There’s a lot of uncertainty at the moment and this is reflected in the performance of indices yesterday, with declines almost everywhere yesterday, except for the Nasdaq, which maintained slight gains (0.09%). The technology index remains well supported by its heavy artillery, namely Microsoft, Nvidia, Alphabet and Amazon. Only a quarter of the stocks in the tech index were in the green at yesterday's close, and this illustrates once again the current shift towards big reliable tech giants.

I'll use a second example to explain much the same thing, just to drive the point home. US equities have been on a sideways track since the start of the second quarter of 2023. This is shown by the S&P 500, which was at 4109 points on the evening of March 31 and 4110 points last night – just a one-point gain in 31 sessions. The Nasdaq 100 did slightly better (+2%), but its gains were largely due to its stars, which all outperformed the index (from Apple at +4% to Alphabet at +15%). The only exception is Tesla, which lost 19% in the interim. This intra-Nasdaq dislocation is also illustrated by Cathie Wood's ARK Innovation fund.

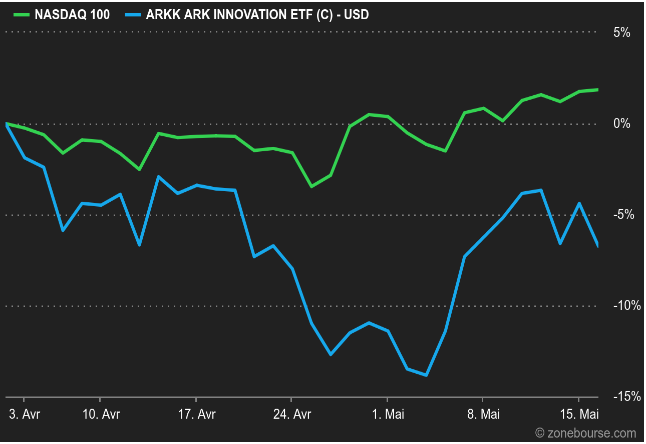

Since the end of March, the ARK ETF has underperformed the Nasdaq

When all you had to do was bet on a hot tech stock to outperform the indices, Nasdaq included, ARK soared. The collapse of this type of stock has cost the fund dearly, since it has lost just over a third of its value in three years. Despite a 20% rebound this year, it went through a rough patch in recent weeks, with significant decorrelation to the Nasdaq. This is because investors have retreated to large, highly profitable stocks and have once again abandoned the more speculative bets. To make matters worse, the only stock in this very tight circle held by ARK Innovation is Tesla, the big loser of the second quarter at this stage. As a result, Cathie Wood's ETF is down 6.7% in Q2, while the Nasdaq 100 is up 1.9%. This is a significant difference. It serves as a reminder that beneath the surface of indices, the scenarios that emerge can be more subtle. And also, that some indices are really hard to beat, because they concentrate positions that a fund manager can hardly afford to approach.

We're slipping into macroeconomics. The debt ceiling theatre of the absurd, as the Financial Times called it yesterday, remains the show of the moment. As always, rumors follow one another, contradicting each other and adding little to the matter. The day before yesterday, the White House suggested that the negotiations were going well. Today, Joe Biden abruptly cuts short his Asian tour to return to the negotiating table with the Republicans. The eyes of the investors go from one side to the other, a bit like those of the tennis spectators. The most likely outcome is that the Republican camp will force the Democratic camp to make major concessions on fiscal policy. Meanwhile, financial markets will remain nervous because uncertainty translates into a risk premium, even if no one believes that the US will ultimately allow itself a credit crunch.

Corporate results are less dense than in previous weeks, but there are still a few well-known names, including Cisco later today.

On a side note, have you noticed how well Japanese markets are doing? The Nikkei 225 gained 0.8% for a fourth consecutive session. Goldman Sachs believes that Japan may be on the verge of a big bull market. Not to mention Warren Buffet’s recent shopping spree in the country. The Japanese economy is doing quite well, especially since last quarter's GDP exceeded expectations. On the other hand, China is brooding after its frankly mediocre statistics of the previous day.

Economic highlights of the day:

The second reading of European inflation for April and April housing starts in the United States are today’s main indicators. The full agenda is here.

The dollar is up 0.3% against the euro to EUR 0.9230 and is flat against the pound at 0.8013. The ounce of gold falls to USD 1984. Oil fluctuates within narrow bounds, with North Sea Brent at USD 75.77 a barrel and US WTI light crude at USD 71.75. The yield on US 10-year debt rises slightly to 3.52%. Bitcoin is trading around USD 26,000.

In corporate news:

- Retail group Target was down 3% in pre-market trading after it said it expected lower-than-expected profit and lower sales in the second quarter, due to the impact of inflation on customers. Its major competitor Walmart was down about 1%.

- Tesla - During the carmaker's annual general meeting on Tuesday, Elon Musk put to rest rumors that he might resign as chief executive. He also spoke of the development of two new consumer models and reaffirmed that deliveries of the long-delayed Cybertruck would begin this year.

- Regional bank stocks are up in pre-market trading, with Western Alliance Bancorp announcing Tuesday a $2 billion increase in deposits as of May 12. Its stock was up 11 percent before the open, with Comerica, Zions and KeyCorp up between 1.3 percent and 3.5 percent.

- Pfizer announced Tuesday that it plans to raise $31 billion through a bond offering to finance the acquisition of Seagen.

- Lyft announced Tuesday that it has appointed Erin Brewer as CFO, succeeding Elaine Paul, who has resigned.

- WeWork announced on Tuesday the resignation of its CEO Sandeep Mathrani and the appointment of board member David Tolley as interim CEO.

- Blackstone and Thomson Reuters were among a group of London Stock Exchange Group shareholders who sold 33 million shares in the exchange operator for about 2.7 billion pounds, a bookrunner said Wednesday.

Analyst recommendations:

- Antofagasta: Canaccord Genuity reinstated coverage with a recommendation of buy. PT up 35% to 1,900 pence.

- Home Depot: CFRA cut the recommendation to hold from buy. PT up 7.8% to $306.

- Intuit: CFRA cut the recommendation to hold from buy. PT up 7.8% to $306.

- Magellan Midstream: RBC Capital Markets downgrades to sector perform from outperform. PT up 7.5% to $66.

- Oxford Instruments: HSBC starts tracking at hold with a target of GBp 2900.

- Rentokil: Jefferies remains Buy with a price target raised from GBp 640 to GBp 740.

- Watches Of Switzerland: Jefferies remains Buy with a price target reduced from GBp 1300 to GBp 1100.

- Werner Enterprises: Credit Suisse downgrades to neutral from outperform. PT up 8.7% to $48.

- Wynn Resort: Barclays upgrades to overweight from equal-weight. PT up 31% to $135.

By

By