Rambus is a fabless semiconductor manufacturer that focuses on the design and commercialization of semiconductors without in-house chip fabrication facilities. By outsourcing its chip fabrication processes to third-party foundries, the company can concentrate on design and sales while avoiding the significant capital investments required to operate fabrication plants. This strategic move has enabled the business to optimize its efficiency and profitability within the highly competitive semiconductor industry.

The semiconductor industry is crucial in powering the devices we use daily, from smartphones to medical equipment. However, the production of electrical chips, including semiconductors, involves numerous procedures that require years of research and development to create, design, produce, market, and support. Additionally, creating a semiconductor factory is costly and complex, posing a significant challenge for many groups in the industry.

Due to the substantial complexity of the production chain and the significant capital investments required for semiconductor production facilities, not all groups have foundries. Rambus is fortunate to have a partner program that includes ASIC Designer, Foundries (Samsung, Intel, TSMC, Global Foundries), IP Developers, EDA Companies, Validation Labs, SoC Partners (Broadcom, Texas Instrument…), which helps to mitigate some of the industry's challenges. By leveraging its partner program, it can deliver cutting-edge semiconductor solutions without having to invest in expensive fabrication facilities, allowing it to remain competitive in this challenging constantly evolving industry.

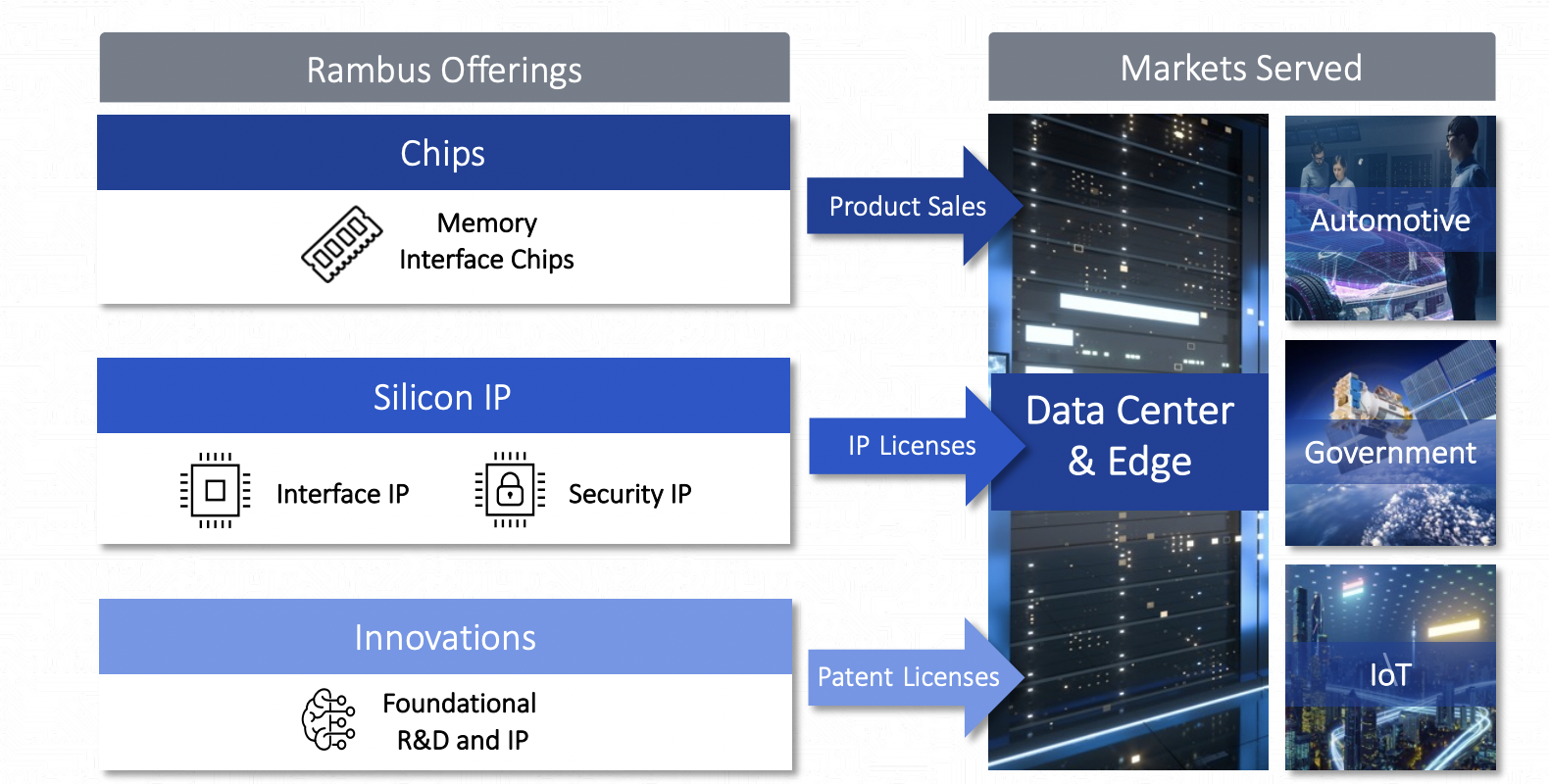

Specialties and Products:

The company focuses on three distinct activities: Semiconductor Space, Royalties, Contracts, and Others. Between 2021 and 2022, it saw an increase in sales in each of these sectors, with Semiconductor Space sales increasing by 57.76%, Royalties by 2.27%, and Contract and Other by 84.44%. The group's products are designed to provide customers with the building blocks needed to develop secure electronic systems, connect various components of electronic devices, and facilitate efficient and speedy data transfer.

One of the company's specialties is Security IP, which comprises semiconductor intellectual property designed to protect against cyber threats and attacks, such as hacking, data theft, and unauthorized access. These pre-designed and verified building blocks expedite the device development process, reduce costs, and make it easier to create new electronic devices.

Rambus also specializes in Interface IP, which refers to a set of pre-designed building blocks that electronic designers can use to connect various components of a computer or electronic device. These building blocks expedite the device development process, reduce costs, and make it easier to create new electronic devices.

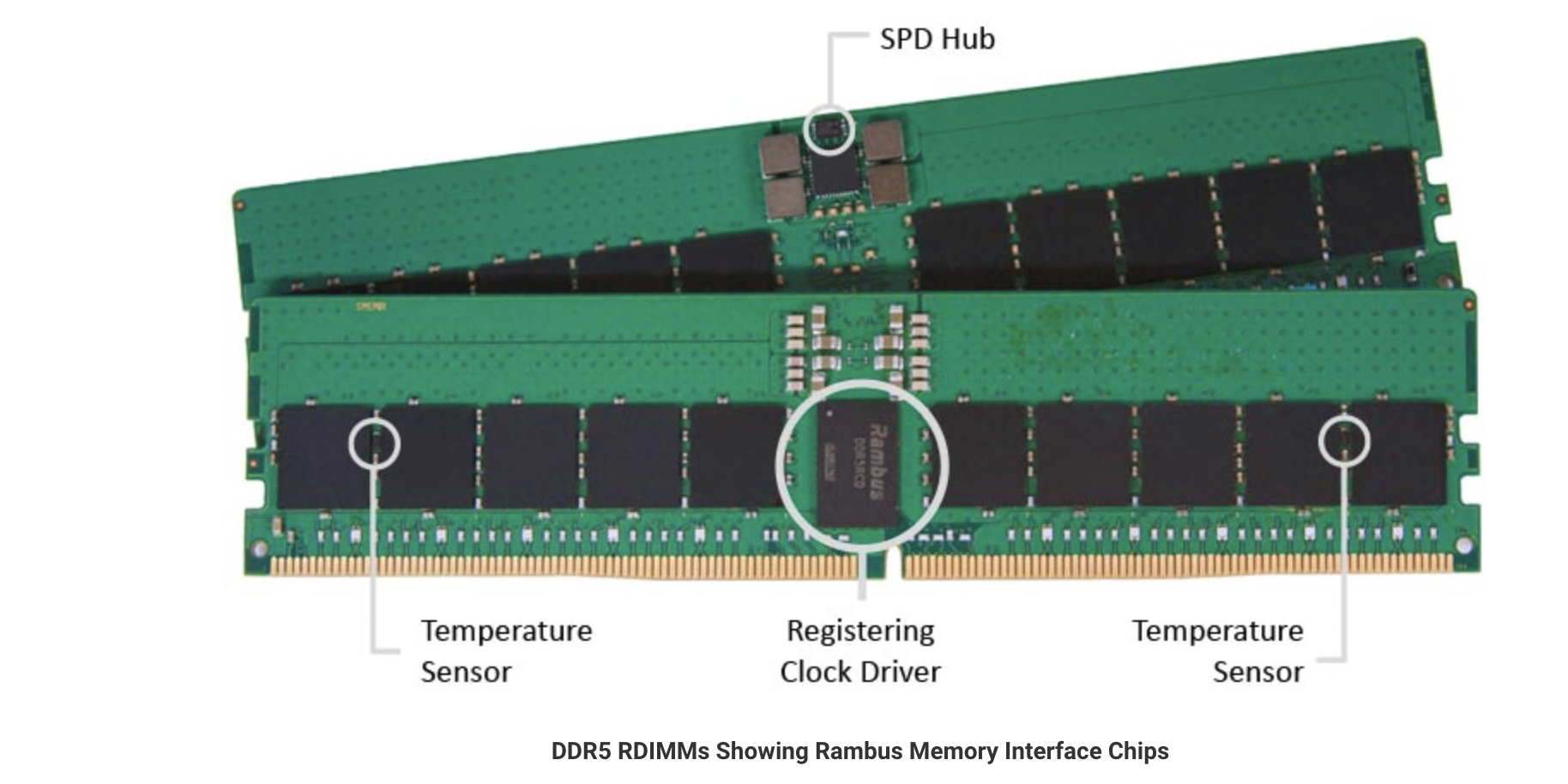

Memory Interface Chips (58% of product revenue growth) are another essential component that focuses on designing and manufacturing. They connect the central processing unit (CPU) to a device's memory, facilitating efficient and speedy data transfer. Different types of memory require specific types of bridges such as DDR3, DDR4, and DDR5 DIMM memory interface chips, which are known for their high speed, reliability, and power efficiency. This segment is the largest contributor to the firm's sales, accounting for nearly 75% of its total revenues.

Partnership :

Rambus is considered as a pioneer in this industry with over 30 years of experience in semiconductor interconnect technology. Its products and services are used in a variety of industries, including data centers, automotive (strong presence with its technology being used in a range of advanced driver assistance systems (ADAS) and autonomous vehicles), consumer electronics, and mobile.

To strengthen its market position further, it will have to continuously seek new patents or intellectual property. Some of its current patents will expire, and the company's incapacity to find new ones will decrease its competitive edge. Nevertheless, the group is currently in a good position due to its strong competitive advantages, which include deep expertise in memory interfaces and security, a strong IP portfolio (more than 3000 patents & applications), and strategic alliances with well-known semiconductor and system manufacturers like Apple, Advanced Micro Devices, Broadcom, Amazon, Google, and Nvidia.

Memory interface solutions are renowned for their speed and efficiency, thanks to their patented signaling and circuitry technologies that optimize memory performance and energy consumption - a crucial aspect of modern-day electronics. Additionally, the business's security and cryptography solutions are highly adaptable and scalable, featuring embedded security technologies that can be tailored to suit a wide range of applications.

A key driver:

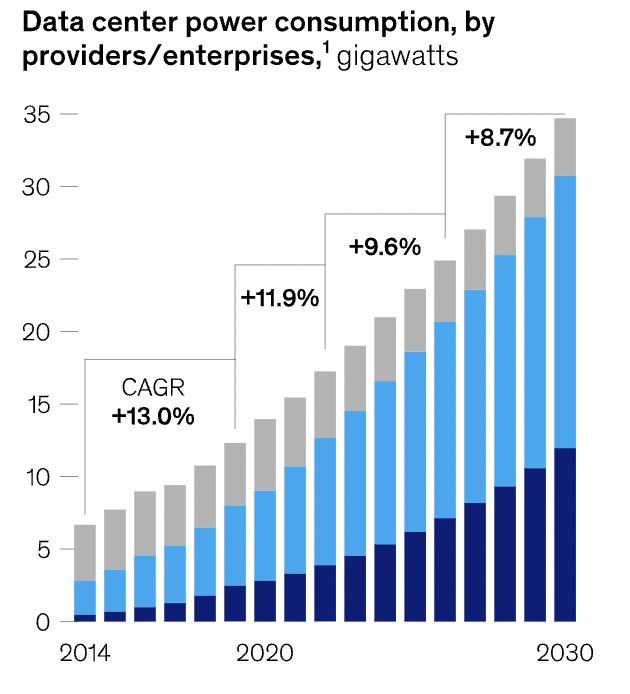

Rambus is in a favorable position to benefit from the increasing demand for AI solutions and data center-related needs that are expected to drive the company's growth in the coming years. With the rapid transformation of various industries by AI, the semiconductor industry, particularly in the DRAM segment where it operates, is anticipated to see new opportunities. The projected doubling of data center demand by 2030 in the US market, as reported by McKinsey, underscores the need for efficient and high-performance products. 8ts revenue from data center-related activities (75%), is poised to capture a significant share of this growth. Furthermore, through its collaboration with IBM, the group is developing new memory solutions that combine the high bandwidth of DRAM with the high capacity of flash memory to enable faster and more efficient AI processing.

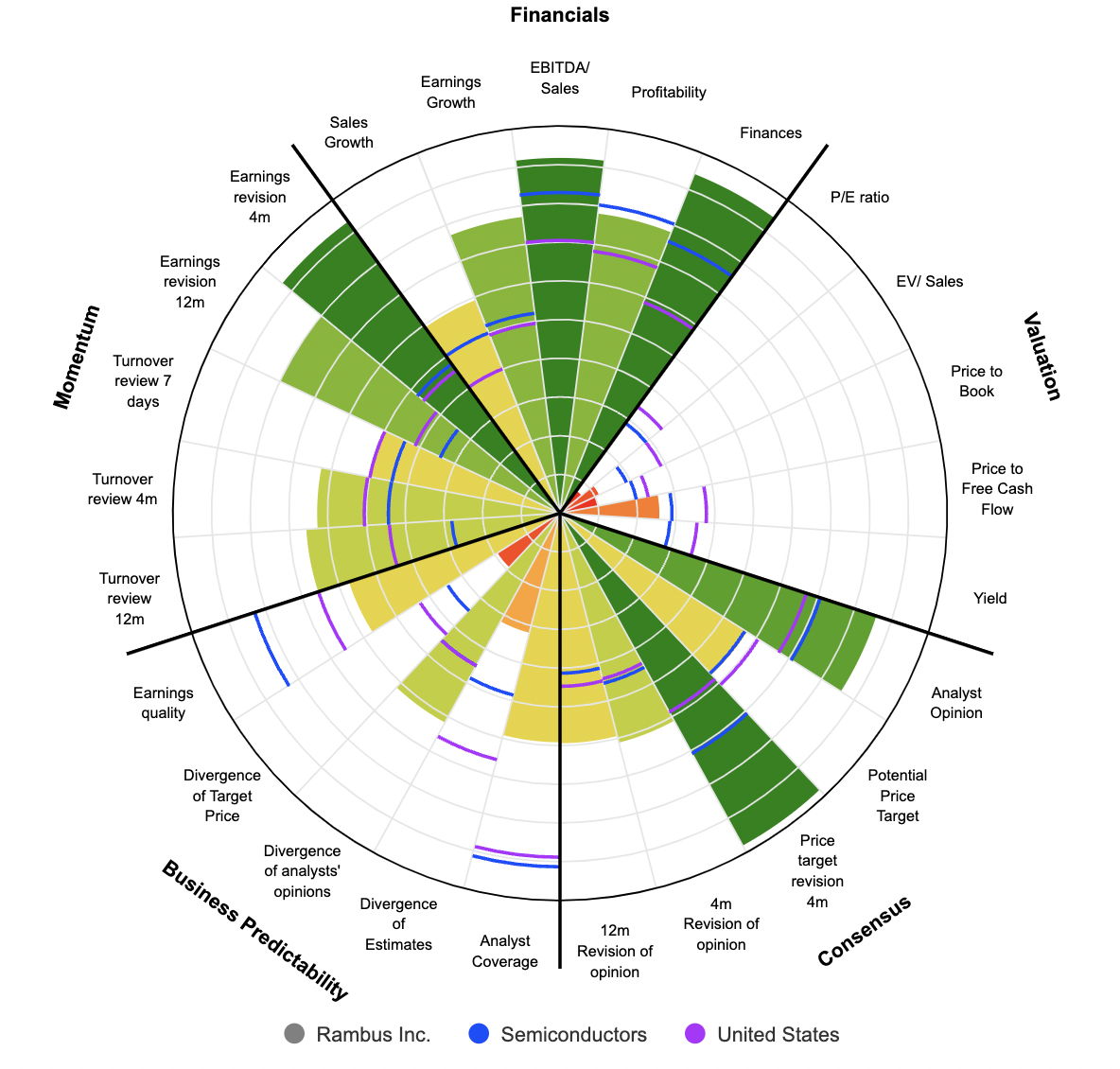

Financials :

Semiconductor industry stocks have performed particularly well in the early part of the year, as shown by the iShares Semiconductor ETF (+21.59%) and Rambus (+39.75%).

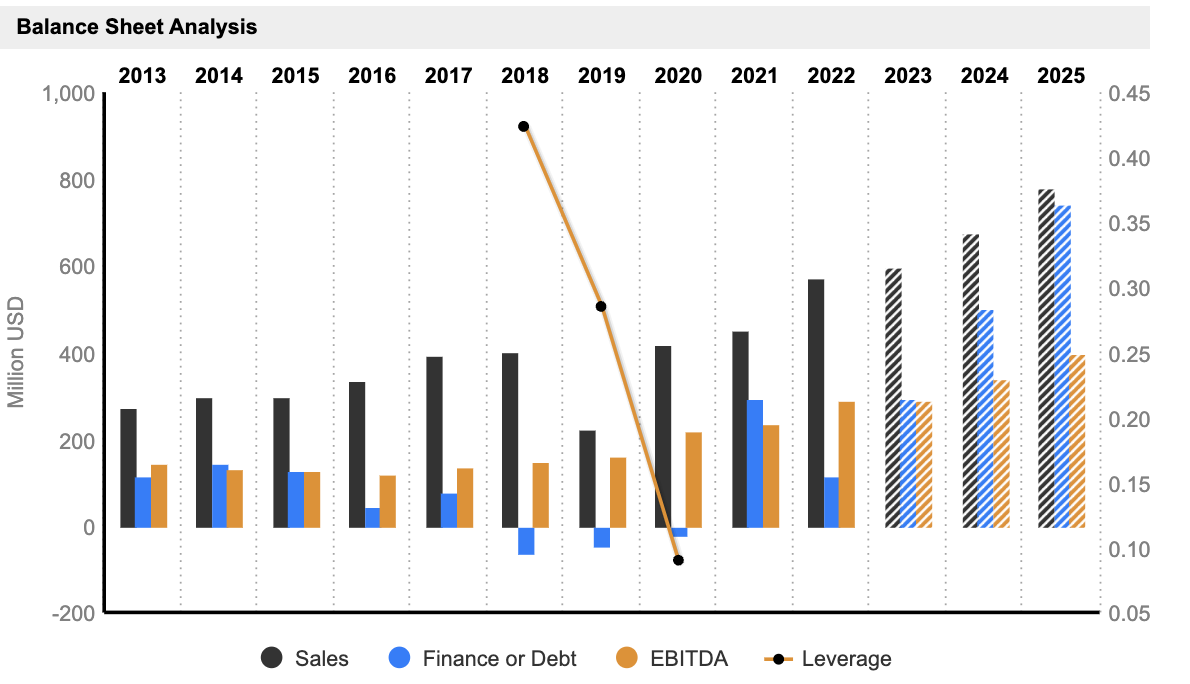

The business saw its market capitalization increase by 400% over the 2013-2023 period, from $1.067 billion to more than $5.378 billion, representing a CAGR of 17.55%. Its revenues rose by 110% ($272 million to $572 million) over the same period. EBITDA and EBIT have respectively a CAGR of 14.47% and 13.57% over the last 5 years for operating margins of nearly 45%. Analysts expect EBITDA to increase by 37% to $398 million by 2025 and margins to be around 45%. The ROA (Return on Asset) has been around 9% between 2013 and 2017 but should return to its levels in 2023 and reach 14% in 2024-2025 according to analysts. The ROE (Return on Equity) has moved in the same way as the ROA, with gains between 12% and 19% during the 2013-2017 period. they should reach 17% (above its competitors) in 2024-2025.

Despite a 97% increase in FCF (Free Cash Flow) since 2018 and an excellent FCF Conversion Rate of 73.7% for 2022, the company's valuation in terms of earnings multiples is rather high. Indeed, the firm is getting paid 59.09 times its estimated earnings per share for the ongoing year. Moreover, the group enjoys a very good management as evidenced by the Net Income forecasted for 2023 ($91.2 million) and 2025 ($167 million) with net margins between 15% and 21%. It also has controlled leverage (Debt/EBITDA) around -0.40x in 2022.

Conclusion:

Rambus is well-positioned to benefit from the exponential growth in data usage and increasing demands on data infrastructure, while the company's innovative products, especially in the DDR5 segment can address these evolving market needs. However, its current valuation is (too) high and its capacity to continue developing new patents and IP will be critical to maintain its competitive position in the marketplace for the upcoming months.

By

By