|

|

| This week's gainers and losers |

Fluence Energy. The market welcomed the publication of the annual results and the announcement of an encouraging outlook for the American energy storage specialist. +31.6%. Coupa Software, the enterprise software company, will be acquired by private equity firm Thoma Bravo for $8 billion, or $81 per share, entirely in cash. Coupa will then be delisted. It is up 26.6% for the week. Moderna's Messenger RNA skin cancer vaccine combined with Merck's immunotherapy drug met the primary efficacy endpoint in a Phase III trial, which is promising for the technology. +16.9% Games Workshop, the British manufacturer of war and strategy miniatures, has signed a deal with Amazon to make movies and series based on the characters of the famous Warhammer 40,000. +15.4% The fact that Elon Musk is obsessed with Twitter does not amuse Tesla's shareholders at all. Especially since the billionaire has sold another 22 million shares of the manufacturer for more than 3.5 billion dollars, which weighs on the price. -12.1%

|

|

| Commodities |

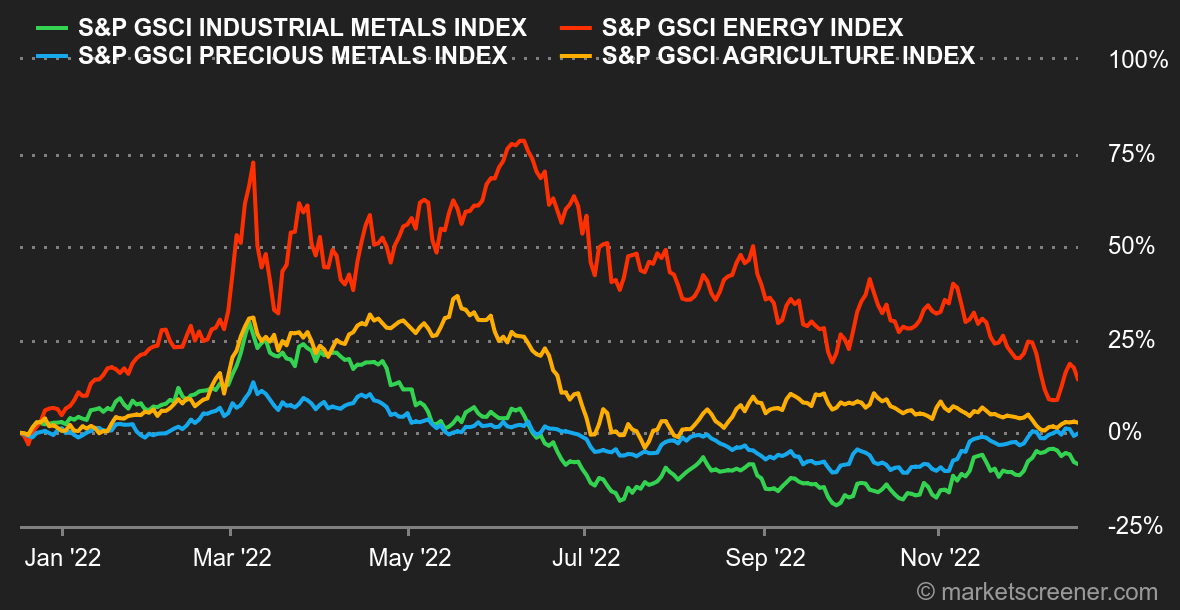

| Energy: Despite the day's decline, oil prices rebounded this week, with weekly gains approaching 3% at the time of writing. Despite depressing economic statistics from China, which could have further affected the morale of operators, the market preferred to welcome the latest report of the International Energy Agency (IEA), which revised upwards its demand forecasts for 2022 but also for next year (by respectively 140,000 and 100,000 barrels per day). Even if the world economy is heading for a recession, the IEA believes that demand remains strong in non-OECD countries. In terms of prices, North Sea Brent is trading around USD 78 while US WTI is trading at USD 73.5 per barrel. Natural gas prices remain relatively stable at 125 EUR/MWh for the European reference. Metals: Through its National Bureau of Statistics, China has unveiled a battery of interesting data to assess the evolution of metal production in the Middle Kingdom. While steel production remained depressed in November, as it is strongly correlated to the good health of the real estate market, aluminum production increased by almost 10% year-on-year. In terms of prices, industrial metals ended the week in mixed order. Lead and nickel fell to USD 2100 and USD 28575, while aluminum (USD 2400) and copper (USD 8400) were broadly stable. On the other hand, rising bond yields weighed on gold, which is trading around USD 1780. Agricultural products: As regards soft commodities, and more particularly wheat, it recovered slightly to 760 cents a bushel, benefiting from questions about the icy weather conditions that are hitting the winter wheat-producing regions, especially in the Black Sea. As such, Russia said it is targeting 80 to 85 million tons of production for next year. This is lower than the 89 million tons harvested this year. |

|

| Macroeconomics |

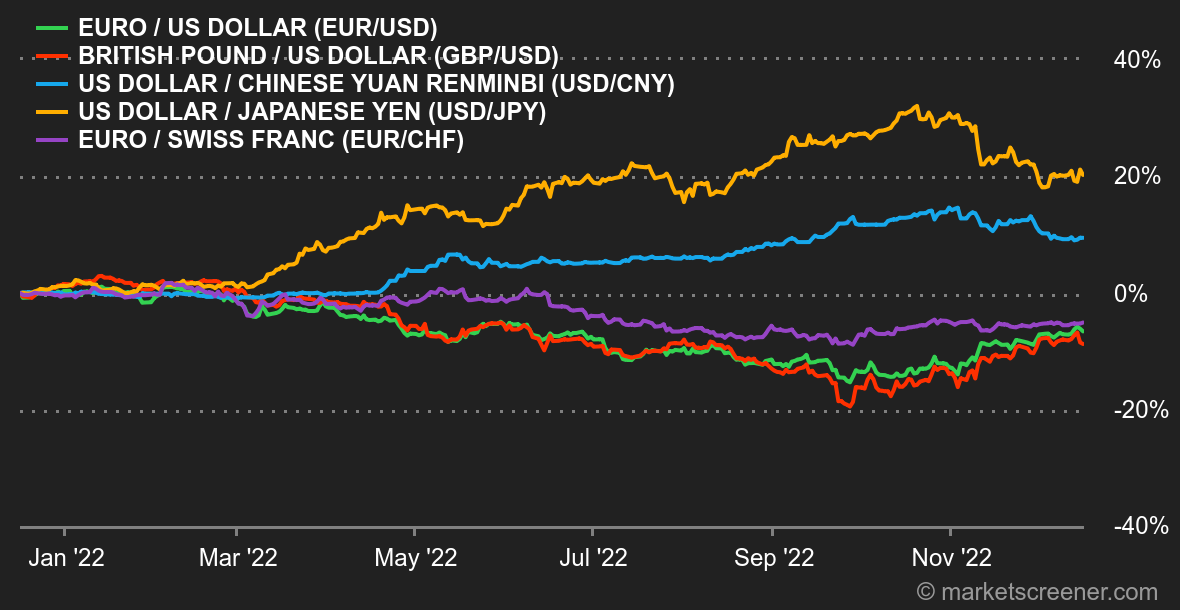

| Atmosphere: Jerome Powell, the head of the Fed, and Christine Lagarde, his peer at the ECB, were careful this week to remind investors that they should not take their desires for realities. Clearly, imagining that rates could fall again as early as 2023 is a mistake. Equity markets paid the price, especially since they had thought that the slightly weaker-than-expected US macroeconomic data would confirm that the Fed would return to a more accommodative monetary policy. In Europe, the ECB's boss made the second move by being more austere than expected on the regional outlook. Currencies: This is the week for the euro, which has regained altitude against many currencies. The gain was modest against the greenback at USD 1.0614, but stronger against emerging currencies, with a 2.5% gain against the Brazilian real (BRL 5.66 to EUR 1). The single currency also recovered more than 2% against the Australian dollar (AUD 1.5884 per EUR). The extra caution penalized currencies known to be more volatile, such as those of the Scandinavian countries. The ruble, meanwhile, lost significant ground against the euro, the dollar and the British pound. "Two opposing forces prevail at the moment: on the one hand, the fall of stock markets around the world, which is positive for the dollar given its role as a safe haven, and on the other hand, the implication of the results of yesterday's ECB meeting, which could prove positive for the EUR-USD in the long run," said a forex trader from Unicredit. Rates: At the end of a week punctuated by the release of a slightly lower than expected CPI in the US and then a 50 basis point hike by the US and European central banks, interest rates finally moved in opposite directions on both sides of the Atlantic. The US 10-year yield is almost stable at 3.40% (with technical support around 3.38/3.5%), while the German 10-year has taken advantage of the ECB President's speech to jump to 1.77% and reach 2.17%. As a result, we are witnessing a tightening between these two rates which should continue. Cryptocurrencies: After episodically crossing the $18,000 threshold in the middle of the week, bitcoin has retraced the entire rebound in the last 48 hours. It is now back around the $17,000 mark as of this writing. This new setback proves, once again, the feverishness of the sector which is struggling to regain the confidence and optimism of investors. The turmoil around Binance in recent days, after the collapse of FTX last month, contributes largely to this nervousness in the market. Digital assets as a whole are on track to close out a more than complicated year for crypto-investors. Timeline: After this eventful week, the next one is shaping up to be a bit quieter. The Ifo business confidence index in Germany (Monday) will precede a Bank of Japan rate decision on Tuesday. In the US, the Conference Board's confidence index (Wednesday) and the PCE inflation index (Friday) will complete the picture. There will also be Thursday's final reading of third quarter US GDP, but the potential for surprise is modest as this is the 3rd reading of the index. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By