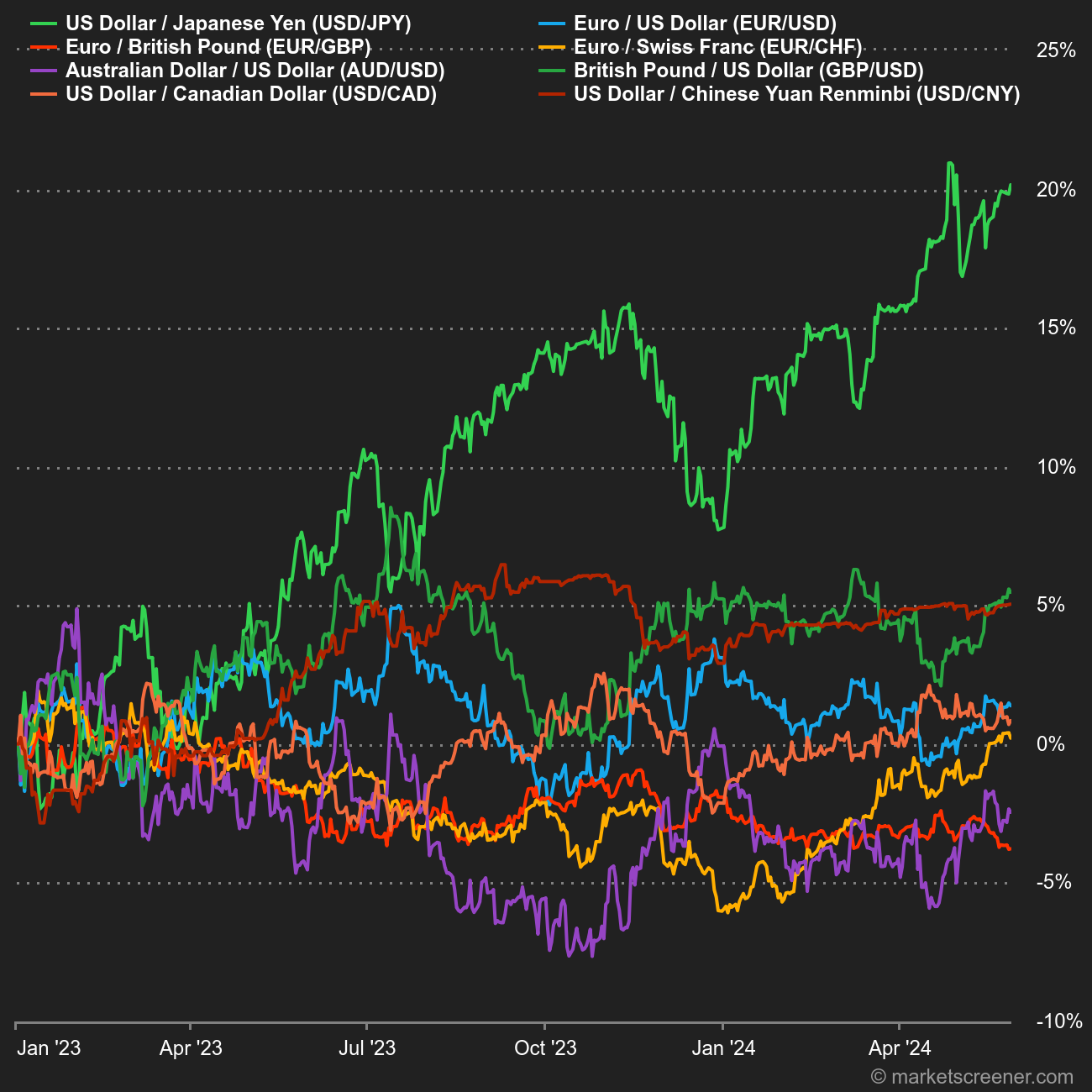

As mentioned in the weekly commentary on interest rates, the Central Bank of Japan meets tomorrow for what could be another hiccup in its dovish stance. The yen is close to its 52-week highs around 151.95, the level which triggered the BOJ's intervention on the foreign exchange market. Technically, there is a potential inflection zone extending to 152.70.

For its part, the dollar index continues to oscillate between initial support at 105.50 max 104.70 and resistance at 107.80, which must be overcome to open up further upside. In parallel, the EURO remains under bearish pressure until 1.0760 is breached, with downside potential limited to 1.0430. Breaking this level will also open up further downside potential on 1.0285.

Commo & Scandies

Commodity currencies also remain in a downtrend. The aussie is holding below its 20-day moving average, currently resisted at around 0.6420. We'll have to wait for the next Reserve Bank of Australia meeting, scheduled for November 7, to hope for a change in trend. The kiwi remains stuck below 0.6000/6040.

Finally, scandies are still weak. USDNOK maintains a bullish structure above 10.49, with a return to the 2020 highs at 11.66. USDSEK is testing 11.18, with a view to a further rise to 11.47.

By

By