Garmin's product lineup is tailored to meet distinct market demands:

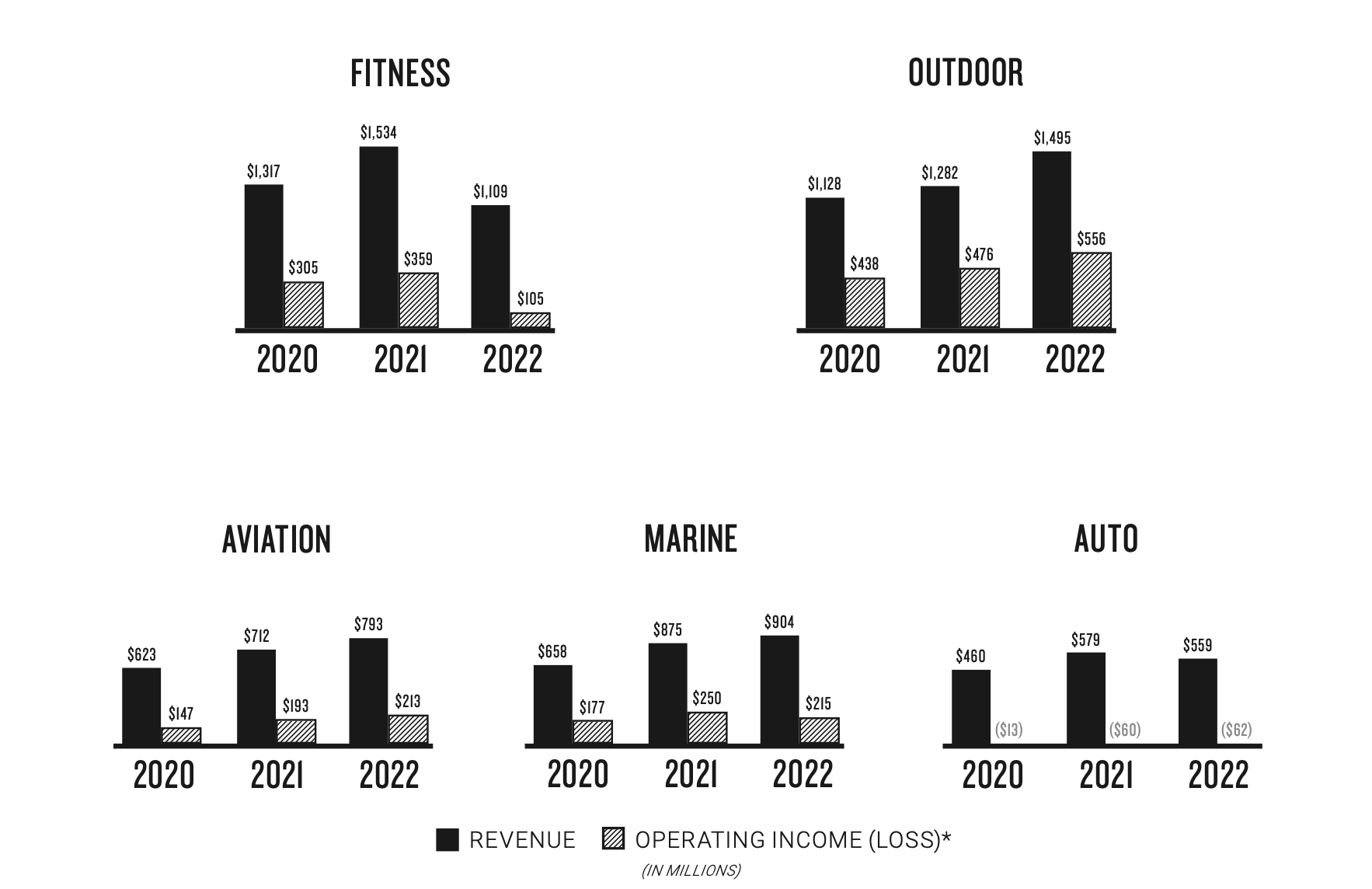

Fitness: It offers a range of products designed for health, wellness, and fitness activities, including sports watches, cycling gear, activity tracking bands, and online platforms.

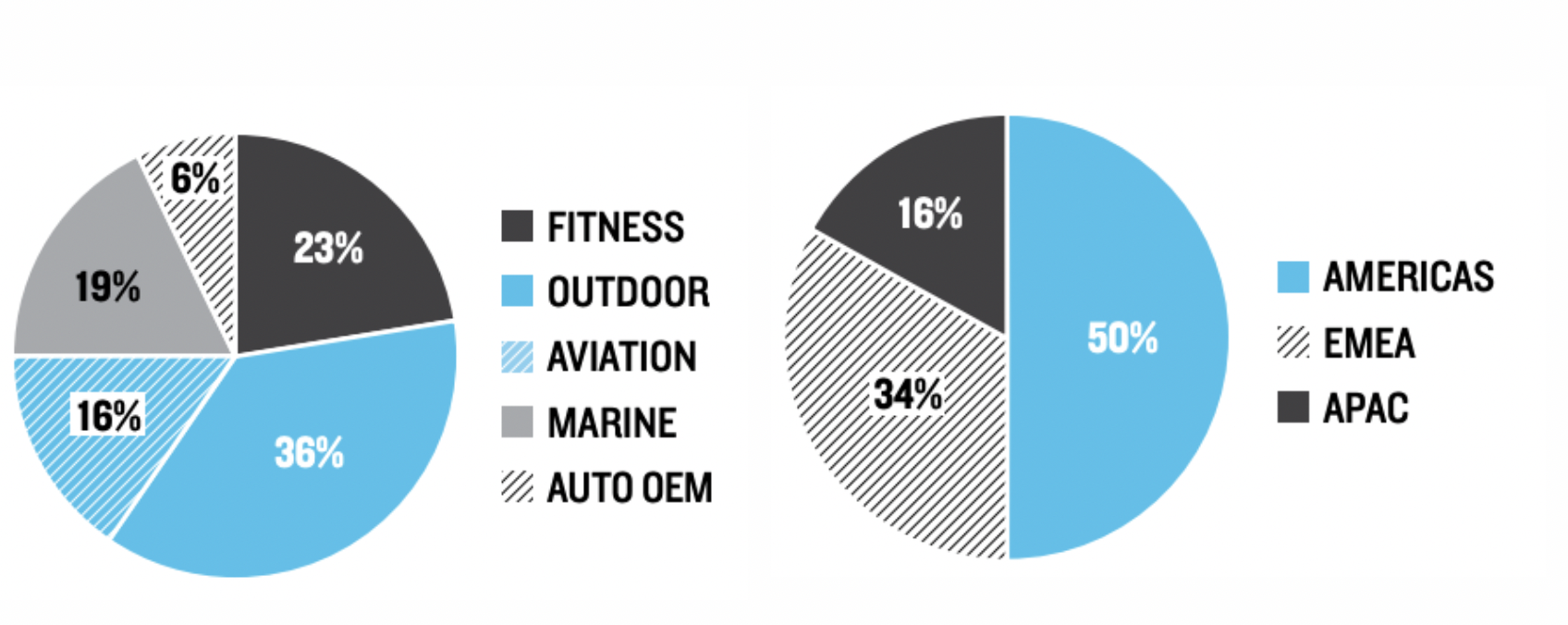

Outdoor: Features adventure watches, golf devices, and outdoor handheld tools. It's the most profitable sector with operating margins exceeding 30%, contributing significantly to the company's overall income.

Aviation: Garmin provides avionics solutions to OEM applications and retrofit installations, including flight decks, weather solutions, and pilot-oriented wearables. The segment also offers web and mobile apps for flight planning and management.

Marine: This division focuses on recreational marine electronics, offering autopilot systems, communication radios, and specialized wearables for mariners.

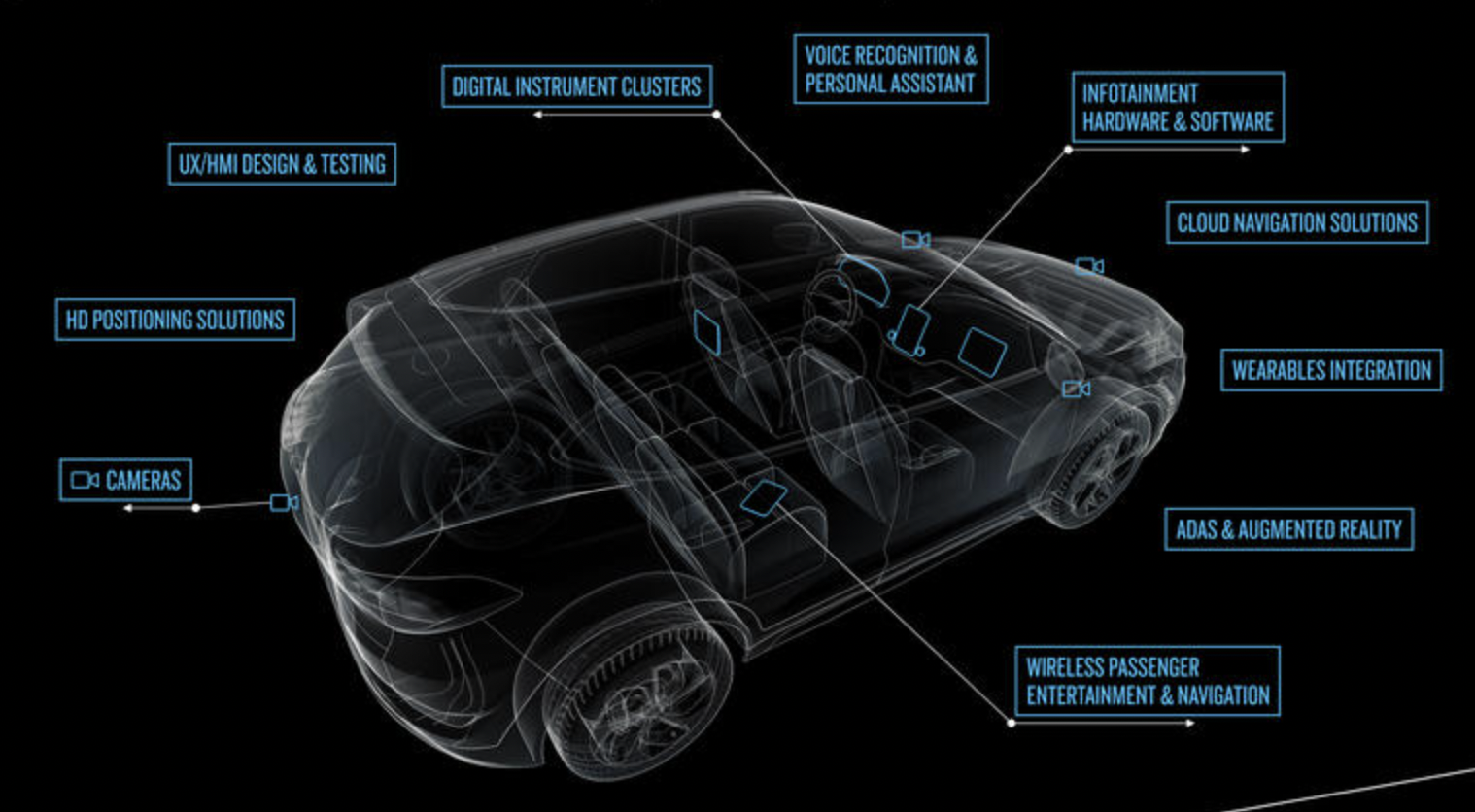

Auto: Garmin develops products for both consumer and OEM markets, including personal navigation devices, dash cams, and advanced in-cabin monitoring solutions.

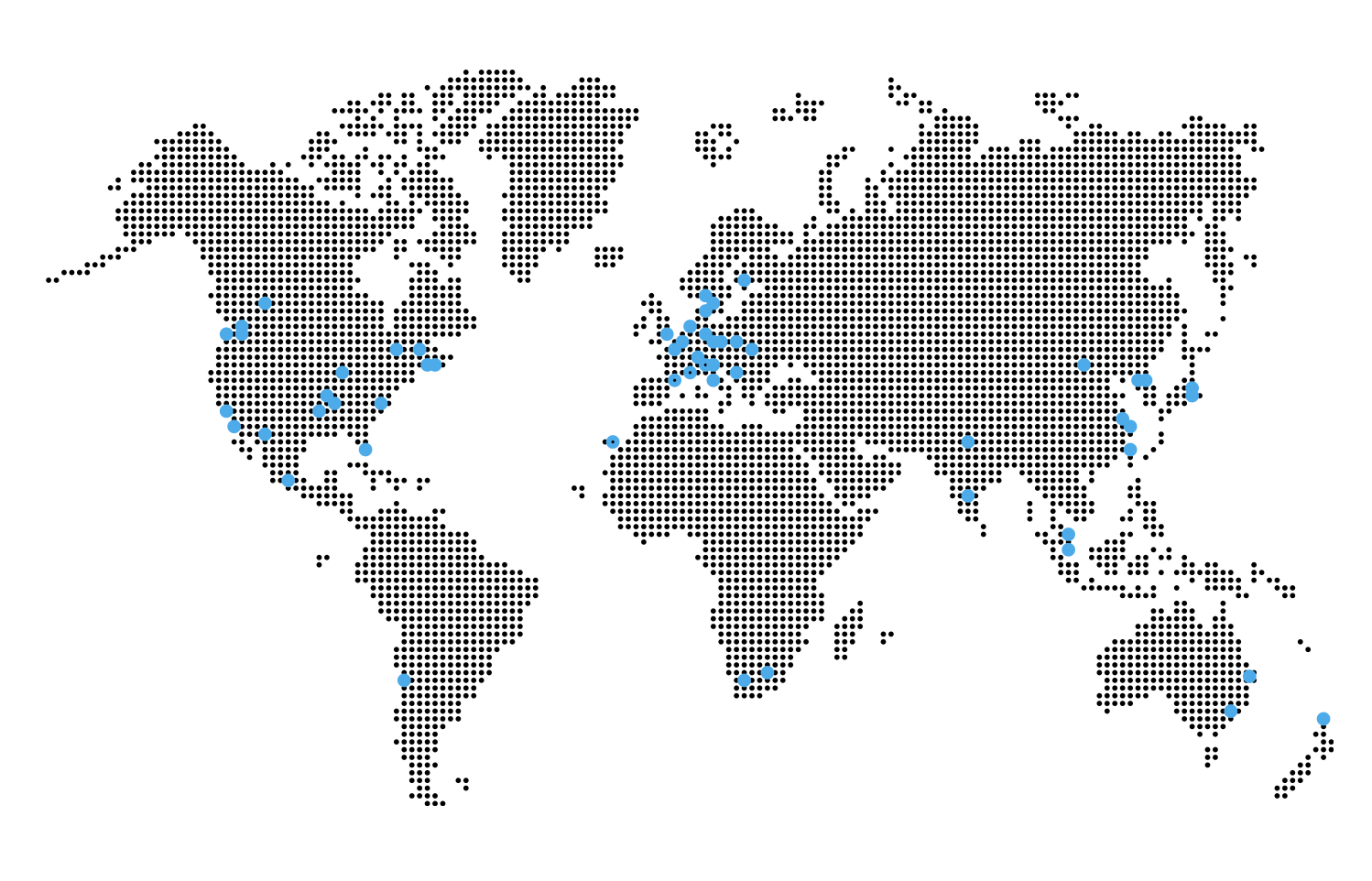

Garmin's global footprint extends across 34 countries, employing over 19,000 individuals, showcasing its international presence and reach beyond the United States.

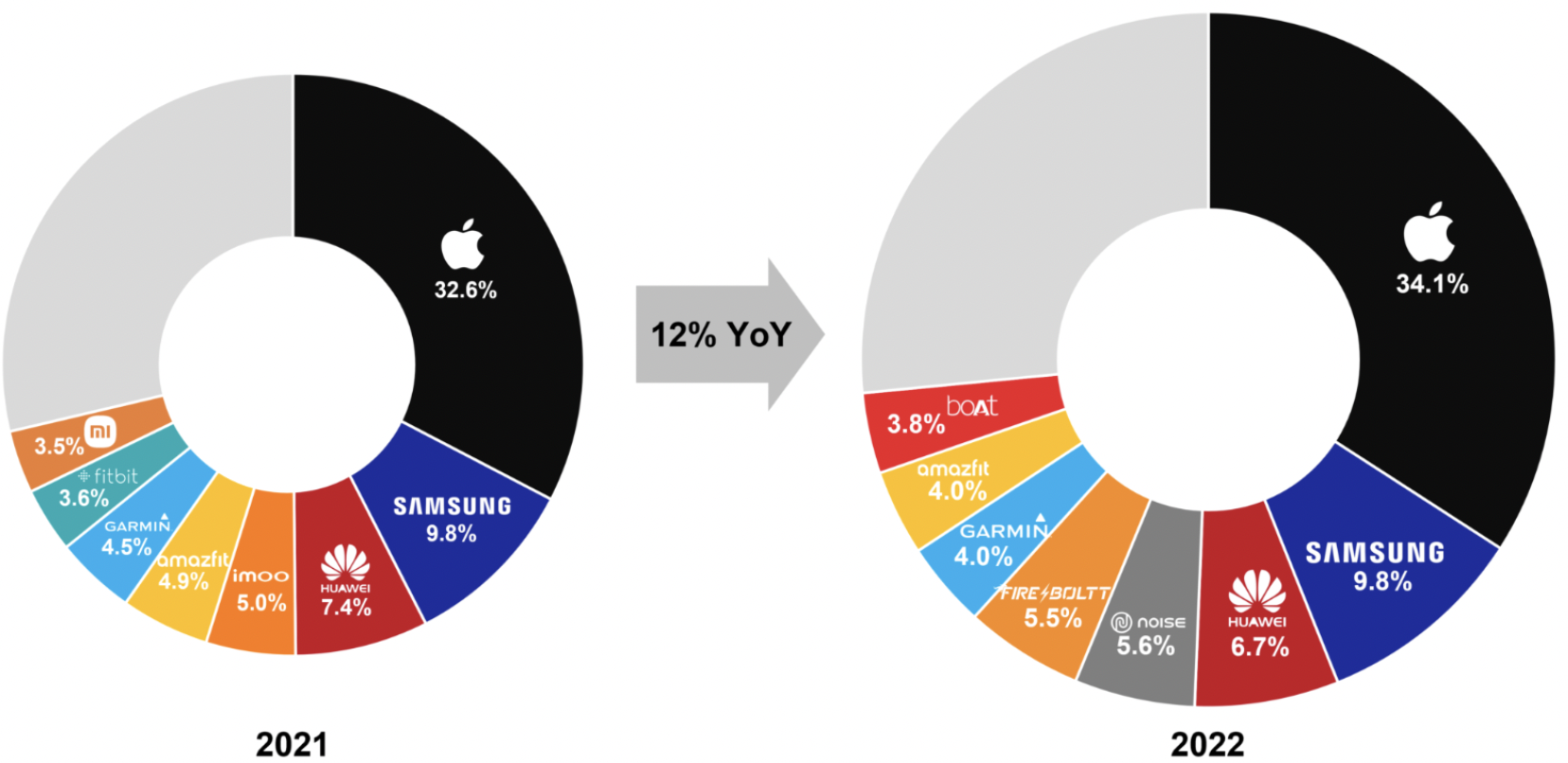

The company's strategic positioning within the thriving smartwatch market aligns well with projected high single-digit growth in the industry. Although specific figures for smartwatch sales are undisclosed, their estimated 4% market share in a $45 billion market implies a substantial smartwatch business.

An intriguing facet of Garmin's strategy lies in its emphasis on augmenting recurring revenue streams. This approach, highlighted in their Q2 2023 earnings call, holds potential to mitigate revenue and earnings volatility while fostering customer loyalty through increased switching costs. Garmin's diverse subscription products, tailored for niche markets like athletes, pilots, and hikers, leverage their core competency in GPS technology, solidifying their premium standing in the competitive smartwatch sector.

Furthermore, the Auto OEM segment, although the smallest, emerges as a promising growth catalyst amidst the rise of intelligent vehicles. Garmin's strategic shift in this domain focuses on integrating multiple automotive aspects, from touchscreens to wireless devices, onto a single System on Chip (SoC). The recent introduction of their advanced in-cabin automotive solution underscores their ambition. Bolstered by a robust R&D commitment, evidenced by a 17% R&D intensity, the company continually enhances its automotive offerings. Management's expectation of a 40% CAGR in Auto OEM segment revenues, based on secured business as of this year, adds to the company's optimistic outlook, reflecting their proactive approach and adaptability in an ever-evolving industry landscape.

In terms of financial performance, the group achieved commendable results, reporting $4.86 billion in revenues and $2.81 billion in consolidated gross profit by the end of 2022. Geographically, the Americas emerged as the group's most significant market, contributing to 50% of the revenue, followed by 34% from EMEA and 16% from APAC. Notably, the group maintained a robust financial position, boasting $2.66 billion in cash reserves and zero debt. The company allocated $679 million in dividends and $207 million in share buy-backs, indicating a shareholder-friendly approach.

In the competitive landscape, Research & Development (R&D) remained a focal point, with the group investing substantially, totaling $835 million in 2022. This strategic focus has resulted in the establishment of 23 R&D facilities and the acquisition of over 1,800 patents, enhancing the company's technological prowess.

Analyzing the management's performance, the company exhibited strong operational growth and healthy margins over the years. While there was a dip in EBITDA and EBIT, decreasing to $1,192 million and $1,028 million in 2022, attributed to challenging macroeconomic conditions and reduced sales, the company's net and operating margins remained stable at around 20%.

Garmin's financial landscape is notably influenced by its exposure to currency exchange rate movements in international markets. While Garmin has not employed hedging strategies using financial instruments in the past, the potential for future volatile foreign exchange rate fluctuations remains a crucial risk factor that could significantly affect the company's operational outcomes.

In the competitive arena, Garmin, with its 4% market share in the smartwatch segment, faces a daunting challenge from industry leader Apple, boasting a substantial 34% market share in shipments and a commanding 60% share of revenues. Despite Garmin's current advantages in areas such as GPS accuracy and data analytics, Apple's continuous enhancements and strategic advancements pose a significant threat. Apple's scale economies, coupled with ecosystem advantages, empower the tech giant. Furthermore, Apple's robust financial position provides ample resources to invest in innovation. This positions Apple favorably to bridge any technological gaps and potentially offer a superior value proposition in terms of both price and features to smartwatch consumers, thereby posing a long-term challenge to Garmin.

CounterPoint – Smartwatch Market

On the operational front, Garmin faces execution risks related to its shift towards subscription-based models. Historically known for its high-end devices with extensive features and no subscription fees, the company must tread cautiously. Limited switching costs mean that if consumers do not embrace the new subscription plans, Garmin risks losing its customer base to competitors, notably Apple. The success of this strategy hinges on customer acceptance and the perceived value proposition, making it crucial for Garmin to strike the right balance between monetizing its offerings and retaining customer loyalty.

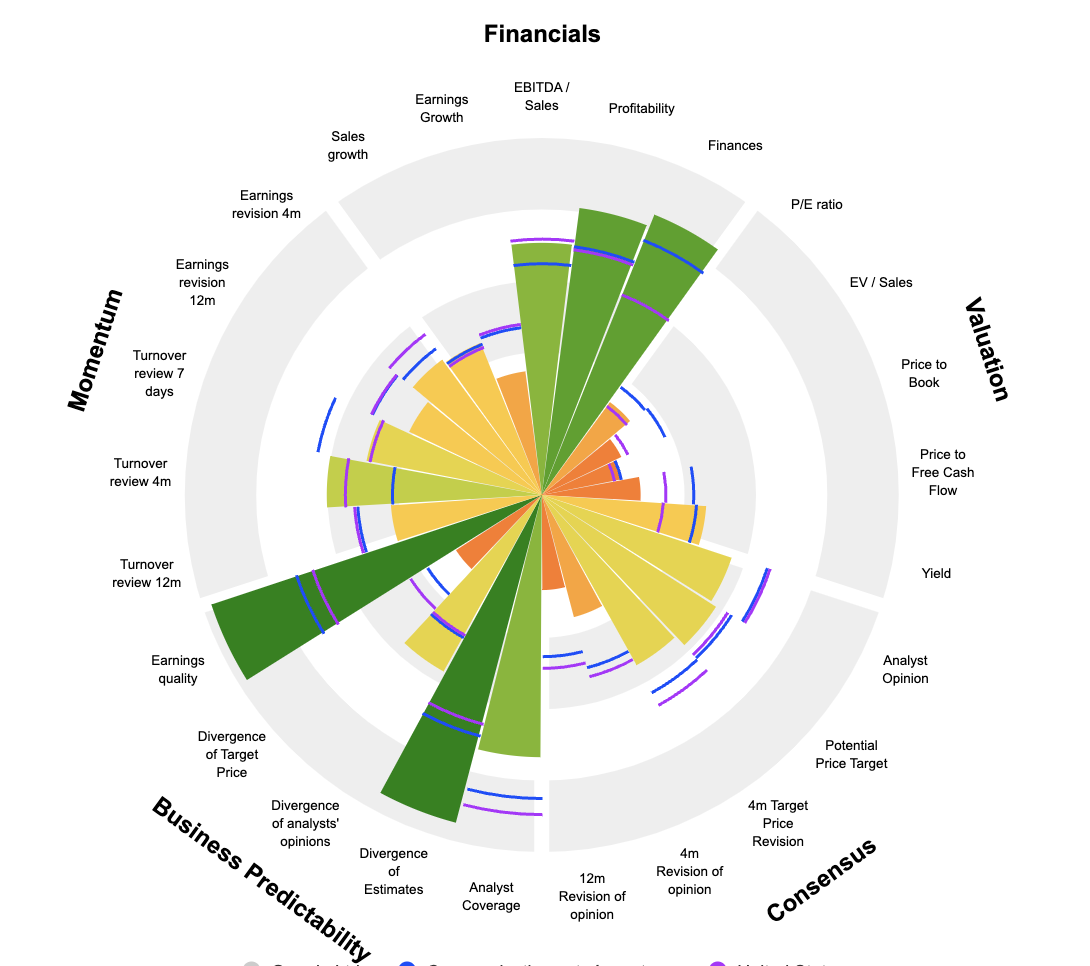

The stock is currently trading at 18.3 times FY2022 earnings, nearly in line with its ten-year average of 19.5 times. Despite strong fundamentals, given the current economic climate, it may not be the ideal investment choice. However, it's prudent to observe the company closely in the upcoming months, particularly focusing on management's announced projects.

By

By