The first quarter, January -

- Total revenue amounted to

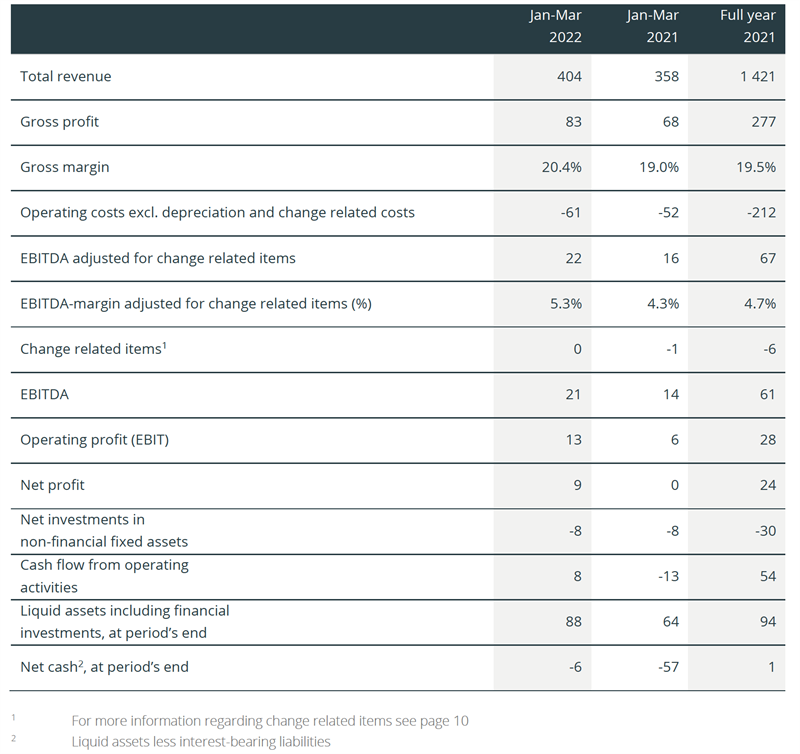

SEK 404 M (358) an increase of 13% or 9% adjusted for changes in exchange rates compared to the same period last year.

-

Gross profit was

SEK 83 M (68) an increase of 21% or 14% adjusted for changes in exchange rates. Gross margin was 20.4% (19.0).

-

Operating costs excluding depreciation and adjusted for change related items were

SEK 61 M (52), an increase of 16% or 13% adjusted for changes in exchange rates.

-

EBITDA amounted to

SEK 21 M (14). Adjusted for change related items, EBITDA wasSEK 22 M (16).

-

Investments in immaterial assets, mainly related to product development, were

SEK 8 M (8).

-

Cash flow from operating activities was

SEK 8 M (-13). Changes in working capital impacted the cash flow withSEK -11 M (-21), which relates mainly to the seasonality of our customers´ payment patterns.

-

Earnings per share, before and after dilution were

SEK 0.19 (0,00).

-

In the first quarter,

Tradedoubler acquired approximately 30% of the shares in the online video shopping company Onbaz, a Swedish startup technology company. The purchase and partnership agreement signed with Onbaz will give the group access to technologies that complement and extend its current offering and products within the growing market of influencer marketing.

CEO

The start of the year 2022 and the results for the first quarter are in line with our expectations and continue the good performance from last year.

Total revenue grew by 9%, gross profit by 14% and EBITDA increased to

Due to the significant macro-economic uncertainties, we experienced some bigger shifts in our business in Q1 that have had an impact on our results. Ecommerce and there especially retail and consumer electronics grew less than in the quarters before while at the same time travel is coming back to relevant levels and fashion clients are growing more than before. We saw as well that clients were more restrictive with additional media spendings which, to some extent, explains the lower growth of revenue compared to the growth of gross profit and with that the higher gross margin.

Our new products Metapic, Grow and Appiness continued to have a positive impact on the overall result. All these products have more than doubled their business compared to the same period last year and have as well a higher gross margin than the core business affiliate marketing.

We see ourselves well-prepared for the coming quarters while we continue our mission to grow the business of our clients and partners in the best possible way to create meaningful results for all stakeholders. We do that with passion and courage, and I look forward to your continued company on this journey.

Contact information

E-mail: ir@tradedoubler.com

Other information

This information is information that

https://news.cision.com/tradedoubler/r/tradedoubler-quarterly-report-january---march-2022,c3569153

https://mb.cision.com/Main/2680/3569153/1581057.pdf

https://news.cision.com/tradedoubler/i/overview-q1-22,c3050526

(c) 2022 Cision. All rights reserved., source