As the spot uranium price climbed just over 6% last week, a key adviser to the Australian government advances the case for nuclear.

-Small scale reactors versus large scale batteries

-Rolls Royce establishes a small modular reactor business

-Prices required by Paladin Energy for a Langer Heinrich restart

-Uranium spot price rises just over 6% for the week

One of the key architects behind Prime Minister Scott Morrison's gas-led recovery plan suggests nuclear energy represents a strategic regional opportunity for Australia.

Andrew Liveris, the former Chief Executive of Dow Chemicals, believes the country needs to overcome concerns about nuclear energy and instead see its potential to reduce carbon emissions.

Liveris notes small scale reactors are "more proven" than the use of large scale batteries to store renewable energy and suggests Australia should repurpose its ageing coal power plant fleet with nuclear technology.

Liveris suggestion is a carbon price of between US$40 and US$80/tonne should be set by the government to incentivise business to wind back carbon emitting operations. Europe has had a carbon price for 16 years while California has a working model.

These comments come after recent significant announcements on nuclear from China, which plans to build some 150 new reactors in the next 15 years as part of its emissions reduction plans.

France also intends to construct new reactors as the basis for a re-industrialised and low-carbon economy, while the UK has recently introduced new funding for large reactors and funded the commercialisation of small reactors.

Following an equity raise, UK-based Rolls-Royce has announced the Rolls-Royce Small Modular Reactor (SMR) business has been established to advance and deliver the next generation of low-cost, low-carbon nuclear power technology.

If approved for use in the UK, Rolls-Royce SMR could reportedly build up to16 reactors across the country for as early as the 2030s.

Company news

ASX-listed Paladin Energy ((PDN)) is the premium and most liquid name in the uranium sector on the ASX, according to Shaw and Partners, and is the broker's preferred exposure to an improving uranium market.

Following the release of an updated reserve/resource statement by management, the analyst notes a well-defined and low-risk pathway to production for the 75%-owned Langer Heinrich uranium mine in Namibia.

It's believed contact pricing above US$50/lb will allow the restart of operations.

Apart from Langer Heinrich, the company has a significant high-grade exploration portfolio, the broker notes.

Uranium pricing

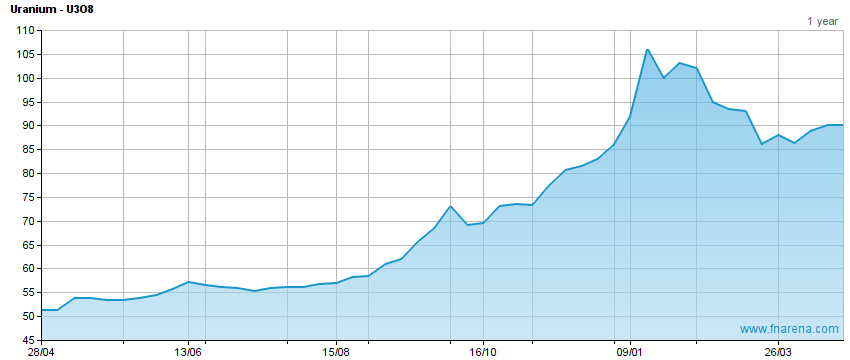

TradeTech's Weekly Spot Price Indicator ended last week at US$46.20/lb, up US$2.70/lb from the previous week. After this 6% rise, the spot price Indicator is up 24% over the last two months, and up nearly 70% since the 2021 low of US$27.40 seen last March.

The price of uranium has risen 52% since the beginning of the calendar year and 57% year-on-year. The average Weekly Spot Price in 2021 is US$33.79/lb, US$4.08/lb above the 2020 average.

There were around 2.5mlbs U3O8 traded last week, compared to 1.8mlbs in the prior week. Buyers for the week included financial entities, utilities, traders and producers, while sellers included traders, financial entities and producers, industry consultant TradeTech reports.

TradeTech's term price indicators are US$43.75/lb (mid) and US$45/lb (long).

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2021 Acquisdata Pty Ltd., source FN Arena