Through its various subsidiaries, the group has 14,000 points of sale, 10,000 of which are in North America. 9 million customers pass through these convenience stores every day and buy 132 million liters of fuel and 750,000 coffees. That said, 65% of transactions are groceries only (25% fuel only, 10% being a mix of both).

The company has seen four decades of exceptional growth. The first brick of this company was laid in 1980 in Laval, Quebec by Alain Bouchard, the founder, former CEO and current president. A. Bouchard was soon joined by Jacques D'Amours, Réal Plourde and Richard Fortin - all four of whom are still shareholders today - to found the empire that became Alimentation Couche-Tard. In the early 2000s, the company became the leader in the food sector in Canada and the 9th largest in North America. Alimentation Couche-Tard bought Circle K in 2004 and exported to the United States and Asia. In the 2010s, the company established itself in Europe under its international Circle K franchise, notably in Scandinavia, Poland, the Baltic States and Ireland.

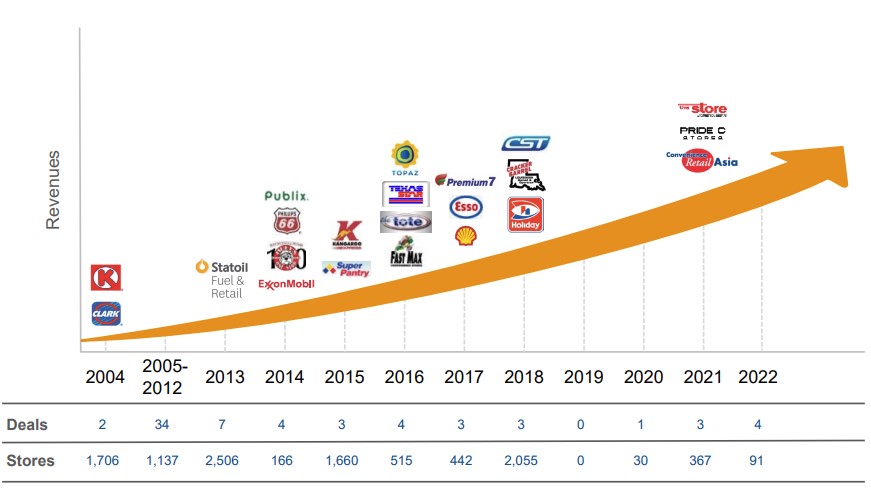

Circle K is an example of what has made Alimentation Couche-Tard grow, a carefully orchestrated mix of organic and external growth. The exceptional capital allocation has been accompanied by a series of remarkably well-integrated acquisitions over the past 16 years. 10,700 points of sale (out of a total of 14,000) have been added via acquisitions since 2004, notably by buying out the service stations of the oil majors and refiners who are selling their distribution activities (Statoil, Exxon, Philips 66, Shell, Esso, etc.). Couche-Tard was there each time to buy them at a good price.

Source: Alimentation Couche-Tard

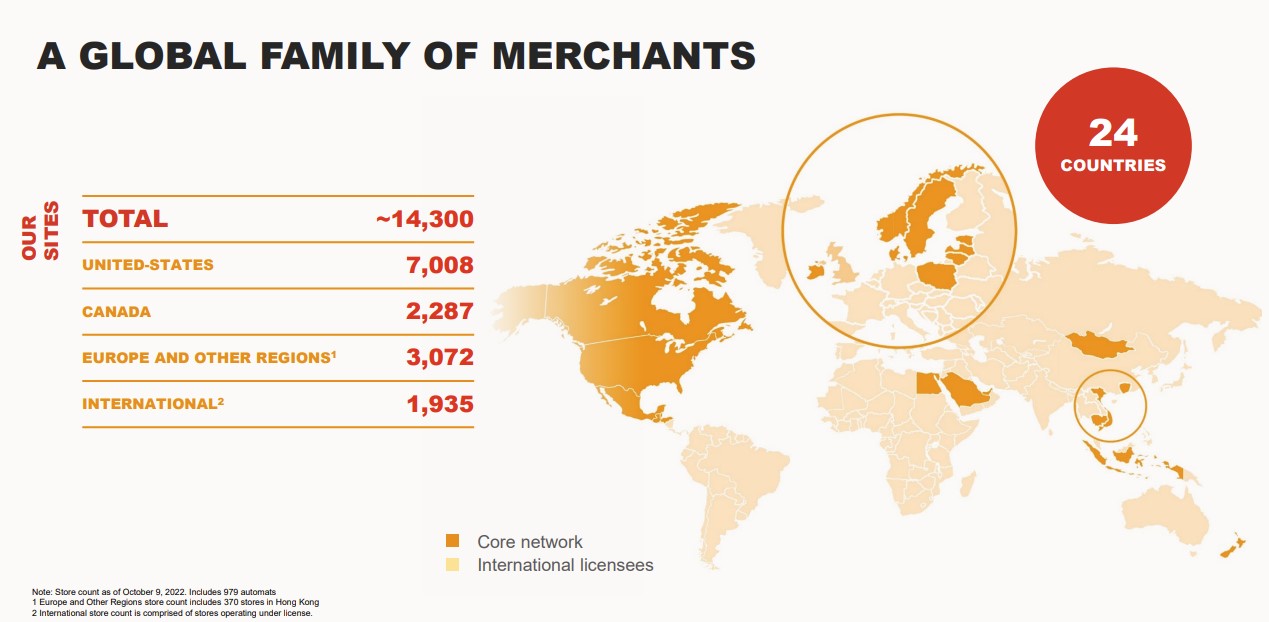

The company is now present in 24 countries and has a hyper-competitive positioning thanks to an inimitable territorial network throughout North America, part of Asia, Northern Europe and the Middle East.

Source: Alimentation Couche-Tard

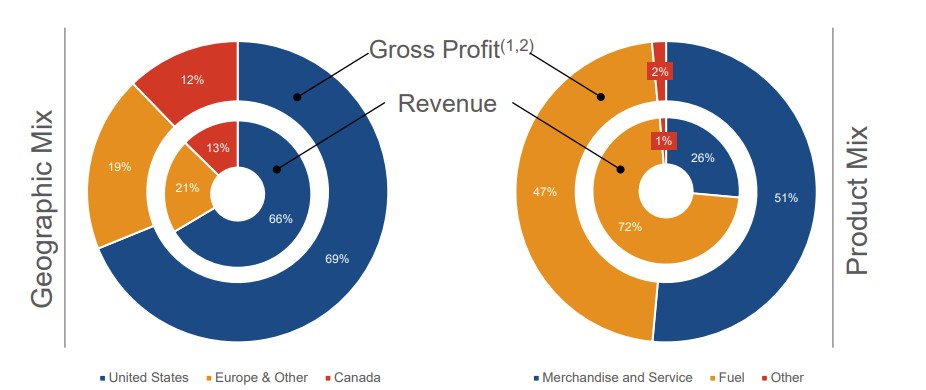

Two-thirds of sales are generated in the United States, one-fifth in Europe and Asia, and the rest in Canada. The product marketing mix is split 50% on groceries and the other half on fuel distribution.

Source: Alimentation Couche-Tard

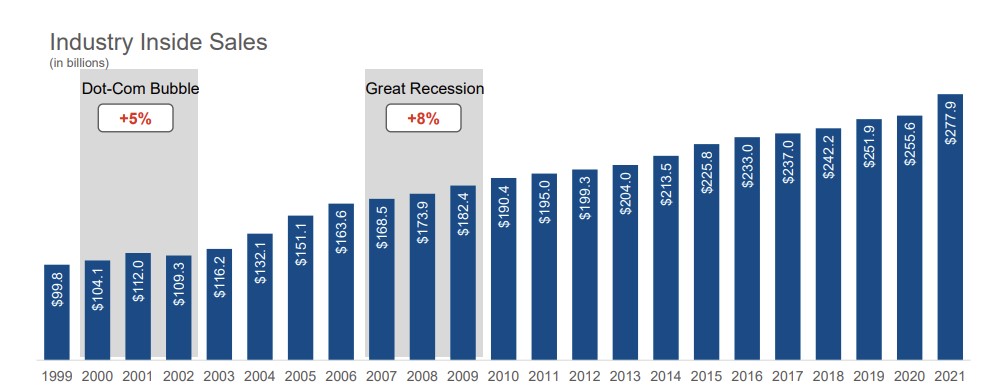

Couche-Tard now has a 5% share of the convenience store market in the United States. This is a market with clear opportunities for consolidation. This segment of stores is also growing steadily in terms of both sales and margins, and has proven to be "recession-proof" over the past 25 years.

Sales growth since 1999 :

Source : Alimentation Couche-Tard

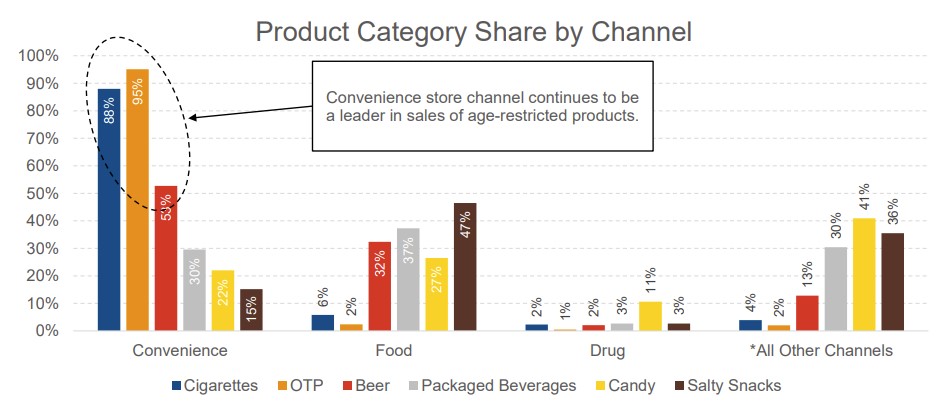

However, a large part of the sales in convenience stores are related to tobacco and its derivatives, as well as to light alcohol. This is both an advantage (regulated sales channel + complete territorial coverage = great difficulty for potential new entrants) but also a risk if we see a decline in sales of cigarettes and nicotine-based products in the coming years.

Breakdown of sales by category :

Source: Alimentation Couche-Tard

A second point of attention: margins on fuel sales are at their highest in 15 years. With the current capacity problems, there are fewer and fewer refineries, but it is not certain that this will last forever.

In terms of opportunities this time, no one is better positioned than Alimentation Couche-Tard to capitalize on the electric vehicle (EV) boom by progressively converting its points of sale into charging stations.

Apart from the above-mentioned competitive advantages (unparalleled territorial coverage, sale of regulated products), another natural competitive advantage of a large distributor is scale, which allows costs to be shared and better margins to be achieved. This is something that Couche-tard does very well.

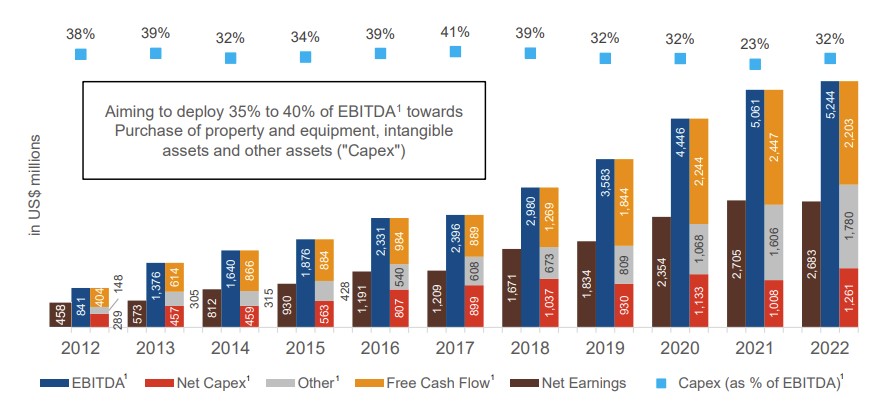

Over the past 10 years (2012-2022), EBITDA and FCF have increased sixfold. And the conversion of EBITDA to FCF is about 45% on average over the last decade. In two words: hats off!

Source: Alimentation Couche-Tard

Maintenance capex is about two-thirds of total capex. All other things being equal, if we stopped investing in growth, we would have an annual free cash flow (FCF) "run-rate" of about 3 billion dollars against a market cap of 46 billion dollars. Thus, Alimentation Couche-Tard pays itself 15 times these cash profits (FCF).

That's interesting, especially since the market seems to value the company as a mature company with plateauing growth. But the truth is, the market has been thinking that about the company for 15 years, and yet it demonstrates every year that it can continue to grow. It has always been able to surprise with the number and quality of acquisitions it has made, and the resulting explosion in profits. We are therefore not immune to new surprises of the same kind over the next 15 years.

Especially since the balance sheet is excellent, with leverage at its lowest level in 15 years (1.3 times EBITDA). Another sign of good management: there is little debt in the midst of rising interest rates despite an exceptional growth track record, a big plus.

Management also seems to think the stock is undervalued since in the first quarter of 2023 (current fiscal year for them), they bought almost $500 million worth of their shares.

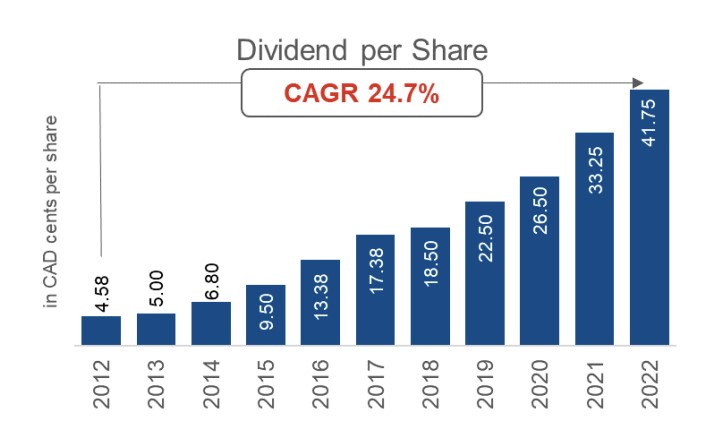

Let's also mention that the stock is a "dividend aristocrat" with a steady increase in the dividend over the last 25 years. Over the last decade (2012-2022), the dividend is growing at 24.7% per year.

Source : Alimentation Couche-Tard

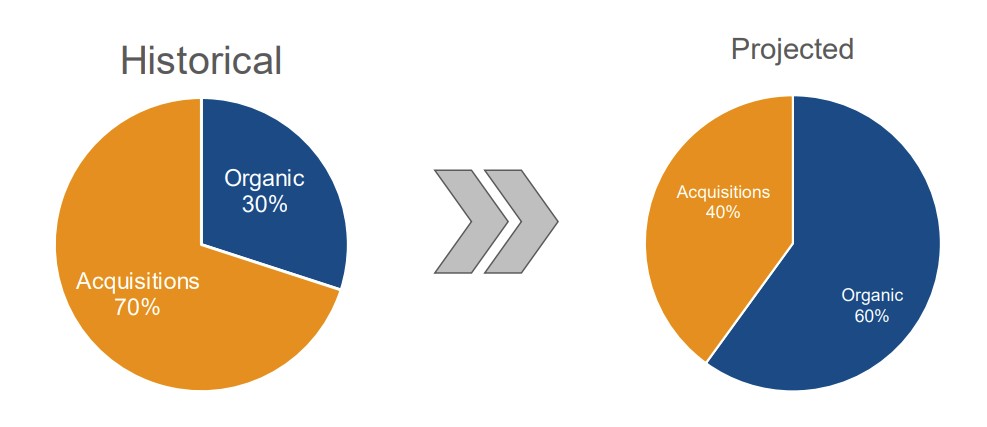

The management's objective is clear: to succeed in doubling EBITDA thanks to share buybacks and organic growth. The group wants to revisit its food offer and put a little less emphasis on external growth. External growth (70% of historical growth) should be reduced to 40% of total growth.

Source : Alimentation Couche-Tard

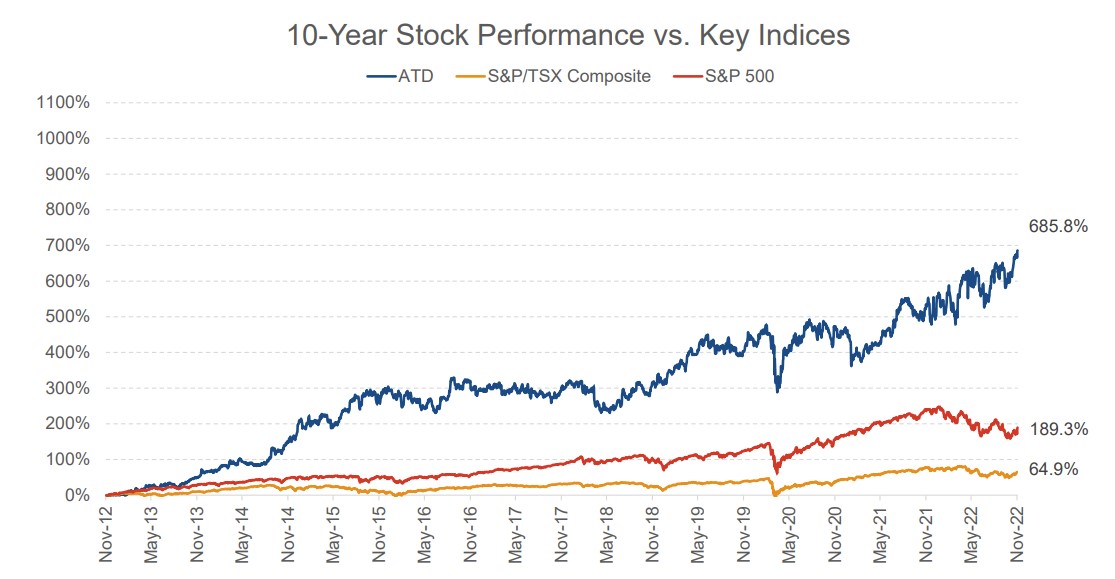

Evolution of the stock price over the last decade vs. the S&P 500 index:

Source: Alimentation Couche-Tard

The stock literally tore up the US broad index since the share gained 617% over the decade against only 68% for the S&P 500, and that's without taking into account the copious dividends that were paid to shareholders.

Alimentation Couche-Tard is surely the best managed company in its sector (food/fuel distribution) but also an anti-recession stock with a price that has risen in a straight line with low drawdowns since its IPO in 1990.

By

By