First things first: the semiconductor industry

The semiconductor industry, in its current form, expanded rapidly following the PC revolution of the 1980s, when personal computers evolved from gaming instruments and tools for geeks to everyday working tools for us all. Over the past four decades, computer chips have become an integral part of almost everything we use, from household appliances to automobiles, and the fortunes of the companies that manufacture these chips have grown, and sometimes been put at risk, with technological developments.

In the early 1980s, semiconductor companies generated almost no revenue, but this situation changed radically in that decade and the next, thanks mainly to the boom in the PC market and then the dot-com bubble. However, between 2001 and 2020, revenue growth in the semiconductor sector slowed to single digits, as an increase in demand for chips for new applications was offset by a loss of pricing power and falling chip prices. Although revenue growth has picked up over the past three years, the sector is now mature.

The semiconductor industry has grown in importance, both in terms of revenues and profitability, and this has been reflected by investors in the market capitalization attributed to these companies. From a few tens of billions of dollars at the end of the '80s, the total market capitalization of semiconductor-related companies rose to over $500 billion in 2000, and to over $4,000 billion today.

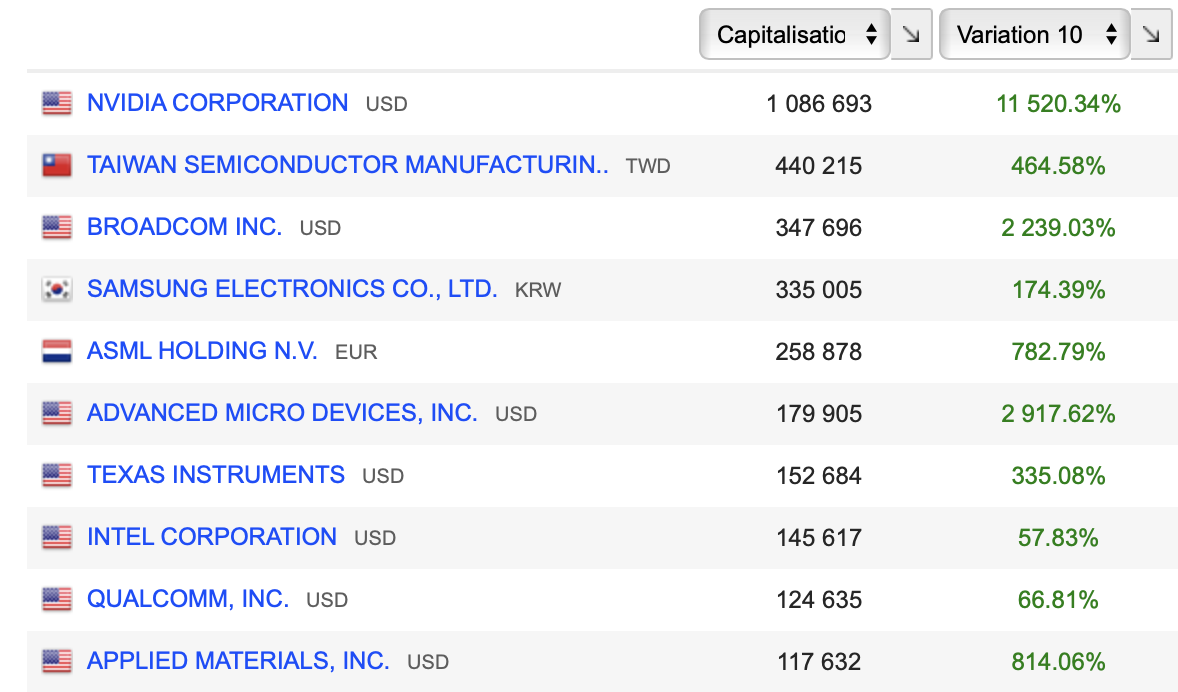

Here are the 10 players with the largest market capitalization:

Source : MarketScreener

Despite this resounding success, the demand for AI-based products and services (and therefore for the semiconductors required for their proliferation) has been underestimated by the market, showing just how quickly market forecasts can be rendered obsolete by changes in the field. The arrival of ChatGPT for the general public in November 2022 and the acceleration of technological advances in AI have changed the game. Forecasts therefore need to be readjusted.

That's why Aswath Damodaran sets out to evaluate Nvidia, the ultimate AI bet that's gripping the market and dividing investors between those who think Nvidia will go all-in and those who are alarmed by a new speculative bubble.

For the record, Aswath Damodaran has held a long position in Nvidia since 2018, long before all this AI hype. Indeed, he defends himself by explaining that he hadn't anticipated such a surge at all, nor seen AI's potential coming. He tells us that he was just lucky to be in the right place at the right time, reminding us that luck often beats intelligence, at least in the markets.

Will the master of valuation hold on to his Nvidia shares despite the seemingly high price? We'll find out.

Nvidia, a champion of profitable growth

Founded in 1993 by Jensen Huang, Chris Malachowsky and Curtis Priem, the company is best known for its graphics processing units (GPUs), which are widely used in video games, digital content creation and scientific research. Nvidia 's core business is based on chip research and design, not manufacturing, and it outsources almost all its chip production to TSMC. These GPUs are specially designed to accelerate graphics calculations, making them ideal for 3D computer graphics and video rendering. Nvidia first enjoyed success with the GeForce series of GPUs for the gaming market, but they later expanded their operations to include products for graphics computing professionals (Quadro series) and high-performance computing and artificial intelligence (Tesla series). In addition to its GPUs, Nvidia also worked on artificial intelligence, deep learning and autonomous automobiles with its AI system-on-a-chip, DRIVE. They also developed the ARM-based Tegra processor for mobile devices and supercomputers. Before it became a thriving company with a presence in many industries, Nvidia was more of a niche player.

Nvidia has grown steadily since its creation in 1993 and IPO in 1999. Most of its growth has taken place over the last decade, as revenues in the semiconductor sector began to stabilize (CAGR of 4% between 2011 and 2020). From its IPO in 1999 to 2005, revenues rose steadily from $160 million to $2.4 billion, at an annualized rate of 26%. Over the following decade (2006-2015), the annual growth rate (CAGR) of revenues declined to 7-8% per year. Even so, this modest growth enabled the company to break into the top 10 semiconductor companies in 2010.

To know more, check out MarketScreener's Roxane Nojac video.

Aswath Damodaran notes two important points in the Nvidia story:

- Growth well ahead of the industry average, even in periods of slowdown.

- Above-average profitability. When R&D expenditure (which is counted as an expense when in fact it is an investment) is deducted, the operating margin comes out at 37.8% and the return on capital employed at 24.4%. Impressive!

Nvidia and AI: a love story

Nvidia 's recent rise in value is largely due to the impact of AI. It is therefore interesting to analyze why AI has become a major force on the market, and to use history as a guide to predict its future impact on investors and companies. Aswath Damodaran points out that it's difficult to know at this stage whether AI is an incremental change or a genuine revolution for the economy. In his view, from a societal point of view, AI is revolutionary because it has been made accessible to everyone via ChatGPT. As for the stock market, his view is more mixed. If we look at recent technological revolutions (personal computers in the '80s, the Internet in the '90s, smartphones in the 2000s and social networking in the 2010s), there have been only a few winners and many losers. What's more, the early leaders often fell by the wayside (Yahoo/AOL, Nokia/BlackBerry, etc.). Finally, to the argument that you can buy a portfolio of companies that will benefit from AI, and make money from those that do, the experience of the AI industry is that you can't buy a portfolio of companies that will benefit from AI, and make money from those that do.usses, past market experience suggests that this portfolio is more likely to be overvalued than undervalued.

On the other hand, Aswath Damodaran warns that there will always be investors who deny technological change. These investors, drawn to the glorious past of once-prosperous companies, underestimate these changes and will continue to strengthen their positions in these former winners/future losers. The stock market, however, is littered with the carcasses of what were once successful companies, disrupted by technological change. This is what happened, to give two examples, with investors in in-store retail businesses that were devastated by online sales, and with investors in traditional newspaper/advertising businesses that were upended by online advertising.

What A. Damodaran is that even if we all agree that AI will change the way companies and individuals behave in the years to come, there is no risk-free path for investors to "monetize this belief".

The AI story has a particular resonance at Nvidia, says A. Damodaran because, unlike most other companies, where it's mainly speculation about potential, Nvidia already has a solid base and a target market. Nvidia has spent much of the last few years investing in and developing products for a nascent AI market. This head start has not only given Nvidia a leading position in the market, but also revenues and profits. Much of the excitement following Nvidia's latest earnings report stems from the announcement of increased revenues from its data centers, much of this increase coming from AI chips. Although the company does not specify how much of this revenue comes from AI chips, it is estimated that the total market for these chips in 2022 was around $15 billion, with Nvidia holding a dominant market share of around 80%. If these estimates are correct, the bulk of Nvidia's 2022 data center revenues of $15 billion will come from AI-optimized chips.

Estimates for the global AI chip market in 2030 range from $200 billion at the low end to nearly $300-350 billion at the high end.

Although there is considerable uncertainty about this estimate, A. Damodaran makes two assertions about Nvidia in this AI chip market:

- The first is that this will be Nvidia's revenue growth engine over the next decade, even if their revenue growth from games and other chips stabilizes.

- The second is that Nvidia has a head start on its competitors, and althoughAMD, Intel and TSMC will all allocate resources to building their AI businesses, Nvidia's dominance won't be easy to shake.

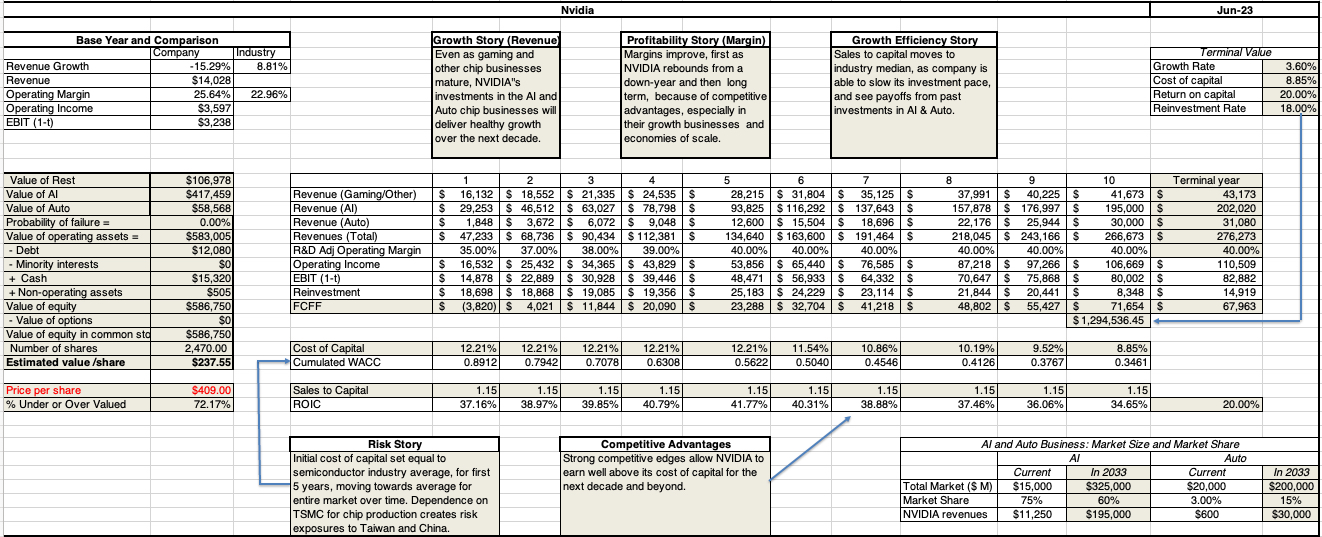

Professor A. Damodaran proposes a fair valuation of Nvidia at $237.55 today, while the latest share price is currently (08/16/2023) $441. His DCF is available here. In this central scenario, he considered that the Californian company continued to have all the positive characteristics of the previous decade (strong growth, dominant market position, technological advantage, etc.). However, we all know how quickly these things can change in this industry - just look at Intel's track record.

Source : A. Damodaran

As an investor in value, and true to his investment philosophy, A. Damodaran divested half of his position in Nvidia, in order to cash in some of his more than 1,000% gain since 2018. History doesn't tell us what he intends to do with the remaining half...

By

By