Watching the stock market rise almost every day, you'd almost think the trees were reaching for the sky. We can always try to reassure ourselves that "this time it's different". Unfortunately, with this approach, the backlash is likely to be severe. As a reminder, the current narrative revolves around the productivity gains generated by AI, but also by a rapid return of inflation towards 2%. While the results published so far have rather reinforced investors' conviction, the publication of the US consumer price index came as a cold shower. Core CPI (excluding energy and food) came in above expectations at +3.9% y/y, versus +3.7% expected. In its monthly version, prices rose by +0.4% versus +0.3% anticipated.

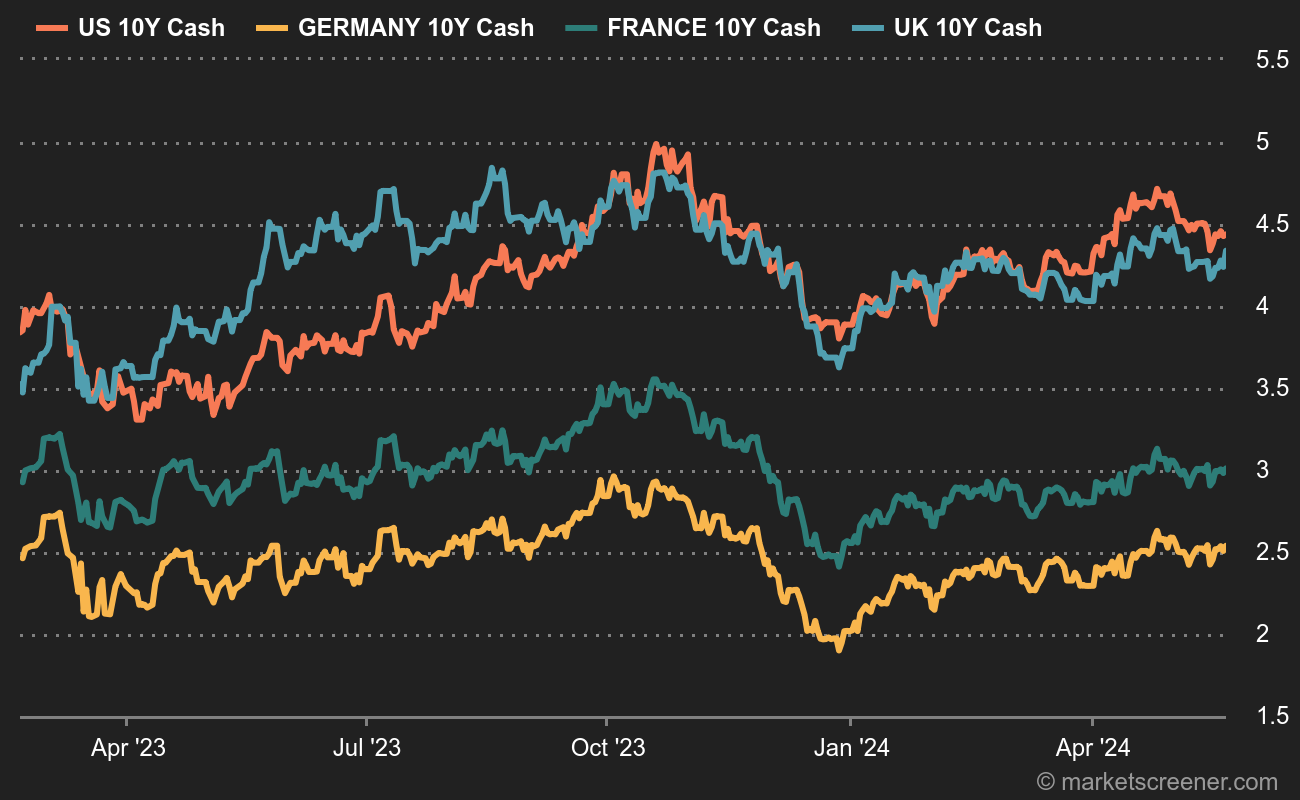

US 10-year yields tighten

The consequence of such data was not long in coming: US indices fell on D-Day, while bond yields tightened. More specifically, the US 10-year yield broke out of an accumulation zone at the top, rising above 4.23/4.25% and paving the way for a further rebound towards 4.40/43%, or even 4.60% at the extreme. By extension, the probability of a rate cut in March has fallen from 60% in January to 8.5% last Thursday, while it is now just over 30% for May.

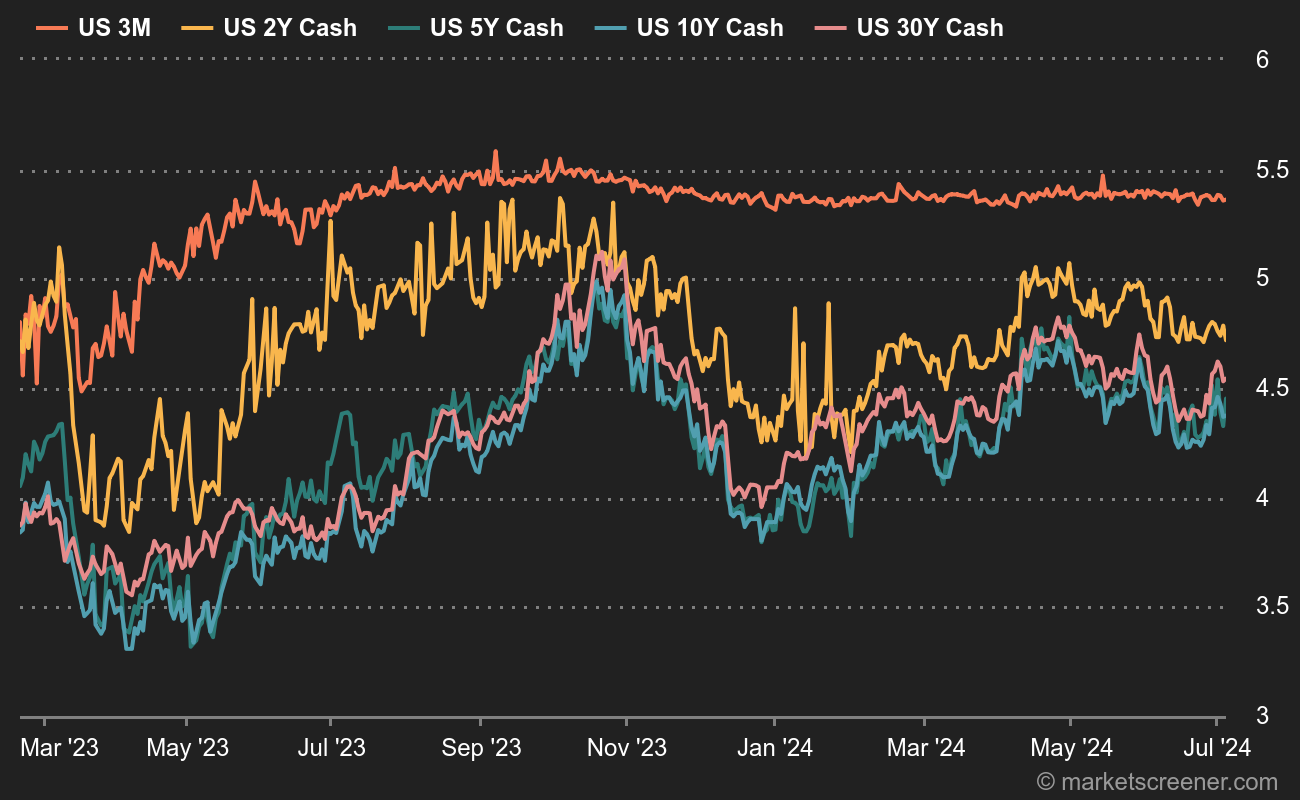

Five one-year US maturities

Even so, investor confidence does not seem to have taken a real hit, as evidenced by the new record highs set by US indices. The current period, however, is reminiscent of a mania for all things technology-related. Proof of this can be seen in the rise of Super Micro Computer, which jumped almost 50% in a single week... The older among you will remember the late 90s, when dotcoms were the "AIs" of the day. Let's hope, however, that the wake-up call won't be so rude.

By

By