RELX has had an eventful history, marked by a series of acquisitions. Today, the group is present in four business areas:

- Scientific, Technical and Medical (STM) is a subsidiary which oversees the publication, editing and management of a vast database of professional content, including theses, scientific journals, and other large-scale intellectual resources. This business is embodied by Elsevier, the world's largest publishing platform, which holds around 18% of all the world's scientific journals, and renowned authors such as Nobel laureates. STM also operates ScienceDirect, a platform dedicated solely to scientific research and primary medicine, which attracts 18 million unique visitors every month. In addition, the subsidiary owns SciVal, an online analytics solution providing research performance data for over 22,000 academic, industrial and government institutions. It also manages Scopus, an abstract and citation database, and ClinicalKey, the reference platform used by healthcare professionals, medical students and teachers in over 5,000 institutions in 90 countries. Finally, STM includes Reaxys, a chemistry research platform, and Sherpath, an adaptive teaching and learning solution offering personalized pathways in over 600 institutions. Sherpath covers more than 200,000 course registrations. Together, these activities generate 34% of RELX sales.

- "Risk" is the Group entity that provides software solutions to help companies manage the risks they face. Its spearhead is LexisNexis, a solution that equips no less than 78% of Fortune 500 companies - the world's 500 largest corporations in terms of sales - as well as nine of the ten largest banking institutions worldwide. LexisNexis processes around 250 million transactions a day. In 2022, this solution was able to detect 443 million individual and 1.7 billion bot-initiated attacks. These figures clearly illustrate the global importance of this software. In addition, the subsidiary offers sector-specific applications, such as ICIS, which equips 90 of the top 100 companies in the chemicals sector, and Cirium, which focuses on the airline industry. Together, these activities account for 34% of revenues.

- "Legal" represents the entity specialized in providing legal solutions and information for legal professionals, including lawyers, companies and government institutions. It offers a full range of services, including legal research, access to case law databases, case management tools, legal intelligence services, software solutions and training. The cornerstone of this business is also LexisNexis. But the applications are rather different. The main platform hosts an impressive 144 billion documents and legal files. Other tools in the subsidiary's portfolio include PatentSight, specialized in patent hosting, and Law360, focused on the dissemination of industry news articles. This entity is responsible for 20.8% of total sales.

- Finally, Relx has an entity that organizes events, trade fairs, trade shows and conferences. In 2022, 254 events were organized. This is the smallest activity in terms of revenues, accounting for 11.1% of the total.

Geographically, the British group generates 60% of its business in North America. Europe accounts for 21% of revenues. Finally, 19% of business is spread around the world, with around 10% of exposure to so-called emerging markets.

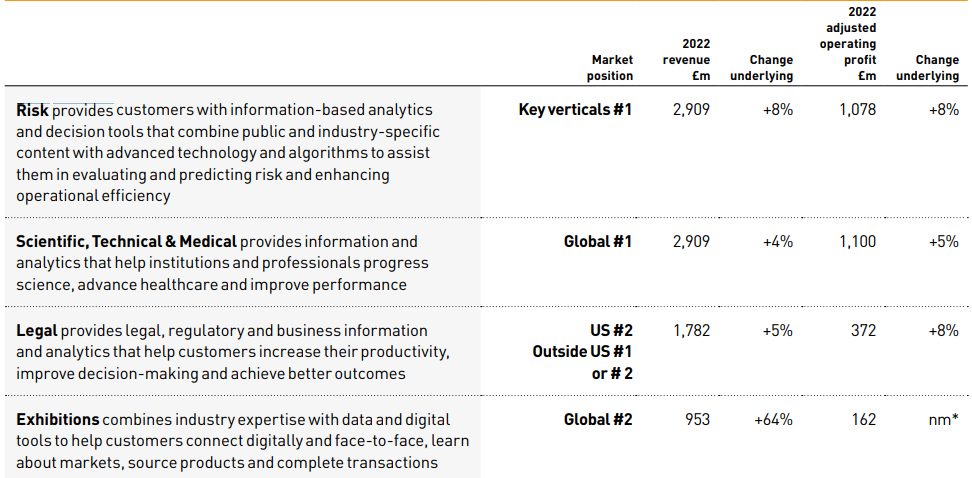

Summary of revenue breakdown (source: Relx)

Unusual exposure

Relx has an atypical positioning. The markets it addresses are highly concentrated, and it is very well positioned in relation to the competition, with, at worst, number 2 positions, as can be seen in the illustration below.

Management that knows what it's doing

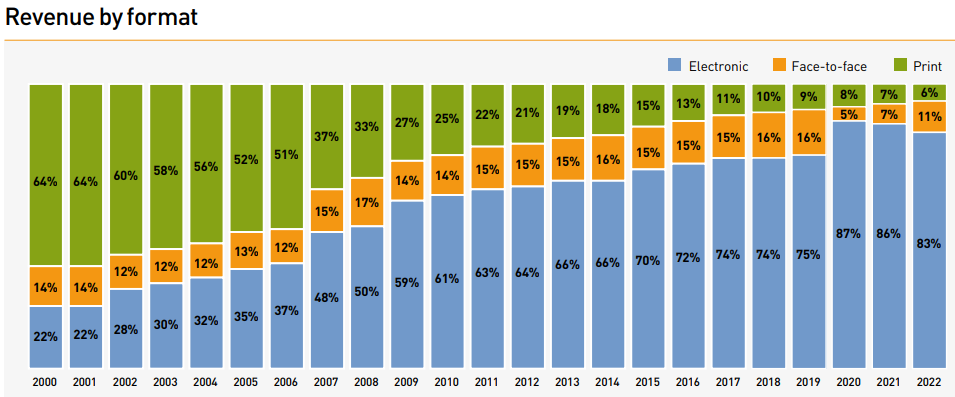

It has to be said that RELX has taken its time to forge the identity it now possesses. The group as we know it today took shape in 1993, following a merger between Reed International, a major player in publishing and the trade press, and Elsevier, which we mentioned earlier. Since then, the Group has expanded through a number of major acquisitions. These include the acquisition of Chilton Publishing and Harcourt Général in 1997 and 2000 respectively, as well as Éditions Masson - a French company - in 2005. More recently, in 2020, RELX acquired SciBite, a company specialized in data analysis. This move demonstrates the Group's ability to transform its business model by turning to digital and dematerialization, rather than persisting with paper printing. The table below highlights this point.

Relx's adaptation to a changing market illustrates that the company is avoiding one of its main risks (source: Relx).

On the other hand, the different activities benefit from significant synergies. To illustrate this, let's take a concrete example: Let's imagine that a pharmaceutical company publishes a patent for a new medical discovery and decides to collaborate with RELX. The patent is published by Elsevier. What's more, the patent is hosted on the platform, offering immediate access to researchers, academics and readers worldwide. At the same time, the "Risk" subsidiary offers publication protection solutions, such as plagiarism detection and online monitoring, to safeguard the pharmaceutical company's intellectual property. Finally, RELX Exhibitions organizes themed professional events, such as medical conferences, enabling the pharmaceutical company not only to promote its patent, but also for RELX to highlight its other activities to exhibiting companies. The pharmaceutical company thus becomes a client of the group for several of its services, broadening the British group's revenue base.

Accounts that are evolving slowly but surely

RELX does not present itself as a company that thrills investors. Yet this is precisely its strength: its growth is moderate (compound annual growth rate - CAGR - of 3.55%), but its financial results are very rarely disappointing, and the company tends to regularly outperform consensus forecasts. Over the period 2013 to 2022, revenues rose by 41.7%. Profitability, meanwhile, shows a degree of stability, with net margin having peaked in 2017 at 22.6%, and now firmly maintained above 16.5%. It seems, then, that the Group's growth lies more in expanding its revenues than in increasing its profit margins.

Free cash flow - the money actually available to the company - is high, and higher than that of listed competitors Thomson Reuters and Wolters Kluwer. Over the last two financial years, they amounted to £5.1 billion.

These funds are almost entirely allocated to shareholder dividends and share buy-backs. The number of shares has fallen from 2.2 billion in 2013 to 1.9 billion in 2022. As a result, the company tends to resort to borrowing to finance its growth and acquisitions, a less appreciable point. However, this indebtedness is well under control, as shown by the fourth row of the table below.

Relx is the largest player in the sector by market capitalization. Although Thomson Reuters and Wolters Kluwer are competitors only in certain parts of the business, they are the UK's two main peers. The three companies are valued roughly similarly from a PER point of view. Thomson Reuters is ahead in terms of operating profitability and free cash flow forecasts for this year. However, it does not benefit from a premium over its competitors, as it has historically been rather irregular in its publications.

Relx's current valuation is higher than that observed over the last ten years, with a PER of 27.4 times, compared with an average of 25 times over the period from 2013 to 2022. This increase is justified by the favorable outlook, particularly for this financial year, which should be characterized by growth outstripping the Group's historical performance, in both revenues and profits.

A final word

Relx is a fine coastal company that has succeeded in establishing itself in niche markets. So far, the company's management has made sound choices, with judicious balance sheet and financial management. The company's ability to integrate acquired companies and switch to the electronic-dominant content model is also noteworthy. We also appreciate the returns to shareholders, even if we'll have to keep an eye on the fact that not all the available cash is being used for this purpose. For the time being, the stock appears to be fairly priced. A valuation premium is justified in view of the outlook. Keep an eye on the share price to take advantage of a pullback if the opportunity arises.

By

By