Japan Stock Exchange (JPX)

Created in 2013, Japan's main stock exchange operator brings together the country's two main stock exchanges, which merged to combat the slowdown in market conditions in the country.

- The Tokyo Stock Exchange (TSE) is the country's largest stock exchange. Founded in 1878, it now has some 3,900 listed companies.

- The Osaka Stock Exchange (OSE) was founded in the same year and focuses mainly on derivatives, such as futures and options.

Regional exchanges

The market has retained four regional stock exchanges, primarily intended for the listing of small, regionally-based companies. These are the Nagoya Stock Exchange (NSE), the Fukuoka Stock Exchange (FSE), the Sapporo Securities Exchange (SSE) and the Hiroshima Stock Exchange (HSE).

Indexes

Japan has numerous indices, as do other financial centers, but two stand out when it comes to characterizing this market: the TOPIX and the Nikkei 225.

- TOPIX: This index is weighted according to market capitalization. This means that companies are included according to their relative size. Toyota and Sony are the two most influential stocks in the index, which includes over 2,000 companies in all.

- Nikkei 225: This index is often used as the benchmark for the Tokyo Stock Exchange. Unlike the TOPIX, it is a price-weighted index, like the Dow Jones. As its name suggests, it comprises 225 stocks.

Scale and size

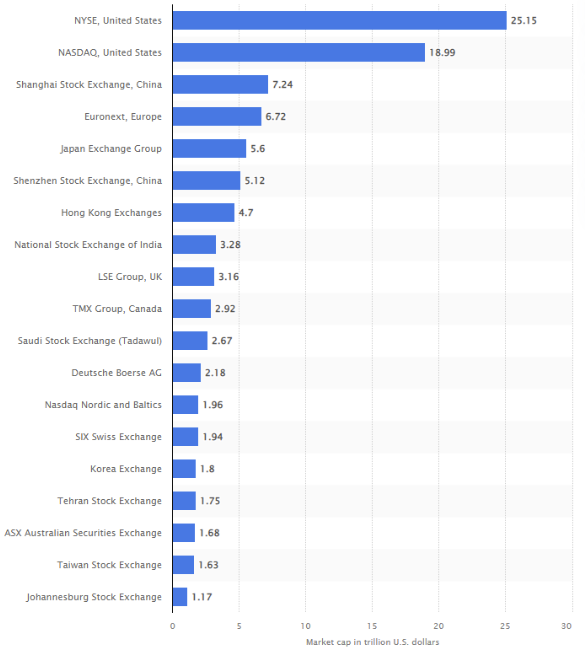

The Japanese market is the world's fifth-largest in terms of capitalization. It comes after the NYSE, the Nasdaq, the Shanghai Stock Exchange and Euronext.

Many large caps

As of May 2023, the Japanese market includes just over 110 stocks with a market capitalization in excess of $10 billion. Twenty of these exceed $50 billion, and four behemoths are above the symbolic $100 billion mark: Keyence, the industrial robot specialist; telecommunications and network services giant Nippon Telegraph and Telephone; and the two international flagships Toyota and Sony.

A market dominated by three sectors

The three most represented sectors among companies with market capitalizations in excess of $10 billion are Technology (22.2%), Industrials (21.8%) and Consumer Cyclicals (18.4%, but led by Toyota). In the MSCI World, industrial stocks account for just 10.5% of the index. Financial services (11.3%), healthcare (10.8%) and consumer discretionary (10.3%) round out the most represented sectors. Conversely, energies are almost entirely absent (just two companies), compared with a weighting of 5.1% in MSCI World. Finally, real estate and basic materials are not major Japanese specialties either.

Investing in Japan: Live stocks

Buying Japanese equities isn't that simple. The Japanese market, like the Hong Kong market, operates on a quota basis. In this case, a quota of 100 for the Nikkei 225, which means you need to buy at least 100 shares of a given stock to invest.

To make matters worse, many stocks have high share prices, which complicates investment. As explained above, the Nikkei 225 is a price-weighted index, so Japanese companies have no interest in driving their share prices down through splits, or risk losing leverage.

Based on these explanations, here are two illustrations:

- SMC Corporation is the company with the most expensive share on the Nikkei 225: JPY 73,590 on May 24, 2023. With a minimum shareholding of 100, you'll need to invest a minimum of JPY 7,359,000 to take up a position. Or USD 52,655 at current exchange rates. The entry ticket is high!

- Z Holdings is one of the most accessible stocks in the index. At JPY 353 apiece, you'll need to pay JPY 35,300 to take a position in Yahoo Japan's parent company. A much more affordable USD 252.

This ratio rule may therefore prevent you from investing in certain shares because they are too expensive for an individual investor. This is something to bear in mind. Other potential pitfalls should also be borne in mind:

- You need a broker who accepts the Japanese market. And, if possible, one with the ability to schedule orders.

-

You need to be aware of currency risk. We're talking here about the possibility of incurring financial losses due to fluctuations in exchange rates between two currencies when investing in foreign companies. If a American investor decides to invest in Japanese companies, the exchange rate risk may materialize as follows:

If an investor buys JPY 10,000 worth of shares at an exchange rate of USD 1 = JPY 140, the invoice will amount to USD 71. If he sells at the same price, but the exchange rate rises to USD 1 = JPY 150 (i.e. the dollar has appreciated), he will only recoup USD 66. That's currency risk (which also works in the other direction).

Investing in Japan: ETFs

ETFs are a classic alternative for avoiding exposure to a limited number of stocks and broker limits. There are generalist ETFs that simply allow you to gain exposure to this market and track the performance of the main indices in the land of the Samurai.

You could opt for :

- The iShares MSCI Japan UCITS ETF (+10.86%) is a heavyweight in the sector. On the other hand, its fees are slightly higher than those of other ETFs targeting the market.

- The iShares Nikkei 225 UCITS ETF (+18.34%), which aims to replicate the NIKKEI 225 index, is denominated in yen.

Choosing a currency-hedged ETF could also be an interesting option. In recent years, both the dollar and the euro have risen sharply against the Japanese yen as a result of monetary policies, with the Bank of Japan (BoJ) looking to stimulate the economy.

The acceleration in Japanese market performance from March onwards is clearly visible. A trend reinforced by Warren Buffett's statements in an interview with Nikkei on April 11, in which he expressed his wish to increase his investment made in 2020 in the five leading Japanese trading companies, namely Mitsui, Sumitomo, Itochu, Mitsubishi and Marubeni.

In addition to the Buffett effect, there are a number of other factors behind the Japanese stock market's renewed popularity. Geopolitics, with the USA and China currently facing economic challenges, is making Japan more attractive to investors. The Bank of Japan's monetary policy remains accommodating for traders, despite higher inflation and the recent change of central bank president. Finally, Japanese companies are in a phase of improved governance, coffers are full and share buy-backs are at record levels.

By

By