At the beginning of the month, it's always interesting to take stock. In the carry trade game (the art of taking advantage of yield differentials between different types of assets) against the euro, the best performers since the start of the year are, in order: the Colombian peso (COP), the Mexican peso (MXN) and the Hungarian forint (HUF). At the other end of the spectrum, the worst performers are the Russian rouble (RUB), the Turkish lira (TRY) and the Japanese yen (JPY). If you follow this column regularly, you shouldn't be too surprised by this trifecta.

In fact, I'd like to take advantage of this ranking to show you a very nice configuration for COPEUR. The currency is well oriented, as evidenced by its rising 89-day moving average, while the RSI is close to a year-long uptrend line. Graphically, the market is consolidating inside a triangle that has been in progress since the beginning of August, whose exit is naturally expected from the top, thus re-launching the upward momentum.

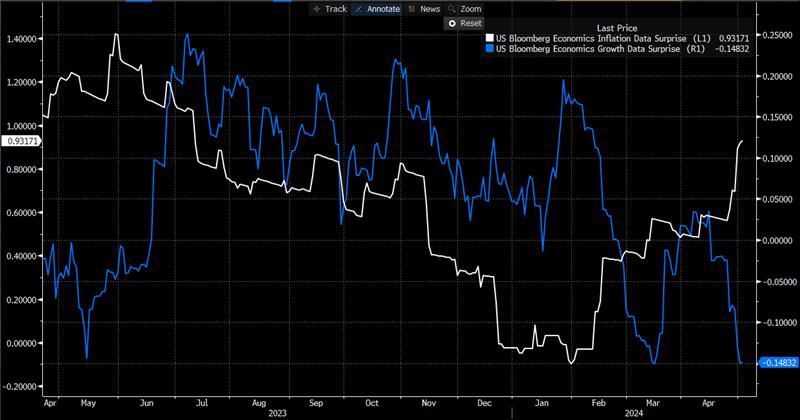

Source: Bloomberg

The EURO is close to its key support at 1.0760 (104.60 in parallel on the Dollar Index). An outright break of this level will counteract the bullish view against the dollar and could send the European currency back towards 1.0548 or even 1.0430. In the meantime, we're keeping our currency balance in euros.

The same applies to the aussie, which remains poorly oriented below 0.6600, with 0.6305 in its sights. The kiwi is attempting an intermediate rebound to the 0.5905/0.5865 support zone, which it will then be necessary to break to open at 0.5770 or even 0.5563.

By

By