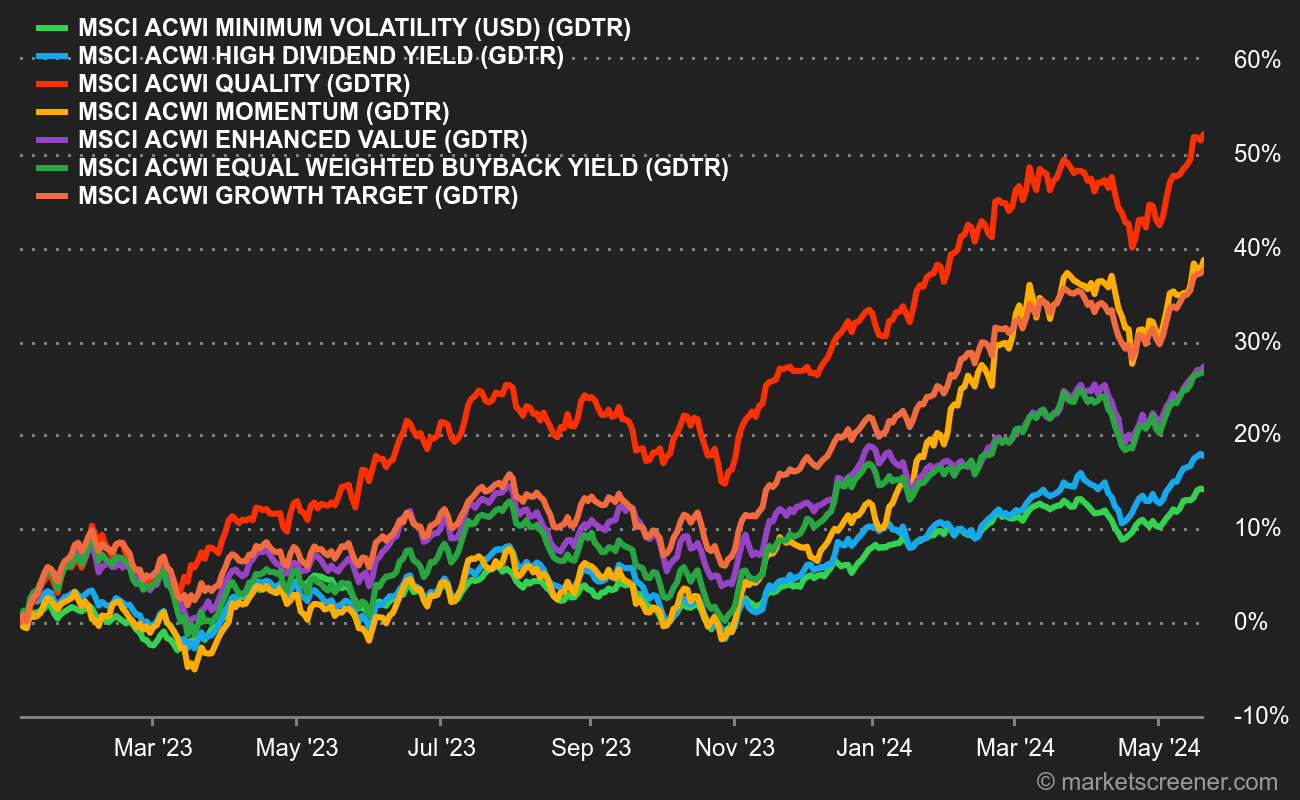

In fact, compared with other types of strategy, we're seeing a surge in "quality" stocks, which are shares of companies with solid, stable financial characteristics and good corporate governance.

These companies are generally well-established, with proven business models, high profit margins, low debt levels and the ability to generate substantial cash flow.

We're talking here more specifically about mega-cap companies such as Microsoft, Apple, Nvidia and Meta, which make up the MSCI ACWI Quality. Their popularity is obviously linked to the artificial intelligence theme and, among others, semiconductors. Outside the US, this index includes companies such as Novo Nordisk, ASML, Roche, BHP, Hermès and Iberdrola. Most of the other components of the MSCI ACWI Quality, apart from the big tech companies, tend to be perceived as defensive stocks (healthcare, industry, finance).

But for the MSCI ACWI Minimum Volatility, which favors defensive stocks, this is of course the main theme. The index is mainly made up of companies such as McDonald's Corporation, Merck & Co, Verizon, Johnson & Johnson and Walmart. All companies focused on consumer staples.

Intuitively, these defensive stocks could just as easily find themselves in the spotlight. After all, the current period is marked by an uncertain economic climate, due in part to aggressive rate hikes by central banks designed to tighten the economy and combat inflation. Each is playing its own card, as illustrated by the desire of OPEC+ member countries to support oil prices, which is not exactly good news for the fight against inflation. Market participants are currently forecasting a halt to Fed rate hikes in June, but fear a bullish resumption as soon as the following meeting, according to CME's Fed Watch tool.

Why does quality trump "minimum volatility"?

Firstly, the hype surrounding artificial intelligence (AI) is largely due to the perception that it represents a societal revolution comparable to that of the Internet. AI is seen as a key sector that will shape the global economy by transforming the employment landscape and boosting productivity.

AI has the potential to revolutionize many fields, such as healthcare, education, transportation, finance and manufacturing, to name but a few. By automating repetitive tasks and improving decision-making processes, AI can increase efficiency and reduce costs for businesses and consumers alike.

While this technological revolution raises concerns about the disappearance of certain jobs, it should also create new opportunities in fields such as R&D.

The growing adoption of AI in various sectors has led to strong demand for companies specializing in this technology. Investors are therefore attracted to the shares of these companies, anticipating significant growth and high returns over the long term. This trend has helped support stock market indices, particularly those heavily weighted in favor of technology companies, such as the Nasdaq 100.

Quality stocks are also often considered attractive investments due to their stable growth potential and financial strength, which makes them more resilient to market fluctuations than underperforming companies in the same sector.

What's more, the agreement on the US debt ceiling has added a thin layer of confidence, easing uncertainties about risk-taking.

Macroeconomic calendar (events likely to lead to volatility) :

- Canada: Monetary policy decision (Wednesday)

- US: Initial jobless claims (Thursday)

- China: CPI and PPI year-on-year inflation indices (Friday)

By

By