Spot gold advanced 0.5% to $2,159.79 an ounce at 0432 GMT, having touched an all-time high of $2,161.09 earlier in the session. US gold futures gained 0.4% to $2,167.00.

According to Marcus Garvey, head of commodities strategy at Macquarie, the slight weakness in US economic data provided a pretext for gold to strengthen, but the magnitude of the rise seems exaggerated, perhaps due to heavy buying of futures contracts that began on Friday.

The US dollar index fell to its lowest level in a month after Powell's statements. Powell indicated that rate cuts were possible in the coming months "if the economy develops as expected" and if there were further signs of slowing inflation. A weakening dollar makes gold less expensive for holders of other currencies.

In a separate exchange with the press, the Fed's Neel Kashkari mentioned that it would make sense for the Fed to cut rates only twice, or perhaps only once, this year.

The median forecast from Fed officials in December was for three rate cuts this year, which would lower the Fed's key rate to a range of 4.5% to 4.75%, from the current 5.25% to 5.5%. Lower rates increase the attractiveness of gold, which is a low-yielding asset.

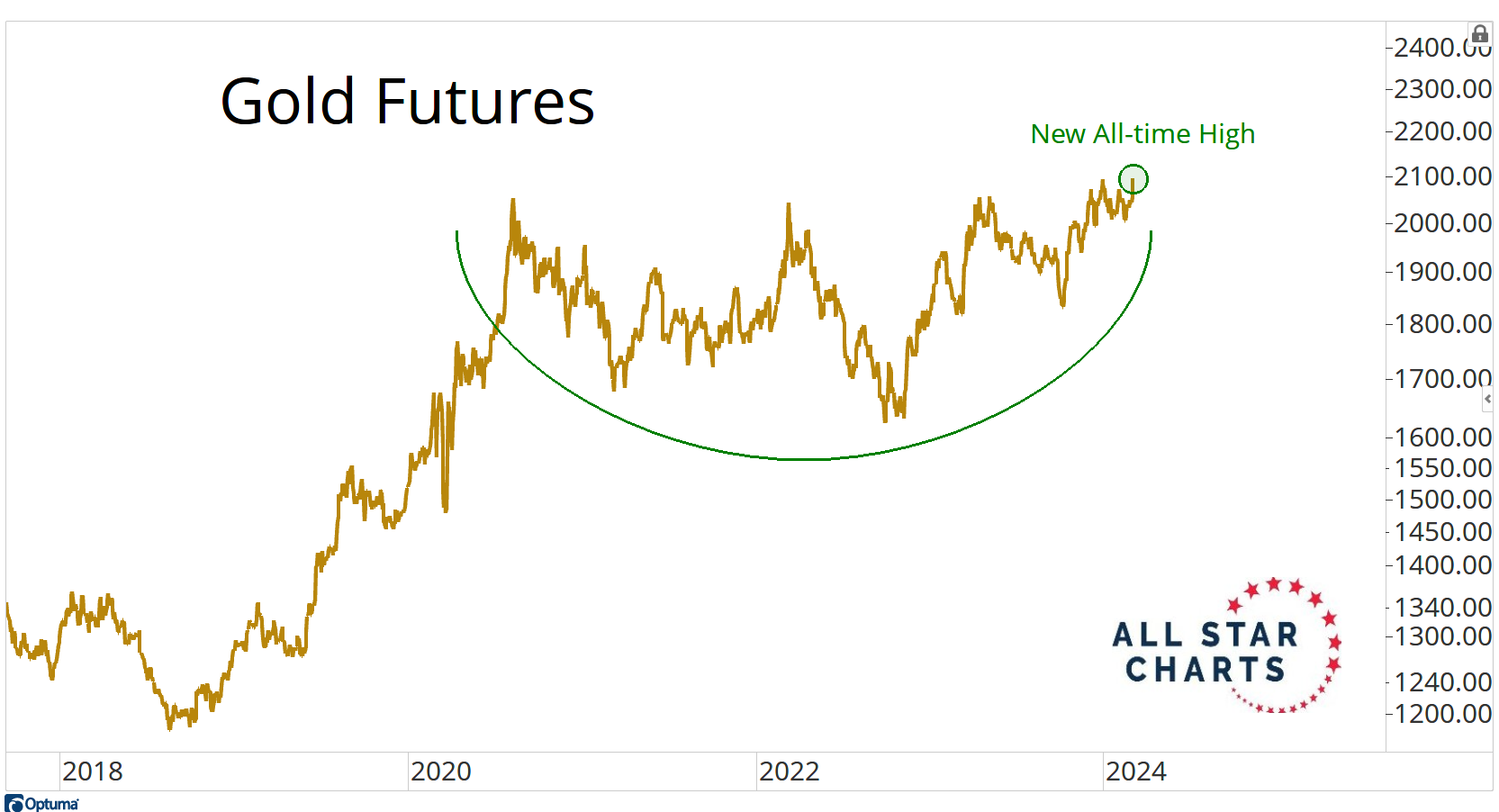

As a result, gold is holding near its highs, and the "rounding bottom" chart formation suggests a medium-term trend reversal that could propel gold to new highs.

By

By