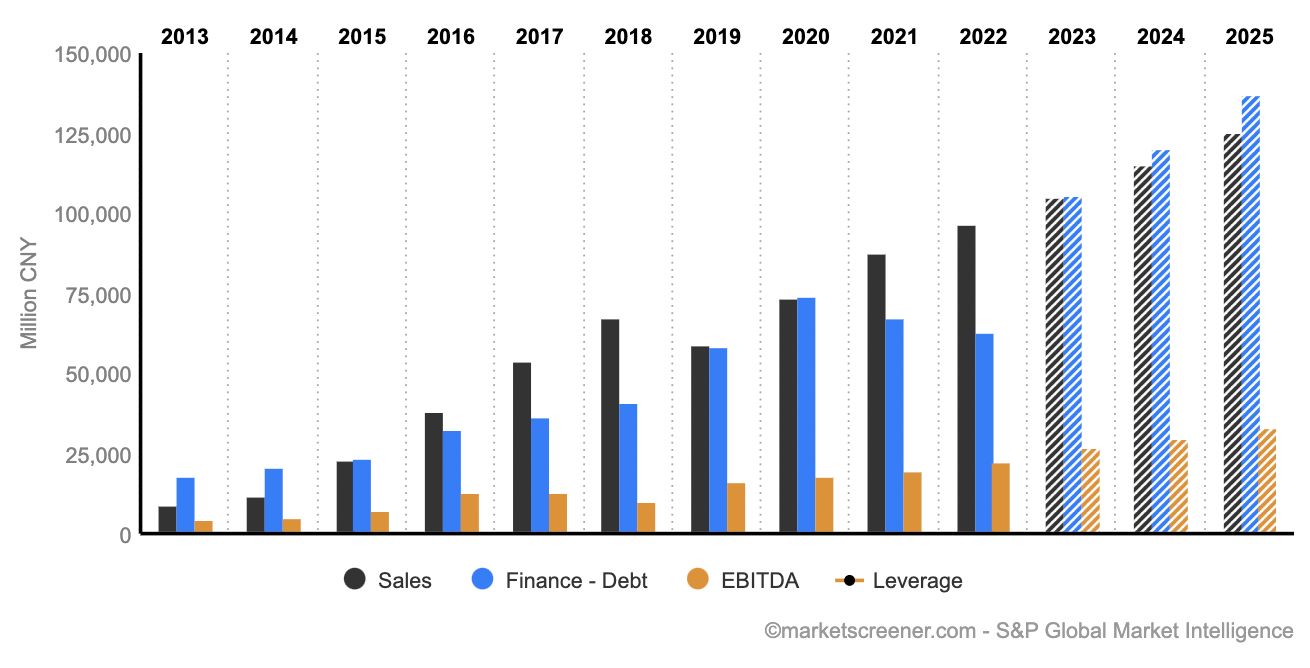

The company’s financial performance has been impressive over the last several years. It has experienced consistent sales growth, with revenues climbing from $38 billion to $96.5 billion. In terms of cash flow, we have a nice $25 billion by 2022, with a strong free cash flow margin of 26%. EBITDA and EBIT have also witnessed robust growth, increasing by 37.08% and 42.33% respectively since 2019, reaching $22.4 billion and $19.6 billion.

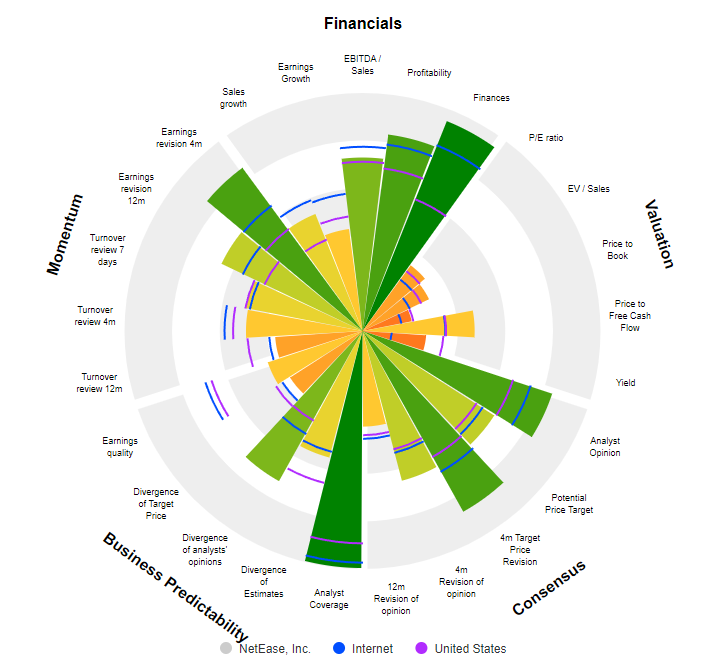

When analyzing NetEase's valuation, we can see that it currently trades at a price-to-earnings (P/E) ratio of 16.2 times earnings, slightly below its 10-year historical average of 22.3 times earnings. This suggests that the stock may be relatively undervalued. Additionally, the corporation boasts a return on equity (ROE) of around 20%, which is comparable to its historical performance, demonstrating its ability to generate favorable returns for shareholders. However, the company's return on assets (ROA) is around 12% for 2022 and beyond. In the first quarter of 2023, it has experienced an 8% increase in gaming revenues, driven by growth in revenues from its historical titles. The company recorded an operating margin of 28.8%, representing a 23.08% increase compared to the same period last year.

The Chinese group has successfully maintained its position as a major player in the global gaming industry for over a decade. Despite the challenges posed by government restrictions aimed at mitigating gaming addiction among young people in China, it continues to develop new games that attract a growing user base. Furthermore, the growing popularity of cross-platform games presents a favorable opportunity for NetEase to increase direct payments from players on PCs, reducing revenue-sharing fees paid to mobile application platforms.

It's worth noting that, being a Cayman Islands-based holding company, it introduces complexity and potential risks related to corporate governance and legal protections, which makes the company also consider the influence of the Chinese Communist Party (CCP) on its operations. The CCP's significant sway over Chinese businesses raises concerns regarding potential government interference, which could impact its growth and profitability. Furthermore, the geopolitical tensions between China and the United States pose additional risks for the group, as demonstrated by past actions taken by the US government to restrict Chinese companies' activities in American markets, such as the case of Huawei in 2019. If similar restrictions were imposed on NetEase, it could significantly impact its operations and revenue.

Overall, NetEase presents an appealing investment opportunity for those looking to capitalize on the thriving video game market. With its expanding international presence, solid financial performance, and a track record of creating engaging games, the company is well-positioned to capture further growth in the dynamic gaming industry.

By

By