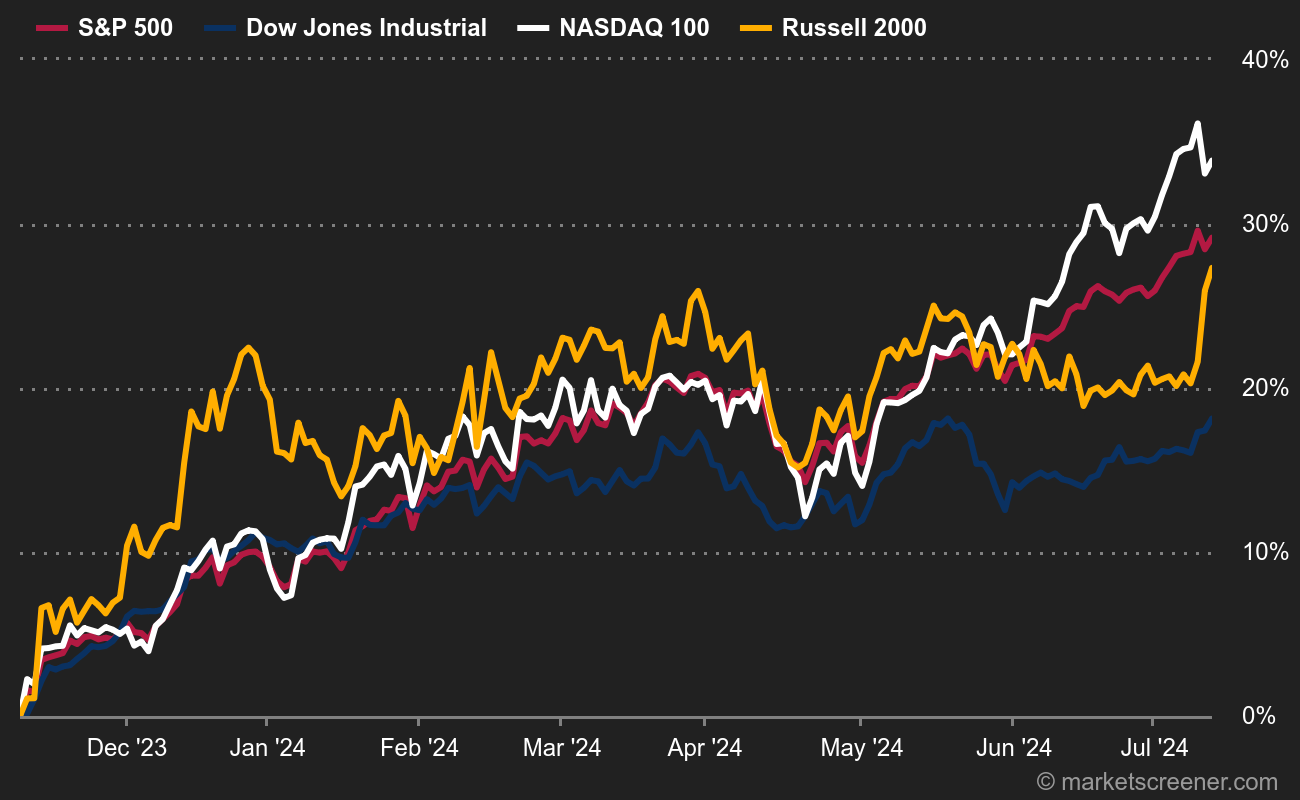

Since November 9, the Russell 2000 has outperformed even the Nasdaq 100, which is notoriously difficult to beat when the market is in a frenzy.

What's in the Russell 2000

The index covers US small caps. It weighs in at 7% of a broader index, the Russell 3000, which includes the 3000 largest companies on the US stock exchange. In other words, it's the Russell 3000 without the top 1,000 companies. The average capitalization of the Russell 2000 is $2.7 billion, and the median is $770 million. The largest company in the index, Super Micro Computer, weighs in at $15.7 billion.

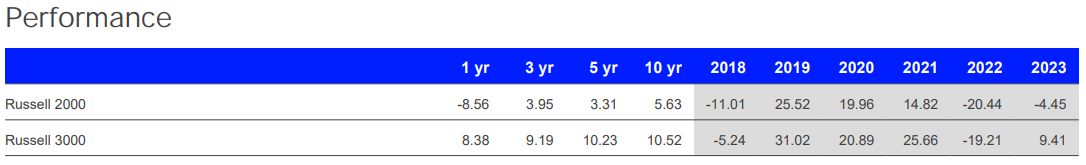

American small caps have been largely neglected in recent years (Super Micro Computer being a very bad example of this). Moreover, the sector's ratios are low compared with those of large-cap companies. The Russell 2000 has a PER of 12.6 times and a price-to-book ratio of 1.75 for the current year. The Russell 3000 is at 19.6 and 3.56 times respectively. As you can see, small caps have been suffering in comparison with large caps for some time now: none of the columns in the table below are to the advantage of the Russell 2000!

By

By