The S&P500, the Dow Jones and the Nasdaq are generally cited as the three major Wall Street indices. There are others, including the Russell 2000, but these three are the most highlighted. Let's see why:

The Dow Jones is the oldest and most iconic of the Wall Street indices. This venerable age excuses a narrow composition (30 stocks) and an archaic method of calculation, since it is the value of the share and not the market weight of the company it represents that counts. For example, Amgen, with a share price of 232 USD, is the 5th largest stock in the Dow Jones and weighs 5.2% of the index, whereas Apple, with a share price of 147 USD, is only 19th and weighs 2.56% of the index. While Apple is capitalized at $2,332 billion, 19 times more than Amgen and its $123 billion. The most represented sectors are Technology (19.6%), Healthcare (19.6%), Finance (17.2%) and Industrials (14.75%).

The S&P500 is the most widely used index because it is broad and representative of the US economy. As its name suggests, it includes 500 companies, with a clear domination of the heavyweights, since it is based on the floating capitalization of companies to determine their influence on the index. Technology is by far the most represented (27.2%), ahead of Health Care (14.4%), Finance (11.7%) and Consumer Cyclicals (10.6%).

The Nasdaq is the modern index favored by investors because of its focus on technology stocks, the most volatile and prolific of the past decade. On a Nasdaq 100 scale, Technology and Communication (which includes Amazon and Meta Platforms) together make up over 66% of the index, or almost two-thirds (I did math in college). Health Care weighs only 6.4% and Industry 3.6%.

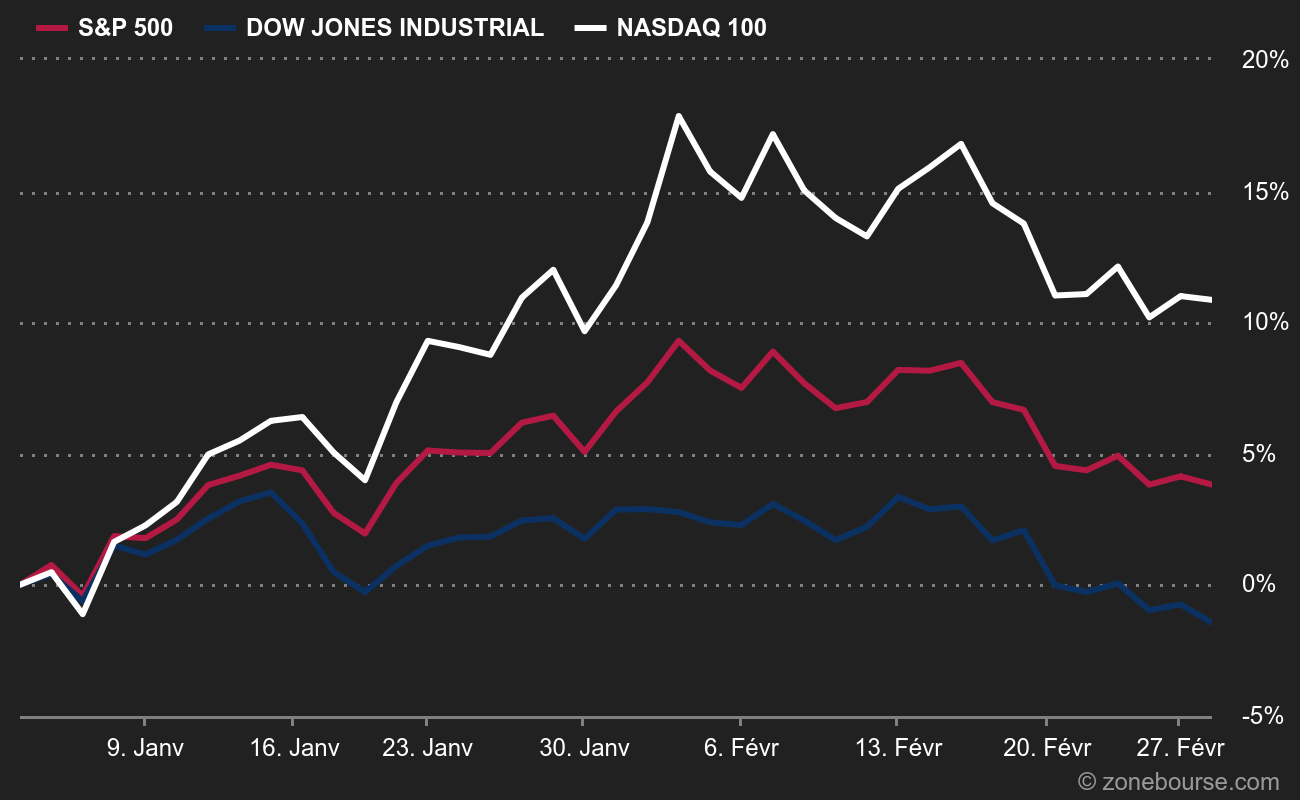

Performance in 2023: The Nasdaq returns to the forefront

The above-mentioned differences are very visible over the last two months, as shown in our first chart:

Nasdaq 100: +10.1% S&P500: +3.4% Dow Jones: -1.5

The explanation is quite simple: technology stocks led the rebound at the beginning of the year. Thus, their overrepresentation benefits the Nasdaq and to a lesser extent the S&P500. The Dow Jones is suffering, because the industrial and health care sectors have been largely neglected. The three biggest decliners are Johnson & Johnson, Amgen and Honeywell (health, healthcare and industrial), which lost between 10.7% and 11.99%. The fourth (-10.2%) is UnitedHealth, the largest Dow Jones weight (10.5% of the index).

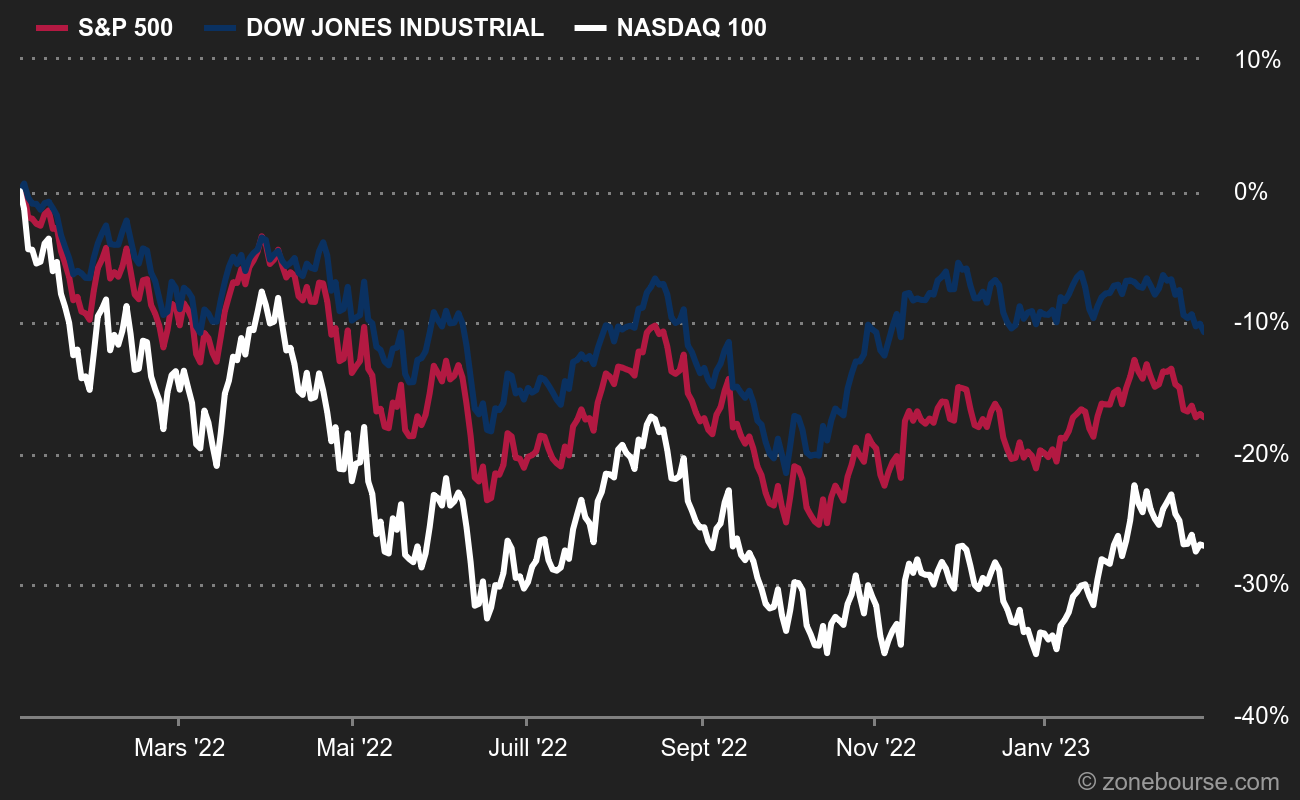

Performance since the beginning of 2022: the Dow Jones has helped cushion the blow

If we take the cursor back to the beginning of 2022, i.e. an extremely negative stock market vintage, here is what it roughly looks like:

Dow Jones: -10% S&P500: -17% Nasdaq 100: -27

The Dow Jones is clearly more defensive than its two acolytes, for the reasons mentioned above. In particular, it benefited from the strength of Merck and Caterpillar over the period. The presence of an oil company, Chevron, also helped. Conversely, technology stocks such as Intel and Salesforce were a drag on performance. As is often the case, the S&P500 is in an intermediate position: it was penalized by its technology stocks, but was able to rely on numbers and diversification to mitigate losses compared to the Nasdaq.

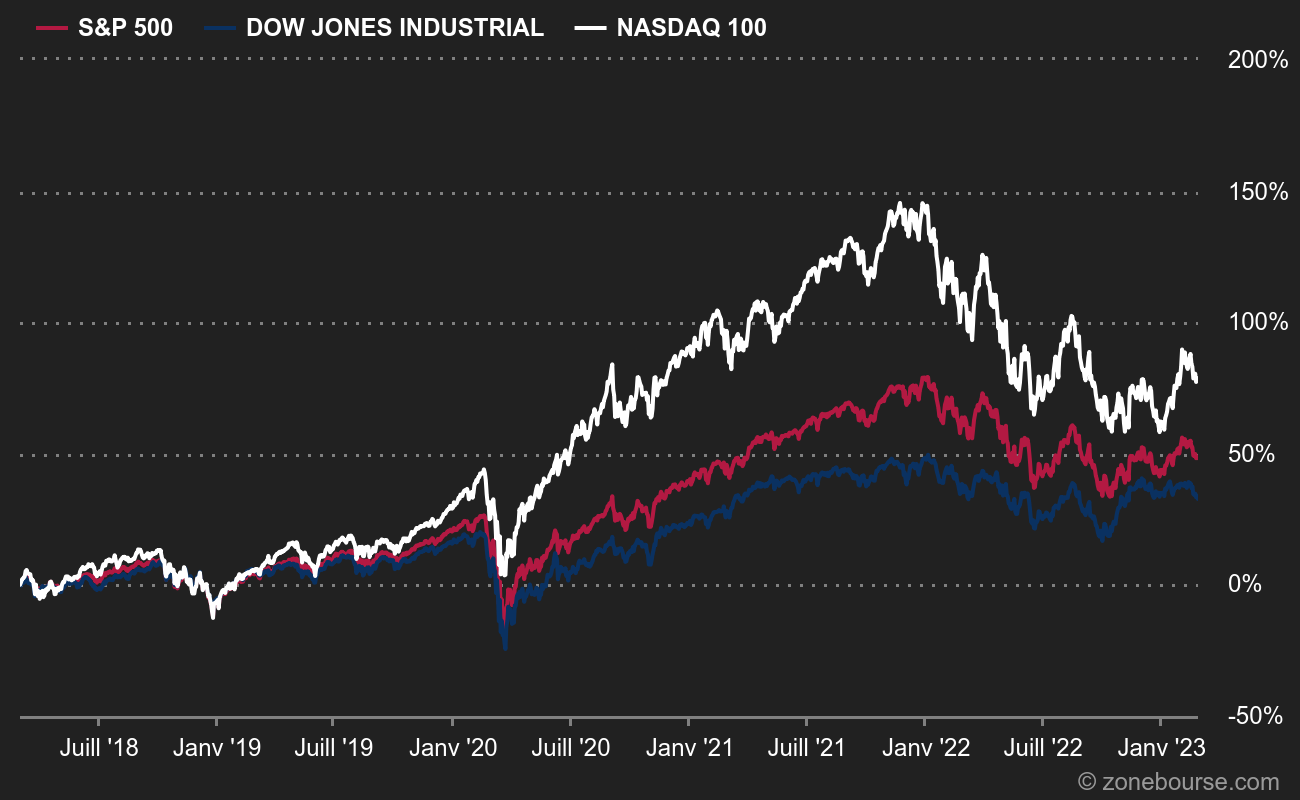

Performance over 5 years: Nasdaq is ahead Nasdaq: +75% S&P500: +46% Dow Jones: +30.5%

The period that began in 2008 after the financial crisis is clearly favorable to growth stocks, led by technology. The digital transformation combined with abundant and cheap money has pulled the Nasdaq. And despite the double blowout of the covid and then the bursting of the speculative bubble in technology stocks in 2022, it is indeed the best performing index over a period of 5 years.

By

By