The company's stock is included in the S&P 500 index. Since its initial public offering (IPO) in 1961, it has experienced an almost uninterrupted upward trend, delivering a remarkable journey of over 90,000% in returns to date (excluding the cumulative dividend payments amounting to $16.5B in 2022). In comparison, the S&P 500 has achieved less than 4,300% growth over the same period. Moreover, Lowe’s Companies has maintained a consistent and growing dividend payment history for since its IPO in 1961, earning it a place on the coveted "dividend king" list.

There are critical indicators in the home improvement market, such as home price appreciation, housing stock age, disposable personal income, and housing turnover. The company closely tracks transformative demographic shifts and societal trends, like the surge in millennial households and the pervasive adoption of remote work, which significantly impact industry dynamics. It exhibits a notable fragmentation, featuring an array of national and regional entities, encompassing warehouse chains, lumber yards, specialty dealers, and mass market retailers, all engaging in intense competition for market dominance.

Lowe's utilizes its diverse portfolio companies to expand its product offerings for customers. Each Lowe's store provides around 40,000 items, and they offer almost two million more products through online channels. However, online sales constituted only 10% of the company's total sales in 2022.

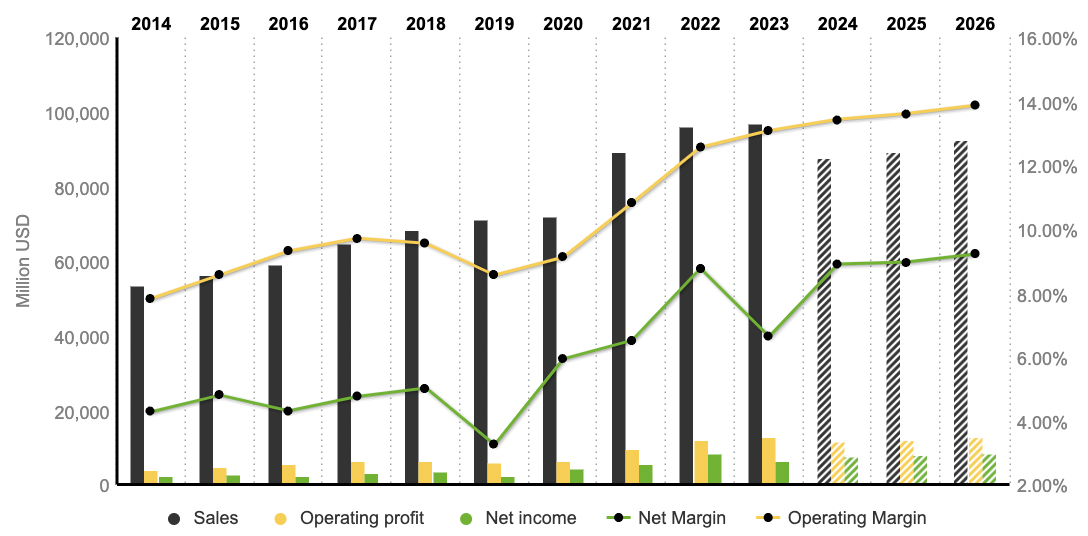

Examining Lowe’s Companies operational and financial performance over the past nine years, it remains strong. From 2014 to 2022, the company achieved a revenue growth from $53.417 billion to $97.1 billion, reflecting a compound annual growth rate (CAGR) of 6.9%. However, analyst predict a slowdown in the revenue from 2024 to 2026 ($92.741 billion). Net income increased from $2.286 billion to $8.442 billion during the same period, with the operating margin rising to 13% and the net margin improving to 8.77%.

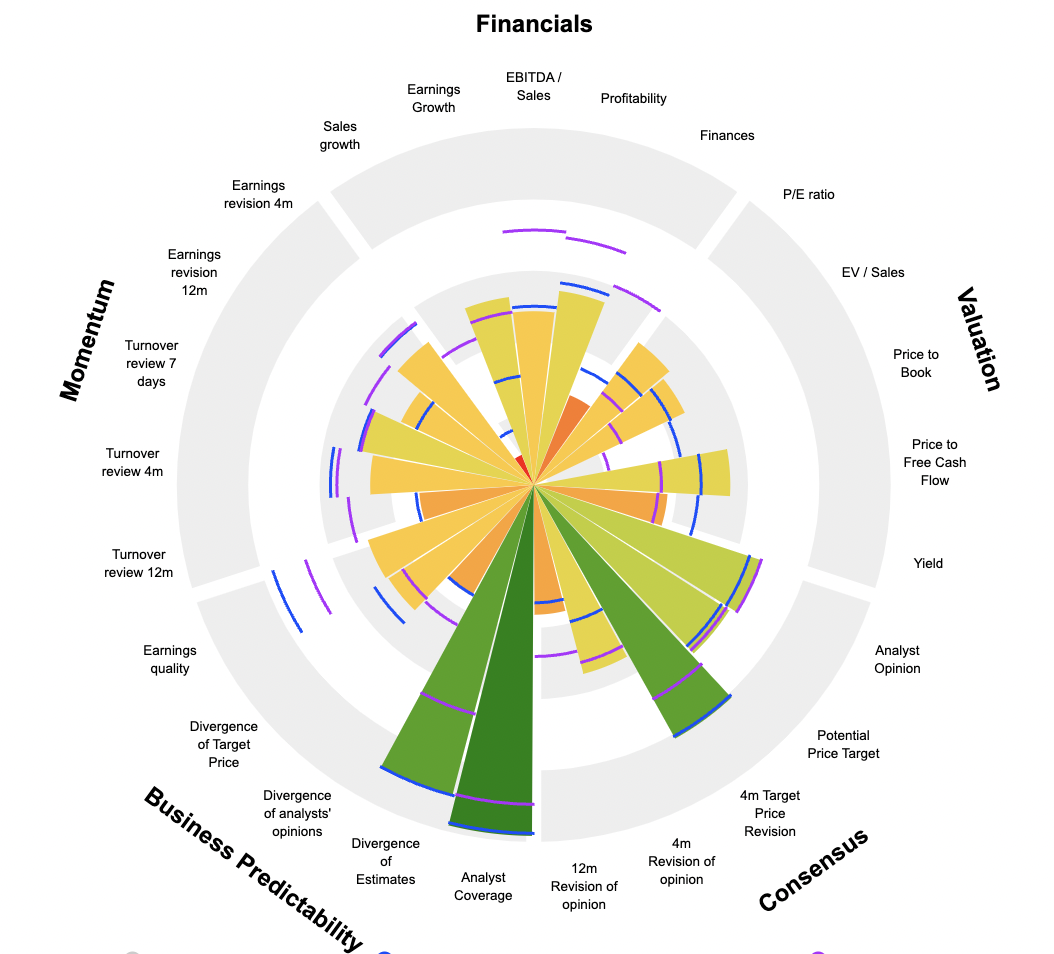

The company exhibits excellent financial management, as evidenced by its strong free cash flow (FCF), which exceeded $8.260 billion in 2022, representing a 160.5% increase compared to 2014. Over the period from 2014 to 2021, the Return on Equity (ROE) rose from 17,9% to 342%, but should decrease to around 36% in 2024, while the Return on Assets (ROA) increased from 7% to 18,5%. With a share price of $199, Lowe’s Companied boasts a market capitalization of $116 billion, implying a price-to-earnings (P/E) ratio of 21.2x, slightly below its historical average (23.6x).

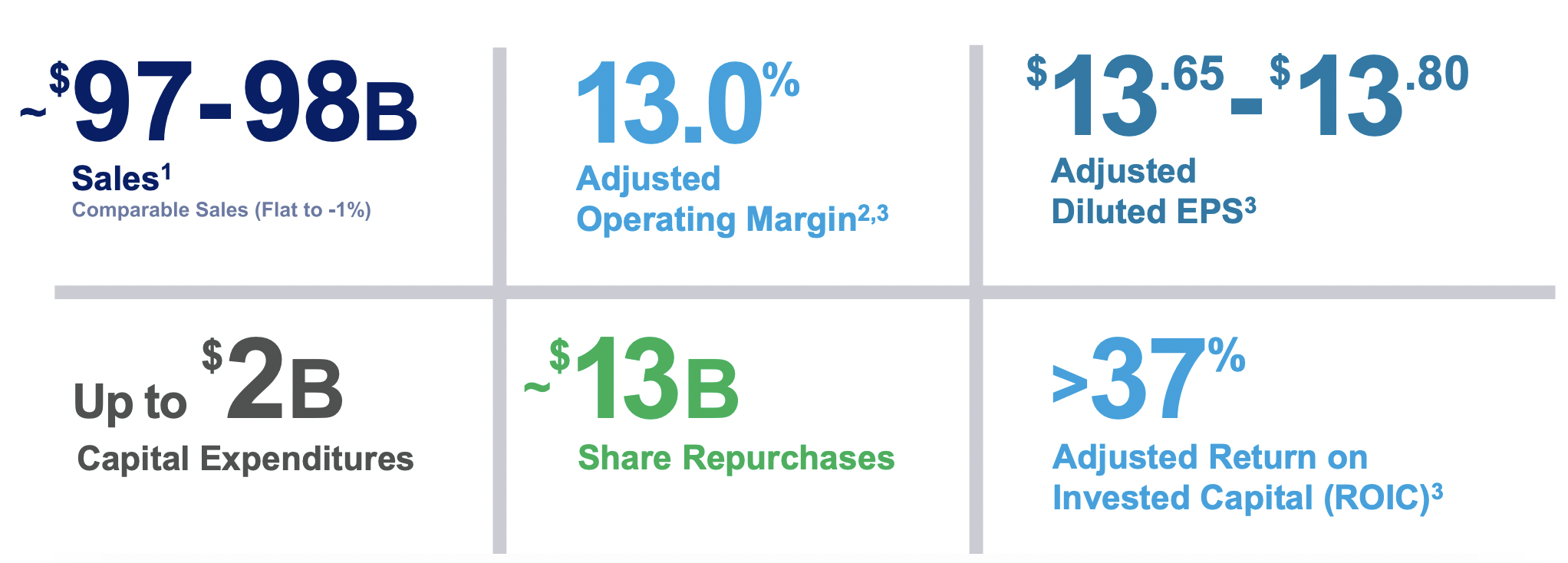

Positioned as an industry leader in a large and highly attractive market, the company aims to achieve a revenue of $90 billion, an EPS of $14,5, an EBITDA of $14 billion, and a capital expenditure (CapEx) close to $2 billion by 2025. Regarding margins, it targets a total company net margin of 9% and an operating margin of 13.6%.

While the industrial giant has already commenced its entry into international markets such as Canada, and India, it is evident that international expansion presents a substantial growth prospect for the company. As anticipated, there will be challenges along the way; nonetheless, the company's past performance attests to its skillful management of strategic shifts. Lowe's has likely reached its maximum growth potential in the US market, resulting in diminished opportunities compared to previous years.

In spite of the inherent risks, which have been previously highlighted, Lowe’s has so far demonstrated adeptness in successfully navigating them. One risk that often arises is the competition posed by Amazon; which has never emerged as a direct competitor due to its limited inventory and inability to match the on-site distribution capabilities offered by Lowe’s Companies.

By

By