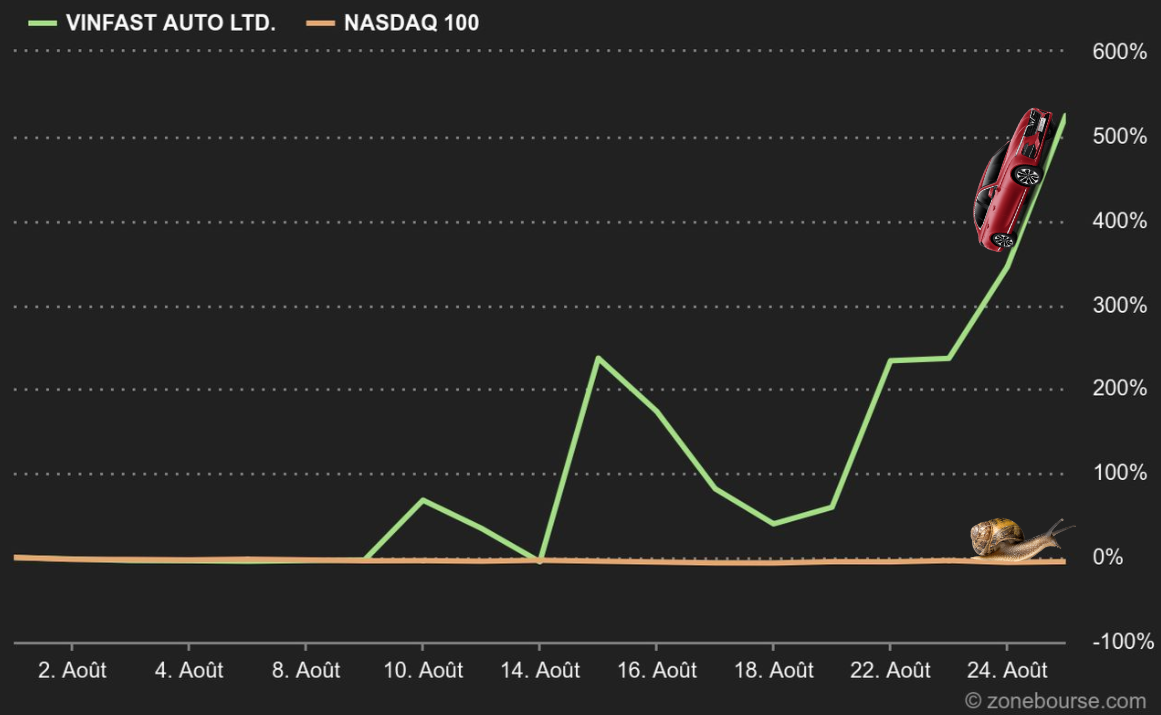

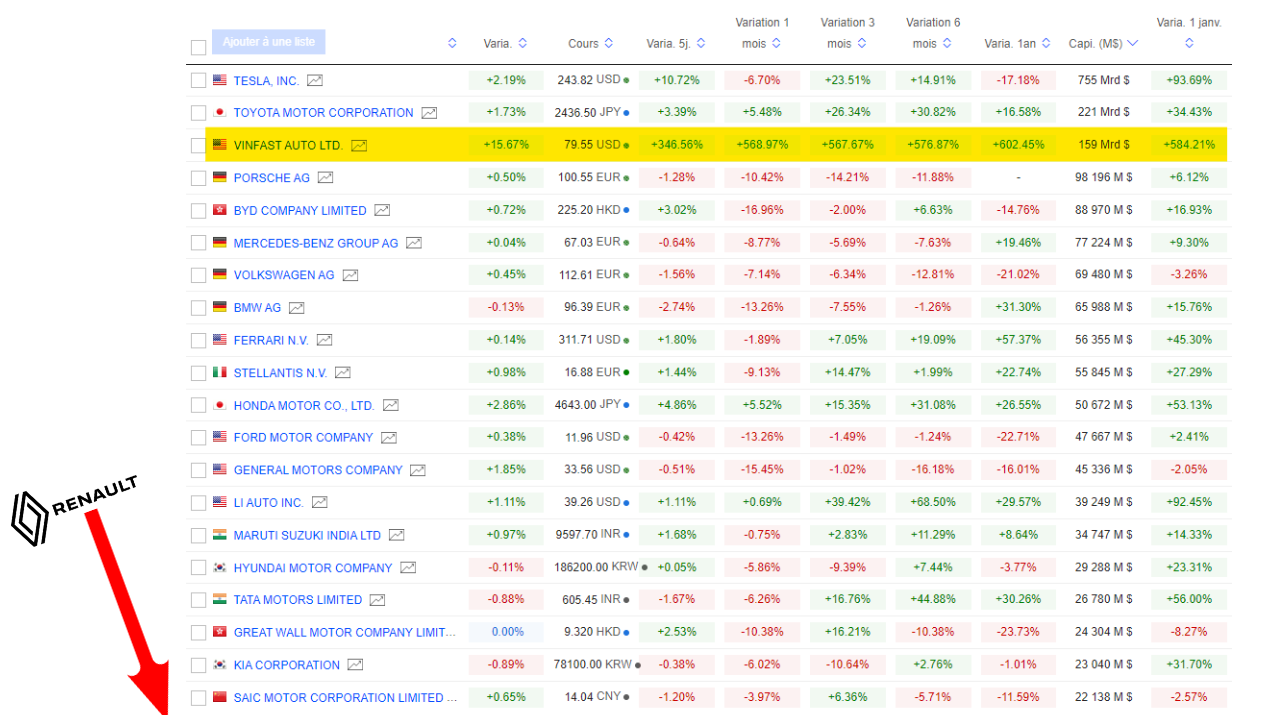

The company made a stunning debut on Wall Street earlier this month, and its valuation has rapidly risen to become the world's third most valuable automaker, just behind Tesla and Toyota. But the small number of Vinfast shares available to the public has made the stock prone to volatility, with variations of 14% or more in 11 of the last 12 sessions. Market capitalization could increase by $50 billion if today's rise is confirmed. And thus threaten Toyota. Mercedes, Stellantis, Ford, General Motors and Ferrari have already been smashed.

50,000 vehicles sold this year?

Vinfast is almost entirely controlled by Pham Nhat Vuong, Vietnam's richest man and founder of parent conglomerate Vingroup, with a stake of around 99.7%. Despite market enthusiasm, It has a long way to go before it can begin to compete meaningfully with Tesla and the traditional automakers pouring billions of dollars into grabbing a share of the electric vehicle market. Only 137 Vinfast EVs have been registered in the US up to June, according to S&P Global Mobility.

The company is launching in the US and Europe at a delicate time for electric vehicles, marked by the price war waged by Tesla. Vinfast hopes to sell up to 50,000 electric vehicles this year, while the Californian company plans to deliver 1.8 million cars. To boost sales, Vinfast is moving away from Tesla's direct-to-consumer approach and turning to dealers. Haven't we seen this before? The company is also building a $4 billion factory in North Carolina. Decidedly, everything is over the top with Vinfast, but it's going to have to "deliver" quickly, in case the market suddenly wakes up from its trip on speculative acid.

By

By