The company offers a range of products and services, including:

Amdocs MarketONE: This is a cloud-native ecosystem designed to facilitate a seamless experience for Over-The-Top (OTT) and digital consumer services.

Amdocs Digital Brands Suite: It is a fully integrated digital business suite tailored for digital telecom brands and smaller service providers.

eSIM Cloud: Amdocs Limited provides eSIM Cloud services, allowing for "digital SIM" capabilities and other services for a variety of IoT devices, including those from major manufacturers like Apple, Samsung, Microsoft, and Google.

AI Service: The group also offers an Artificial Intelligence (AI) service, enabling service providers to enhance the home broadband experience.

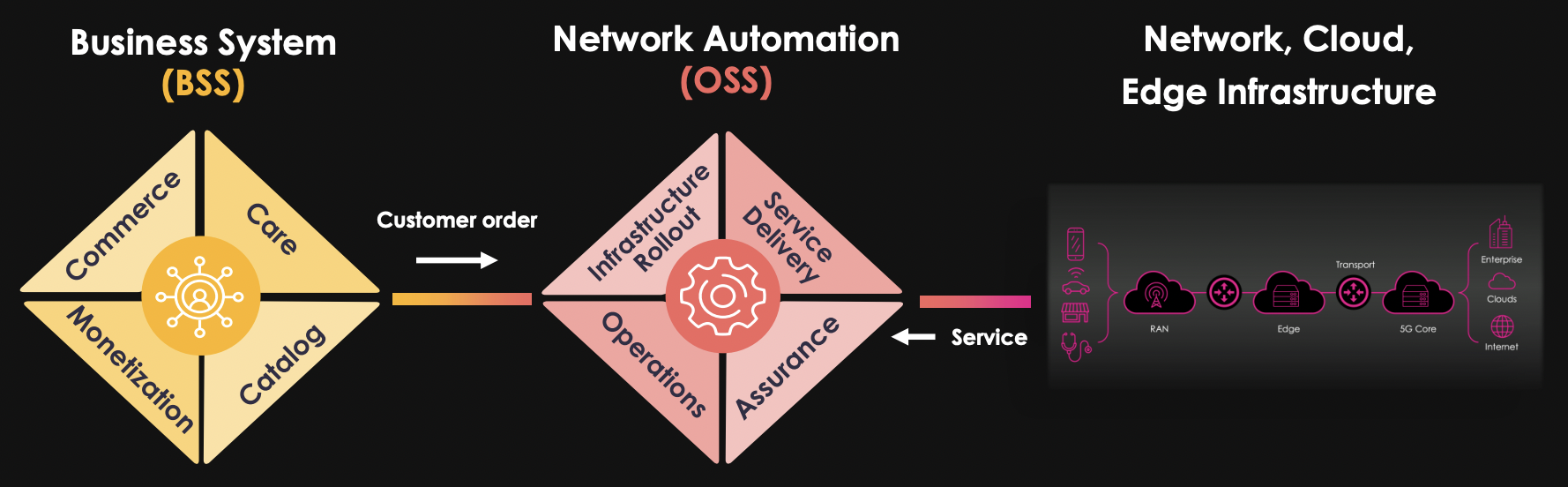

The company's primary focus is on network automation, which involves using software to connect business systems and network infrastructure. This automation streamlines the deployment of infrastructure and the delivery of services to customers. In addition, the company has made substantial investments, totaling over $1 billion, in developing its "next-gen cloud platform."

Amdocs's success is driven by its customer base, which includes major telecommunications giants such as America Movil, AT&T, Bell Canada, Singtel, Telefonica, Telstra, T-Mobile, Verizon, and Vodafone. Additionally, it serves cable and satellite providers like Altice USA, Charter, Comcast, Rogers Communications, and Sky. The company also has established partnerships with numerous global content owners and distributors, including well-known names like MGM and Warner Bros. Discovery.

However, it's essential to be aware that in 2022, a significant portion of the company's sales, specifically 27% and 20%, came from its two largest customers, AT&T and T-Mobile, respectively. This concentration of revenue from a small number of clients poses a potential risk and should be considered in assessing the company's financial stability.

The group's growth strategy revolves around three key areas: Digital (expand its IT operations in the digital domain), 5G (development), and Cloud (accelerating cloud adoption across all platforms and customer segments is another priority). It places significant importance on expanding into new geographies and emerging markets. While it already has a strong presence in developed countries like Europe, it is eyeing further growth in emerging countries such as Albania, Bulgaria, Hungary, Serbia, and various African nations.

In the competitive communication and media industry, Amdocs faces challenges in gaining market share and distinguishing itself from rivals. It contends with providers of BSS/OSS/CRM services like Oracle and Salesforce, with Salesforce being a CRM leader. Additionally, it competes with companies offering IT services, network equipment, and niche domain expertise, including Accenture, Cognizant, Ciena, Huawei, Stripe, and Aria Systems. This intensifying competition underscores the need for Amdocs to innovate and differentiate itself in a rapidly evolving industry landscape.

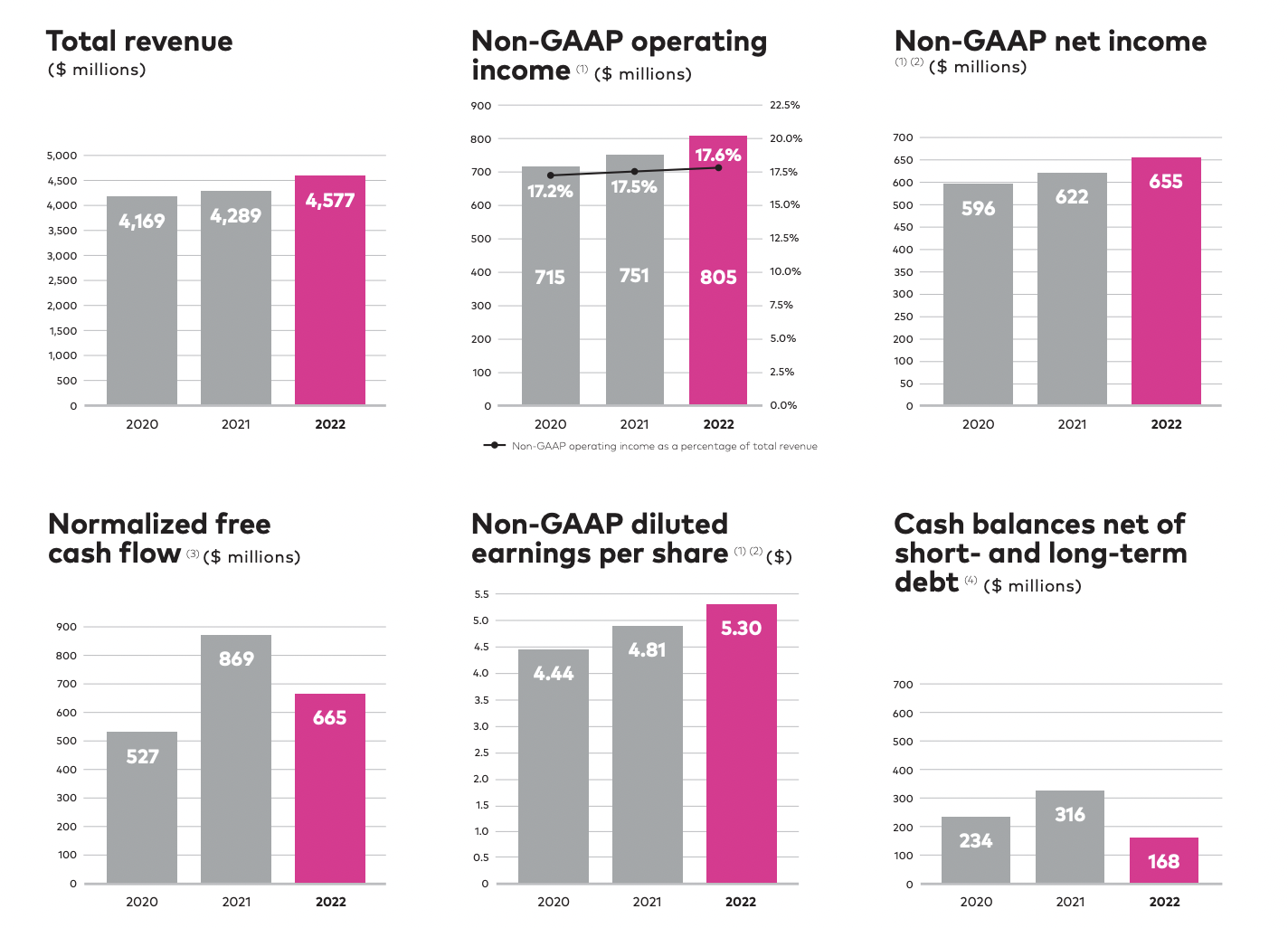

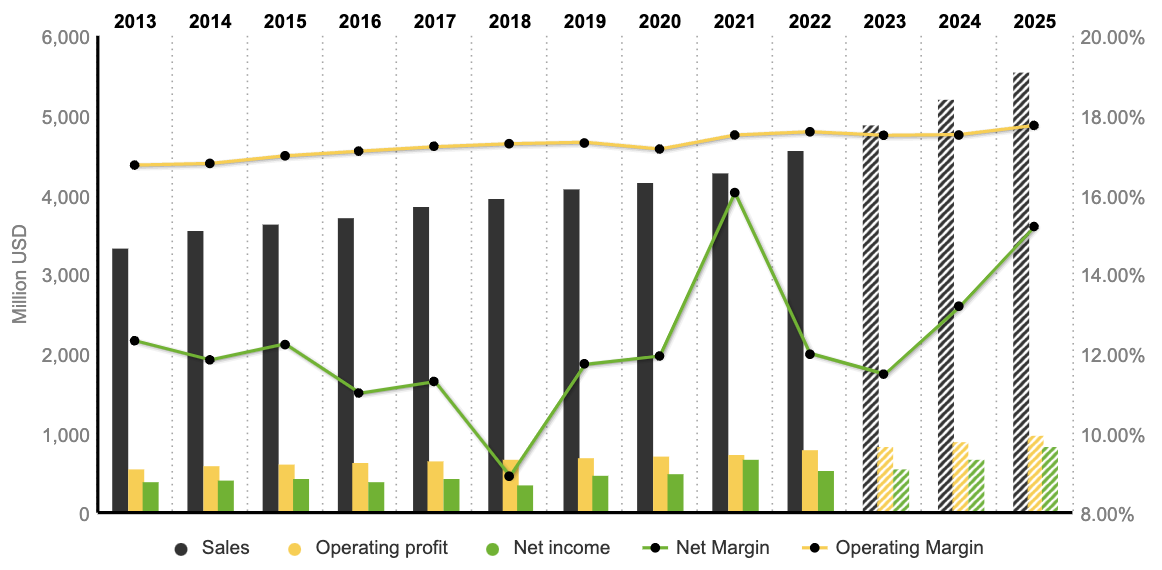

In terms of financial performance, it has experienced growth in 2022, achieving record sales of $4.576 billion, representing a 3.2% annual increase over the past decade. Its workforce consists of over 31,000 employees. The revenue is divided into two main segments: managed services arrangements, accounting for 60% of sales, and other services, making up 39.8% of sales.

North America is the dominant region, contributing to 67.8% of sales, with an 11.1% increase from the previous year. Europe accounts for 12.7%, and the rest of the world contributes 19.5% of sales. The company maintains development facilities in various countries, including Brazil, Canada, Cyprus, India, Ireland, Israel, Mexico, the Philippines, the UK, and the US.

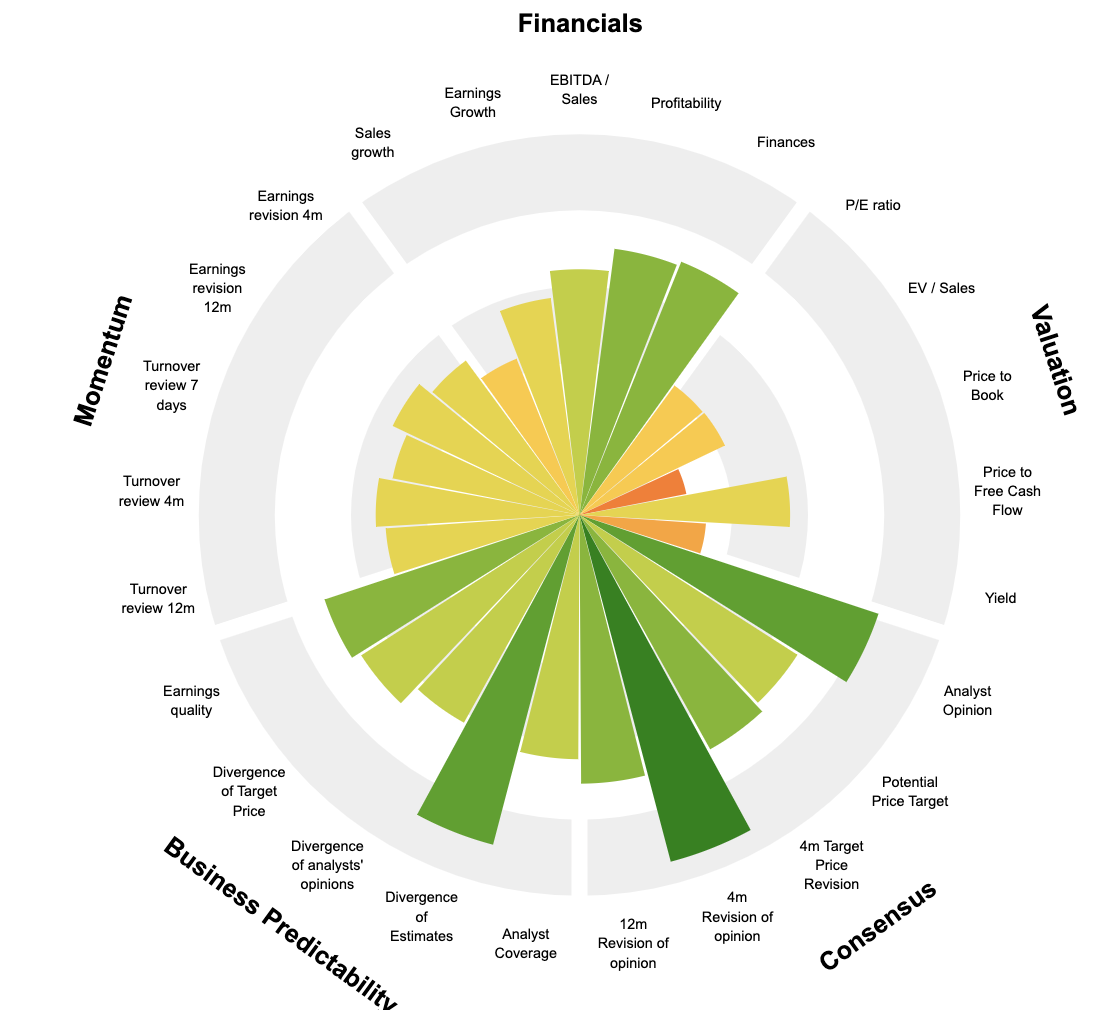

Financial performance reflects stability and strength. Over the past decade, Free Cash Flow (FCF) has remained consistent, moving from $564 million ten years ago to $530 million today. The company's financial health is underscored by a healthy balance sheet, with EBITDA growing from $663 million in 2013 to $958 million in 2022, showing a Compound Annual Growth Rate (CAGR) of 3.74%. Operating margins have stabilized at around 17-18%, and the net margin stands at 11-12% for the current financial year. Amdocs is currently priced with a reasonable Price-to-Earnings (P/E) ratio of 17.9x, slightly below its 10-year average of 18.8x. The company also boasts a high Return on Equity (ROE) of 18.4% in 2022, indicating strong returns for shareholders, along with a Return on Net Assets (ROA) ranging from 10-11%. Furthermore, Amdocs maintains a substantial cash position, with $573 million in cash in 2022, providing ample liquidity to support its operations and potential investments, compared to $709 million in 2021.

The company is a dynamic presence in the competitive communication and media industry, boasting a diverse portfolio of advanced services, including cloud-native solutions, digital business suites, eSIM offerings, and AI services, positioning the company favorably for innovation. However, the reliance on a limited number of major clients such as AT&T and T-Mobile does introduce a revenue concentration risk, underscoring the need for sustained innovation and diversification. In this highly competitive landscape, missteps can be costly, especially considering less favorable forecasts for fiscal 2024 due to challenging macroeconomic conditions.

By

By