Fueled by early signs of the outbreak plateauing in some U.S. hot spots, including New York State, the S&P 500 traded up as much as 3.5% during the session, only to lose ground sharply late in the day to finish down 0.16%. The index, however, remains up 19% from its March 23 low.

Much of Wall Street's recent recovery has been thanks to a $2 trillion package aimed at stimulating the economy as much of the country hibernates to slow the spread of the coronavirus.

Still, many investors remained skeptical that Wall Street's recent rise represents the start of a sustained recovery.

The S&P 500 is still down more than 20% from its Feb. 19 record high. However, most of the index's constituents are worse off. The median change in the S&P 500 since Feb. 19 is a decline of 26%. The index's largest components have mostly outperformed, including Microsoft and Amazon.

Graphic: Largest companies outperform S&P 500

Scott Wren, senior global equity strategist at Wells Fargo Investment Institute in St. Louis, is among many investors skeptical about the sturdiness of the recent rally.

"You're still vulnerable. Let's say the virus news turns worse. The market's not going to like it. Or the government can't get fiscal stimulus into the hands of businesses quick enough, that's going to be a problem," Wren warned.

With Saudi Arabia and Russia disagreeing about output cuts in the face of a swelling oil glut, the energy sector remains down 40% from Feb. 19.

Graphic: S&P 500 sector declines since Feb. 19

Consumer staples has been the S&P 500's best-performing sector, down about 10% since Feb. 19, steadied by a 10% gain in bleach maker Clorox.

Wall Street's 10 most valuable companies have lost a combined %1 trillion in market capitalization since Feb. 19, although one of them, Walmart, has actually increased its value by $12 billion as consumers staying home from work and school stock up on food and household goods.

Graphic: Market cap losses since Feb. 19

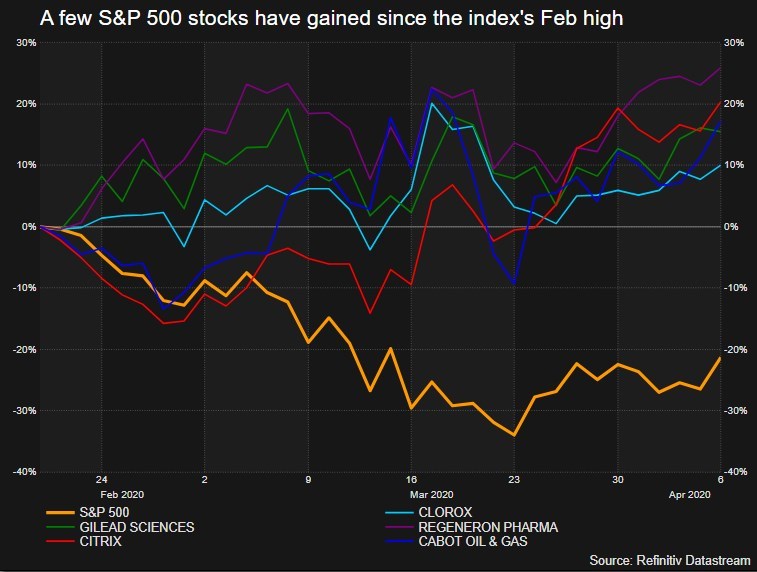

Shares of Regeneron Pharmaceuticals and Gilead Sciences, both working on coronavirus treatment drugs, have been among the S&P 500's top performers since Feb. 19, up 25% and 11%, respectively. Citrix Systems, which sells software helping organizations work online, has surged 19% in that time.

Graphic: A few stocks have gained since the S&P 500's Feb high

LPL Financial said in a research note that Wall Street remained vulnerable as investors await solid indications that the outbreak is not becoming worse.

"We continue to watch for signs of a peak in new cases in the United States, which would allow investors to start thinking about a resumption of economic activity and a potentially powerful economic rebound in the second half of this year. In the meantime, stocks may revisit the March lows," LPL Financial wrote.

By Noel Randewich

S&P 500

S&P 500